XPeng Motors’ Breakneck Run Continues, but Concentrated Lineup Risks Loom

In the third quarter of 2025, XPeng(NYSE: XPEV, HKEX: 9868)’s deliveries posted explosive growth, reaching 116,007 units, up 149.3% year-over-year (YoY) and 12.4% quarter-over-quarter (QoQ), setting a new record for quarterly deliveries.

However, the MONA M03 and P7+ together contributed more than 70% of total sales, serving as the core drivers underpinning the company’s performance growth. That said, this heavy reliance also brings potential risks.

Ⅰ. Strong Q3 Results, Surging Sales

In the third quarter of 2025, XPeng recorded revenue of RMB 20.38 billion (approx. USD 2.91 billion), up 101.8% YoY. Net loss came in at RMB 0.38 billion (approx. USD 54.29 million), narrowing from RMB 0.48 billion (approx. USD 68.57 million) in the second quarter and RMB 1.81 billion (approx. USD 258.57 million) in the same period last year, indicating continued loss reduction.

The sharp rise in sales volume was a key reason behind XPeng’s earnings improvement. In Q3 this year, vehicle sales revenue reached RMB 18.05 billion (approx. USD 2.58 billion), up 105.3% YoY and accounting for 88.6% of the company’s total revenue.

In terms of sales volume, XPeng delivered a cumulative 116,000 vehicles in Q3, up 149.3% YoY. A closer look shows:

In July, XPeng sold 36,717 vehicles, up 229% YoY;

In August, XPeng sold 37,709 vehicles, up 169% YoY;

In September, XPeng’s sales reached 41,581 vehicles, up 95% YoY.

As of the end of October, XPeng’s year-to-date cumulative sales this year had already reached 355,000 vehicles, achieving ahead of schedule the 350,000-unit sales target set at the beginning of the year.

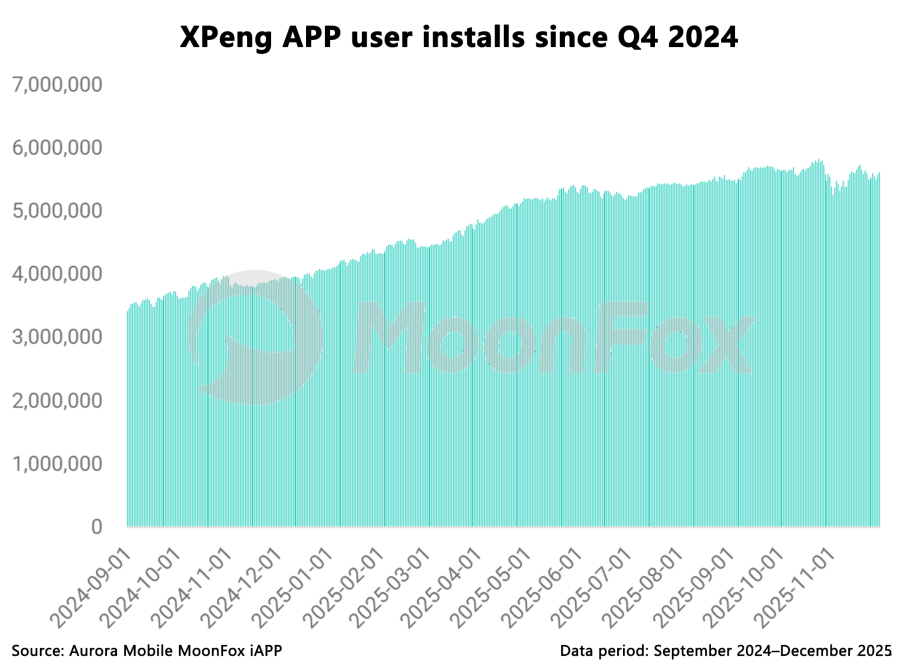

Ⅱ. App installs rise in tandem, laying the groundwork for repeat purchases

Driven by the sales momentum, the XPeng app has also been growing rapidly, with installs climbing sharply. User stickiness has continued to strengthen.

Ⅲ. Proactive Product Portfolio optimization strengthens competitiveness

XPeng has been actively advancing optimization of its product portfolio. By streamlining Stock Keeping Units (SKUs) and focusing on core models, it has built a clearly tiered product lineup—“entry-level, mainstream, and premium”—to better address the needs of different consumer segments.

As an entry-level model, the MONA M03 comes standard across the lineup with 20+ pieces of Intelligent Perception Hardware, bringing advanced urban intelligent driving / ADAS down to the RMB 150,000 (approx. USD 21,428.57) price range. This enables more consumers to access advanced intelligent driving technology at a lower cost, further expanding XPeng’s user base.

In the RMB 200,000 (approx. USD 28,571.43) price segment, the P7+ further strengthens its advantages in the smart cockpit and driving range. Equipped with a full-scenario automated parking system, it supports a broad set of functions such as automated parking and remote parking, effectively simplifying the parking process. The smart cockpit adopts the latest human–machine interaction technology, featuring a larger high-definition display, faster and smoother system responsiveness, and a richer app ecosystem, delivering a more intelligent and comfortable driving and riding experience. Its long driving range effectively alleviates consumers’ range anxiety, giving it a distinctive edge among peers in the same class and further consolidating XPeng’s brand perception as a front-runner in the “top tier of intelligence.”

