Li Auto’s Performance Plunges, BEV Transition Faces Formidable Headwinds

In the third quarter of 2025, Li Auto (NYSE: LI; HKEX: 2015) recorded a net loss attributable to parent company shareholders of RMB 625 million (approximately USD 89.286 million), swinging to a loss on a year-over-year (YoY) basis and ending its streak of 11 consecutive profitable quarters.

Li Auto attributed the loss to the recall of 11,400 Li Auto MEGA vehicles on October 1 this year.

I. Li Auto’s Q3 Earnings Fell Short of Expectations; Share Price Continues to Slide

In the third quarter of 2025, vehicle sales revenue was RMB 25.9 billion (approximately USD 3.7 billion), down 37.4% from RMB 41.3 billion (approximately USD 5.9 billion) in the third quarter of 2024; total deliveries were 93,211 units, down 39.0% YoY.

Total revenue was RMB 27.4 billion (approximately USD 3.914 billion), down 36.2% from RMB 42.9 billion (approximately USD 6.129 billion) in the third quarter of 2024, and down 9.5% quarter-over-quarter (QoQ) from RMB 30.2 billion (approximately USD 4.314 billion) in the second quarter of 2025.

Net loss was RMB 624.4 million (USD 87.70 million).

Since July this year, Li Auto’s stock has been under pressure.

At the same time, Li Auto is expected to continue its steep decline in the fourth quarter, with projected vehicle deliveries of 100,000 to 110,000 units, representing a YoY decrease of 37.0% to 30.7%.

Li Auto was once a star among China’s emerging EV makers, with cash flow and profitability far ahead of its peers. Yet in China’s fiercely competitive new energy vehicle market, Li Auto’s “fridge + TV + big sofa” playbook now appears to be losing its edge.

II. Core Issue: A Late BEV Transition and Insufficient Production Capacity

Competition in the new energy vehicle market continues to intensify, with the price war escalating further, leaving Li Auto under mounting pressure on multiple fronts.

In the EREV segment, brands such as AITO and Deepal are going head-to-head with Li Auto, leveraging their respective technological strengths and go-to-market strategies; in the BEV arena, rivals including Tesla and NIO have already established meaningful advantages in technology, branding, and market share, and Li Auto urgently needs to accelerate its catch-up efforts.

While maintaining its edge in EREVs, Li Auto must also speed up deliveries of its BEV models and execute technology deployment at pace, while balancing investment across its dual-track strategy. This raises the bar for Li Auto’s R&D capabilities, capital commitment, and go-to-market execution. How it can deliver a successful strategic transition and enhance competitiveness amid cutthroat market dynamics has become one of the company’s defining challenges.

Second is the production-capacity constraint. Although the newly launched BEV models i6 and i8 have received an enthusiastic market response, with orders surpassing 100,000 units, they are facing severe supply chain challenges. In the third quarter, deliveries of these two models accounted for only 18% of total deliveries, underscoring how supply chain bottlenecks are constraining new-model fulfillment. While Li Auto has attempted to raise production capacity by introducing a dual-supplier system with Contemporary Amperex Technology Co., Limited (CATL) and Sunwoda Electronic Co., Ltd., and expects to increase the i6’s monthly capacity to 20,000 units by early 2026, in the near term the stability of the supply chain remains an urgent issue that must be addressed.

Meanwhile, before the downturn in its core vehicle business has been effectively contained, Li Auto has begun expanding into new lines of business.

Earlier this year, Li Auto established two second-tier divisions, “Space Robotics” and “Wearable Robotics.” On December 3, it officially launched its first AI smart glasses product, Livis, with prices starting at RMB 1,999 (approximately USD 285.57).

However, the secondary market’s response has been lukewarm.

Amid the economic slowdown, the market has become more rational. The AI smart glasses market has long been crowded with brands including RayNeo, Xiaomi, Meizu, and Huawei. Backed by players ranging from major tech giants to telecommunications operators, these brands have created a highly competitive landscape—while more entrants continue to pour in. At present, Li Auto’s AI smart glasses offer no clear visibility on market prospects, and trying to “sell a story” to win investor confidence is not a viable approach.

