Bilibili Q3 2025: Enhanced Profitability and Optimized Revenue Structure

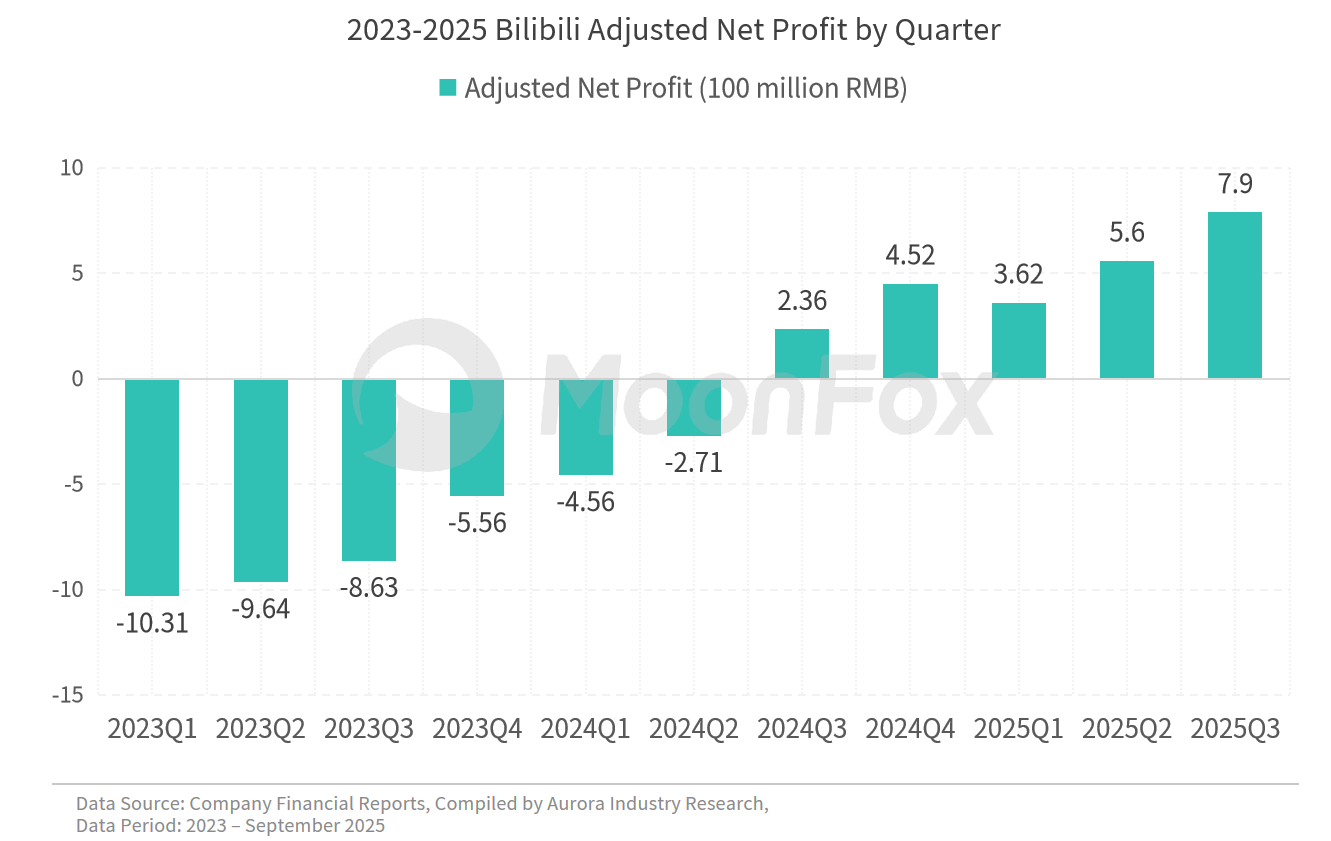

As of the end of September 2025, Bilibili has achieved positive adjusted net profit for five consecutive quarters, with steady revenue growth and a significant improvement in profitability. Based on financial report data, this analysis will cover overall performance, current business revenue structure, and future trends.