Ⅳ. Sustained high-intensity R&D investment to reinforce technological barriers

In the third quarter of 2024, XPeng’s R&D expense reached RMB 1.0 billion (approx. USD 142.86 million), accounting for 10% of operating revenue.

By the third quarter of 2025, XPeng further stepped up its R&D investment, with R&D expense rising to RMB 2.43 billion (approx. USD 347.14 million), up 48.7% YoY.

To date, the company has filed more than 3,000 intelligent driving–related patents. These patents broadly span multiple dimensions of intelligent driving, including sensor technologies, algorithm optimization, and autonomous driving decision-making, fully demonstrating XPeng’s deep accumulation and innovation capabilities in intelligent driving technology R&D.

XPeng’s in-house developed XNGP full-scenario intelligent ADAS has achieved comprehensive coverage across both highways and urban roads, providing users with a more convenient and safer driving experience. As of the third quarter of 2025, the penetration rate of the XNGP system reached 60%. XPeng’s technological edge is gradually being translated into differentiated product competitiveness, helping the company stand out amid intense market competition.

Ⅴ. Key Risk Worth Close Attention: Overreliance on a Limited Number of Core Models

Although XPeng has made progress in product diversification, it still faces a degree of overreliance on a single set of core models at present.

The MONA M03 and P7+ together contribute more than 70% of total deliveries, serving as the central pillars supporting the company’s performance growth.

However, such a high level of reliance also introduces potential risks: if market demand shifts, or if competitors launch more competitive products, deliveries of these two models could come under pressure, which would in turn adversely affect the company’s overall performance.

To mitigate this risk, XPeng needs to accelerate the rollout cadence of new models in 2025, further enrich its product portfolio, address the needs of different consumer segments, reduce dependence on any single model, and enhance the company’s resilience to downside risks.

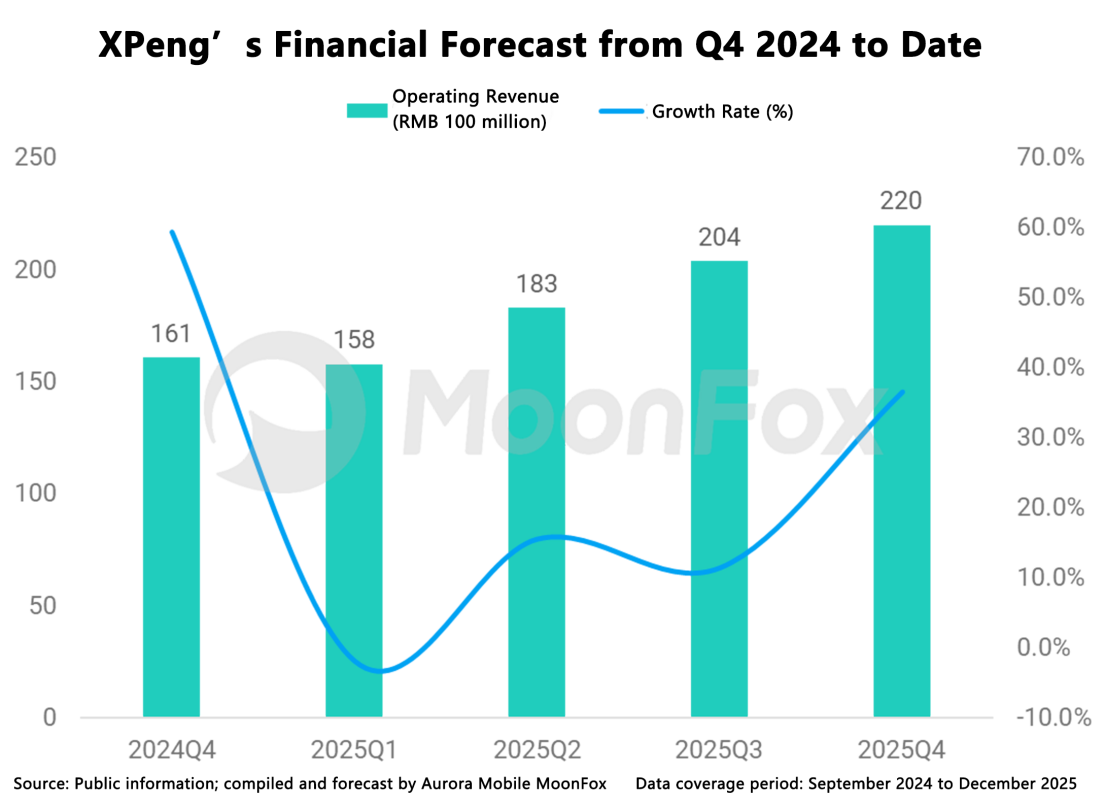

Ⅵ. XPeng’s Financial Forecast for Q4 2025: Revenue Expected at RMB 22 Billion (approx. USD 3.14 billion)

XPeng is expected to deliver 125,000–132,000 vehicles in Q4 2025. Based on Aurora Mobile - MoonFox user data and a Financial Model, XPeng’s revenue in Q4 2025 is projected to grow 36.6% YoY to approximately RMB 22 billion (approx. USD 3.14 billion).

Meanwhile, Aurora Mobile - MoonFox expects XPeng to reach breakeven in Q4 this year.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

2025 Internet Industry Annual Review Research Report

Bilibili: A "Forever Young" Platform with a Long-term Vision

Pop Mart Business Decoded: Measuring the Value of Emotional Consumption