III. A Relatively Stable Consumer Base; the Core User Franchise Remains Intact

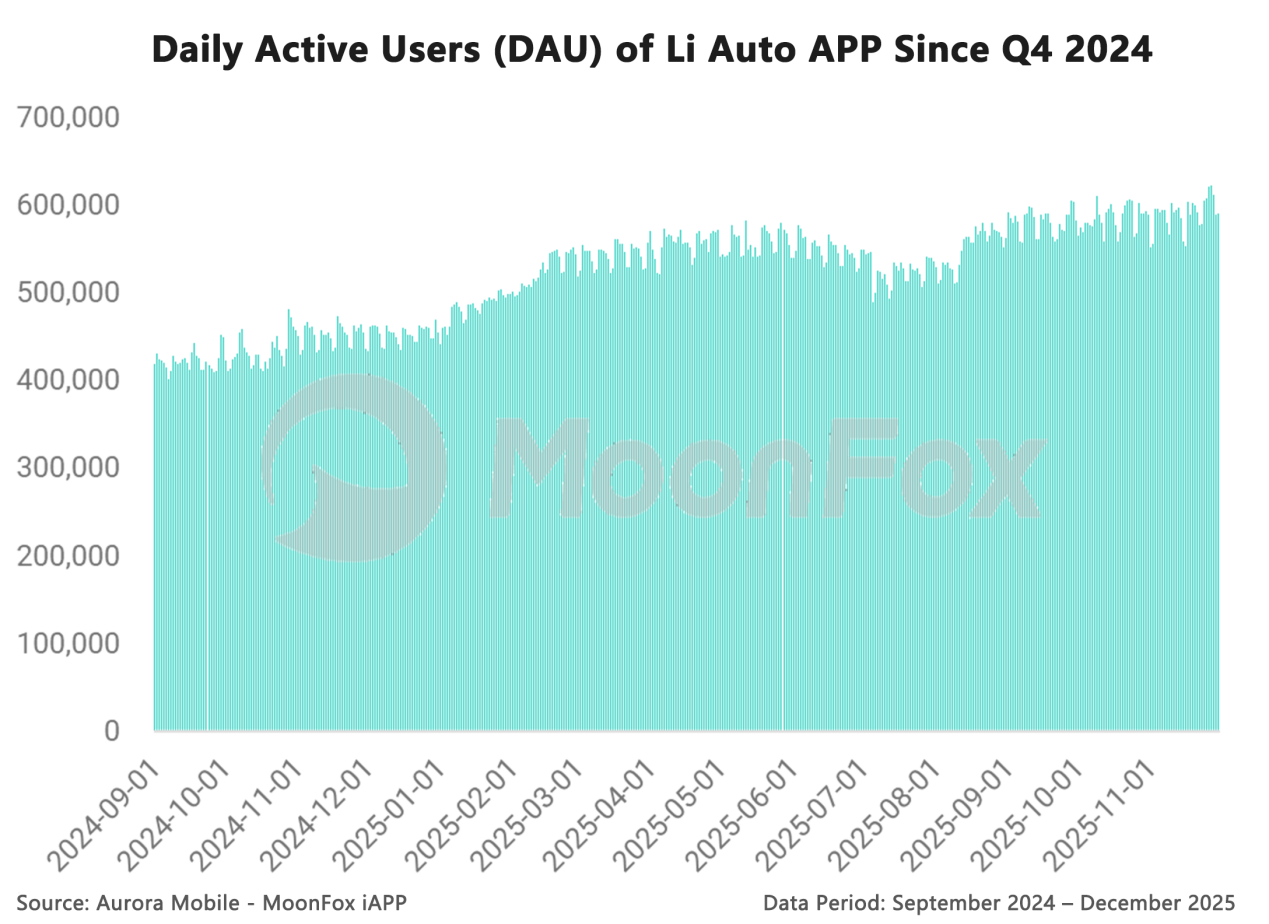

Although Deliveries have continued to decline, data from Aurora Mobile - MoonFox show that Li Auto’s app user engagement is very high and has remained on a steadily rising trend. Overall, the company’s core consumer base demonstrates strong stickiness, which is currently the key to any turnaround for Li Auto. At present, Li Auto urgently needs to enhance product competitiveness; staying focused on its core auto manufacturing business is the right path for future development.