Ⅰ. Overall, Bilibili’s Operational Efficiency and Profitability Improvements Stand Out in 2025

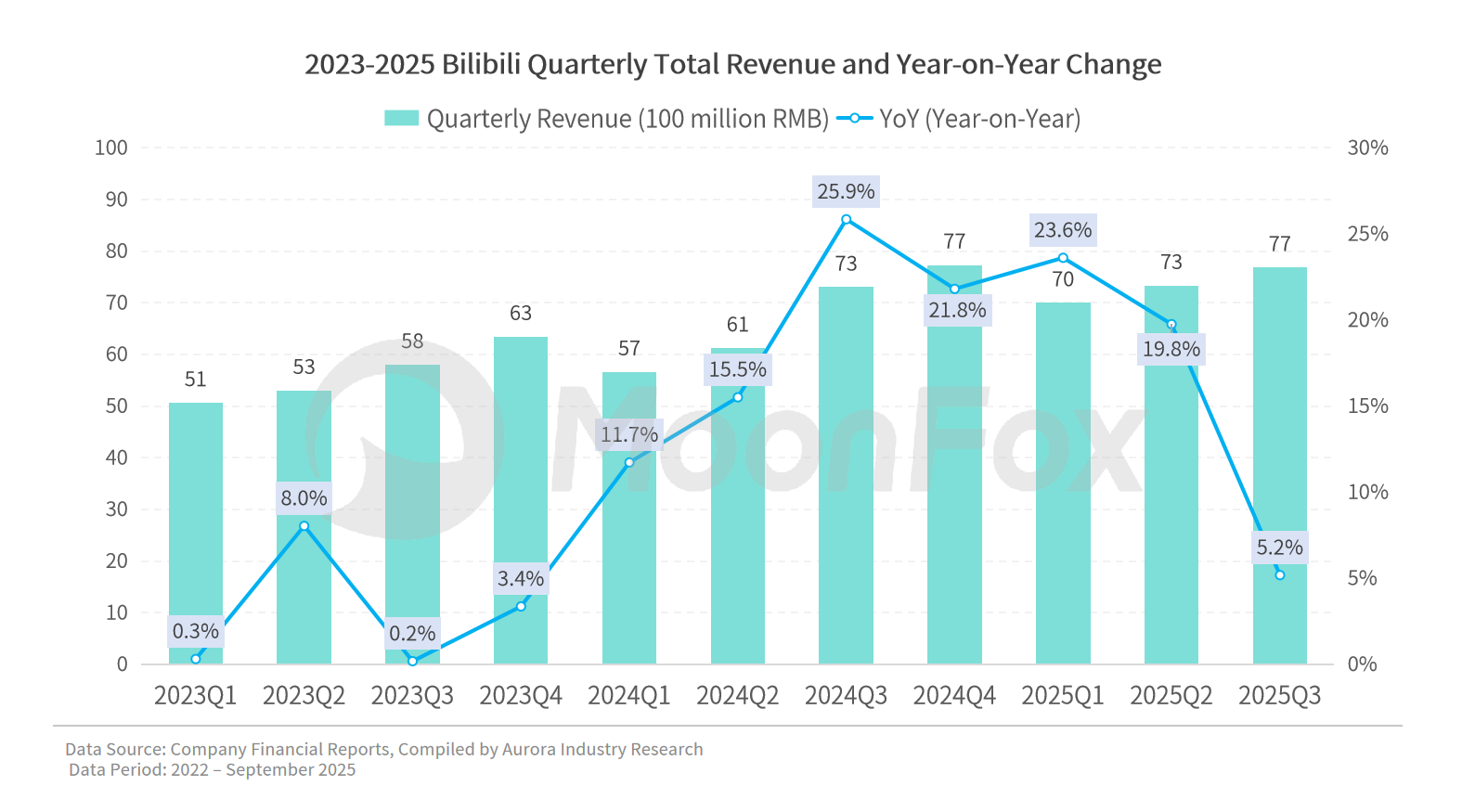

In Q3 2025, Bilibili’s total revenue increased by 5.2% year-on-year to RMB 7.69 billion. Since achieving single-quarter profitability in Q3 2024, Bilibili’s quarterly revenue performance has remained stable, with year-on-year growth rates gradually moderating throughout 2025.

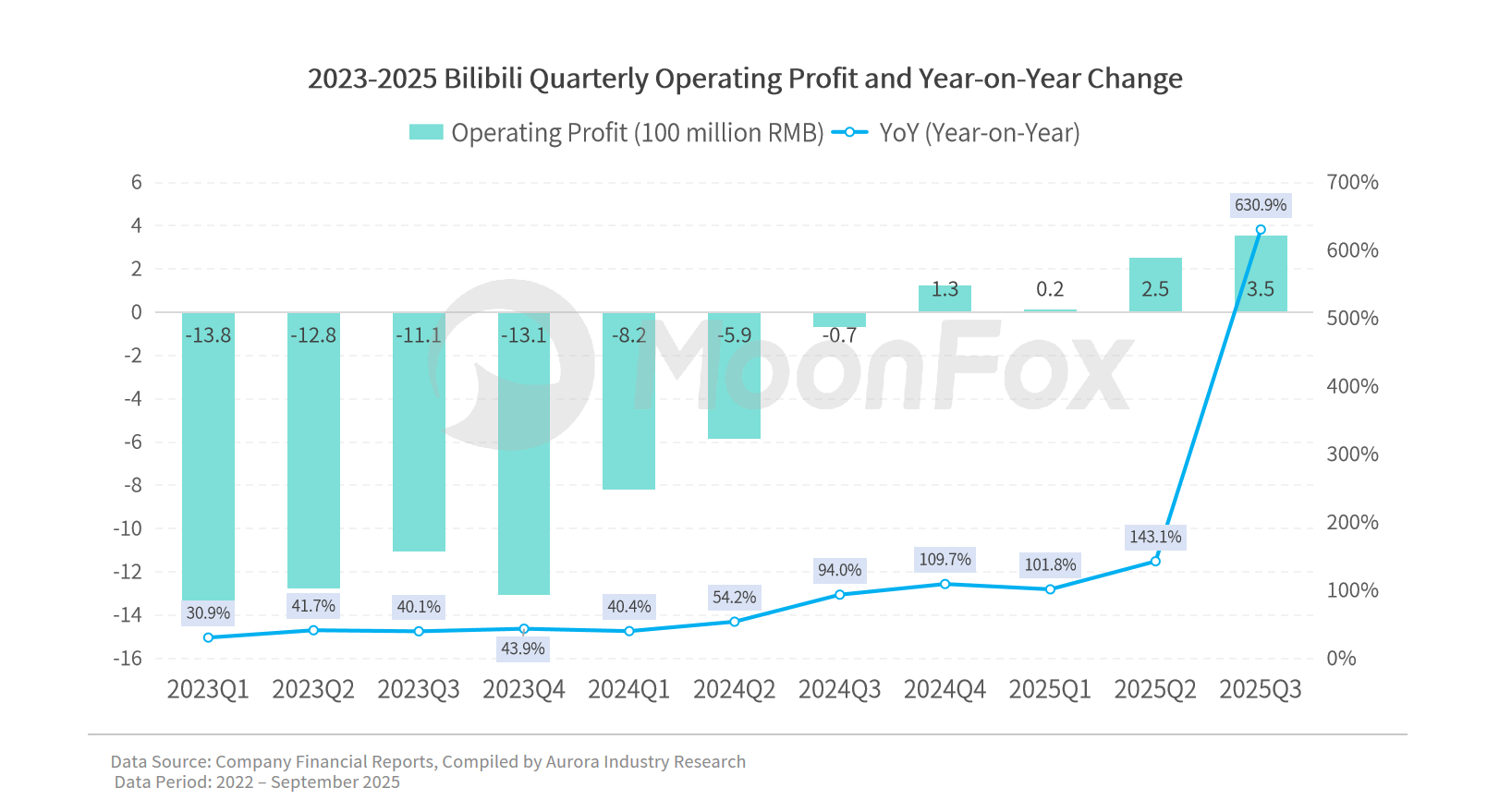

However, Bilibili demonstrated robust growth in EBIT (Earnings Before Interest and Taxes / Operating Profit), with Q3 2025 EBIT surging by 630.9% year-on-year. Despite stable absolute revenue figures, the company’s core business operational efficiency continues to improve, with significant results from cost reduction and efficiency initiatives.