IV. Q4 Outlook: The Downtrend Remains; Near-term Pressure Is Set to Intensify

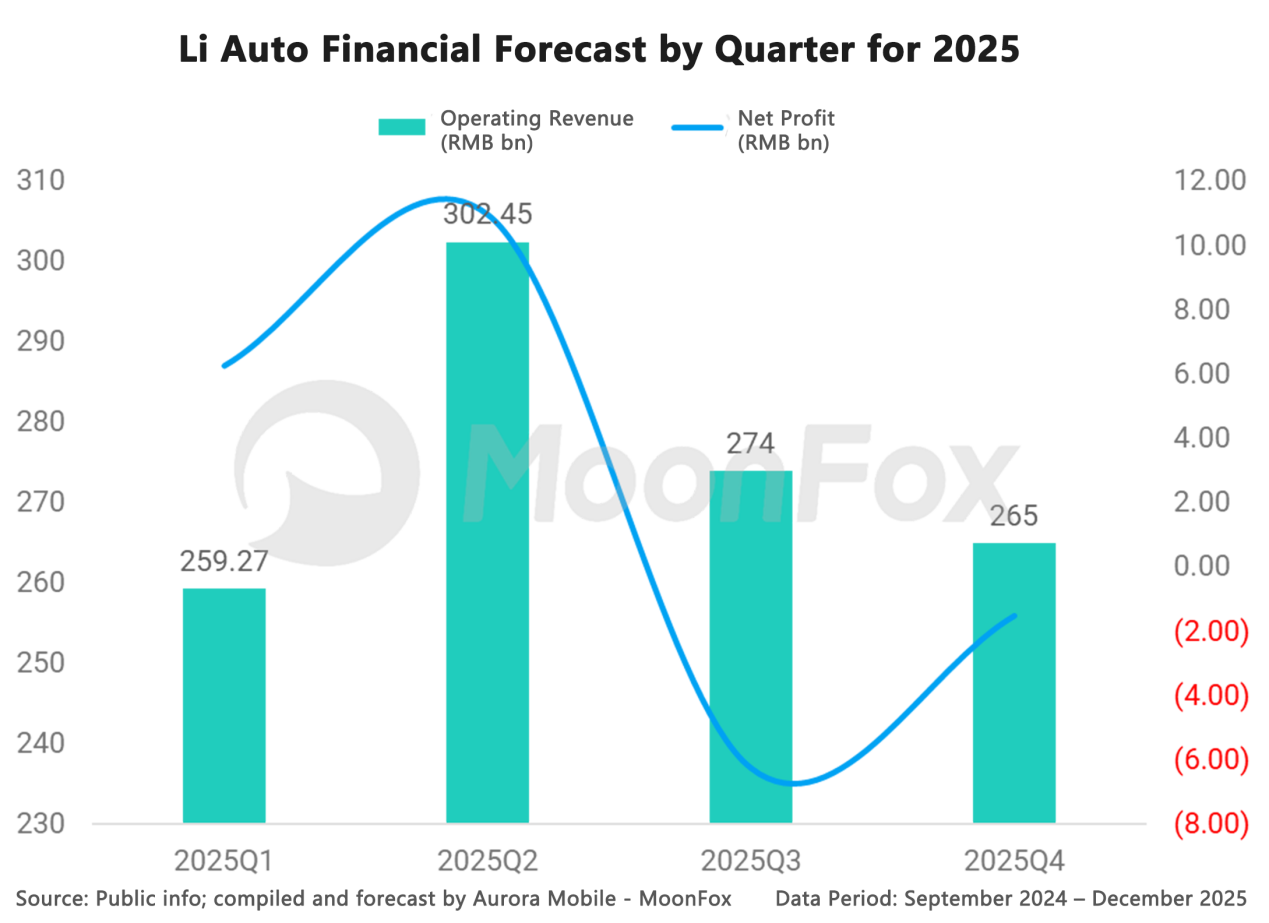

Aurora Mobile - MoonFox expects that, given such an intensely competitive environment, Li Auto will be unable to resolve its model lineup and production capacity issues in the near term and will continue to face a challenging market environment.

For Q4 2025, Aurora Mobile - MoonFox forecasts Li Auto’s revenue at RMB 26.5 billion (approximately USD 3.786 billion), down 40% YoY.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

2025 Internet Industry Annual Review Research Report

Bilibili: A "Forever Young" Platform with a Long-term Vision

Pop Mart Business Decoded: Measuring the Value of Emotional Consumption