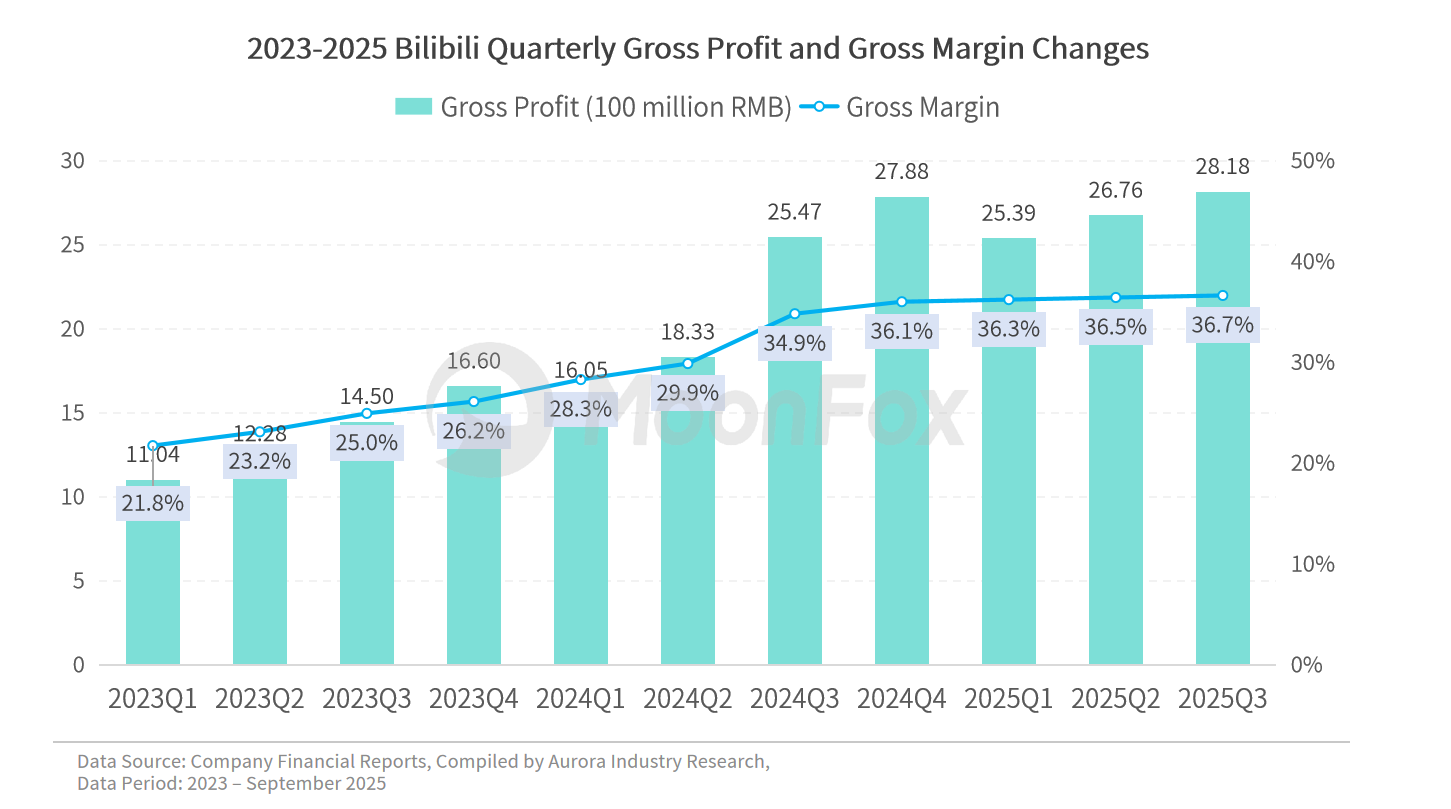

Adjusted net profit increased by 233% year-on-year to RMB 790 million. The gross margin has grown for 13 consecutive quarters, reaching 36.7%, with single-quarter gross profit at RMB 2.82 billion—a historical high. The stable gross margin and net profit growth are strong evidence of Bilibili’s enhanced profitability.

Ⅱ. Revenue Structure Optimization: Advertising Becomes a New Growth Driver

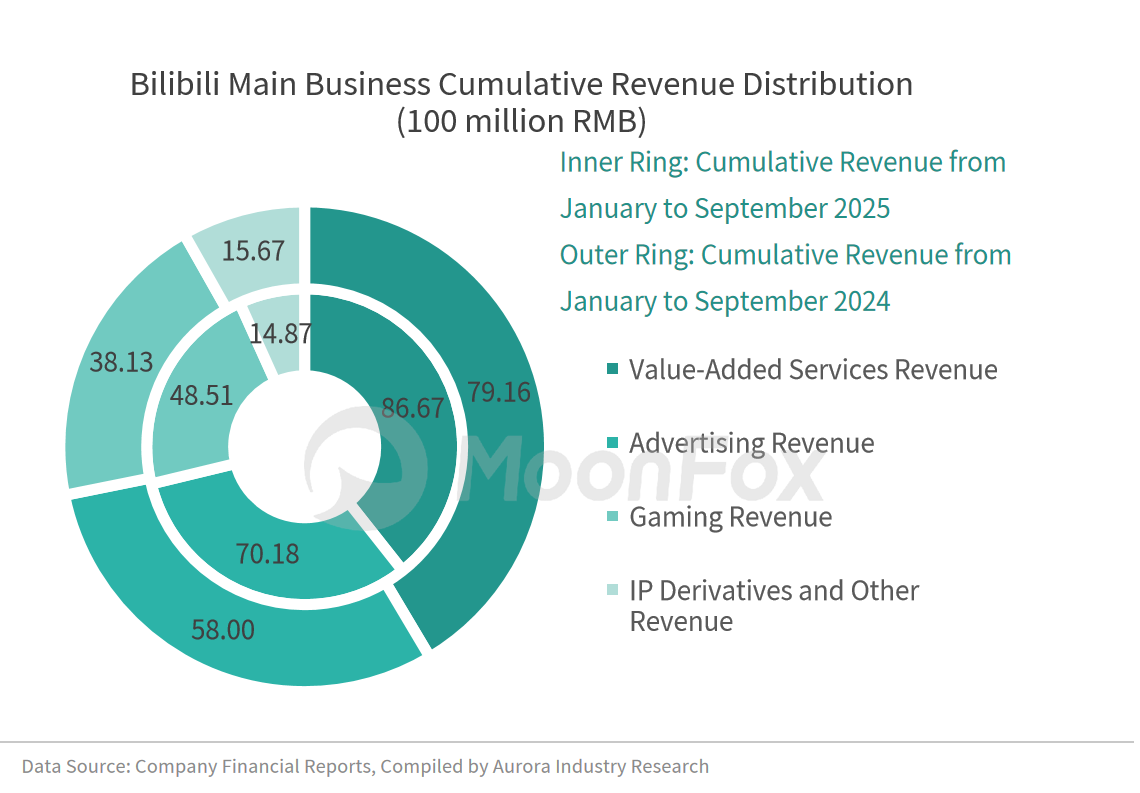

For the first three quarters of 2025, total revenue reached RMB 22.023 billion, up 15.3% year-on-year, with the following breakdown:

Value-added services revenue share decreased by 3 percentage points to 39% of total revenue, but remains the company’s core business.

Advertising revenue share increased by 2 percentage points to 32% of total revenue, with cumulative revenue of RMB 7.018 billion, up 21% year-on-year.

Gaming revenue for the first nine months reached RMB 4.851 billion, up 27.2% year-on-year, accounting for 22% of total revenue.

IP derivatives and other businesses generated RMB 1.487 billion, down 5.1% year-on-year, accounting for just 7% of total revenue.

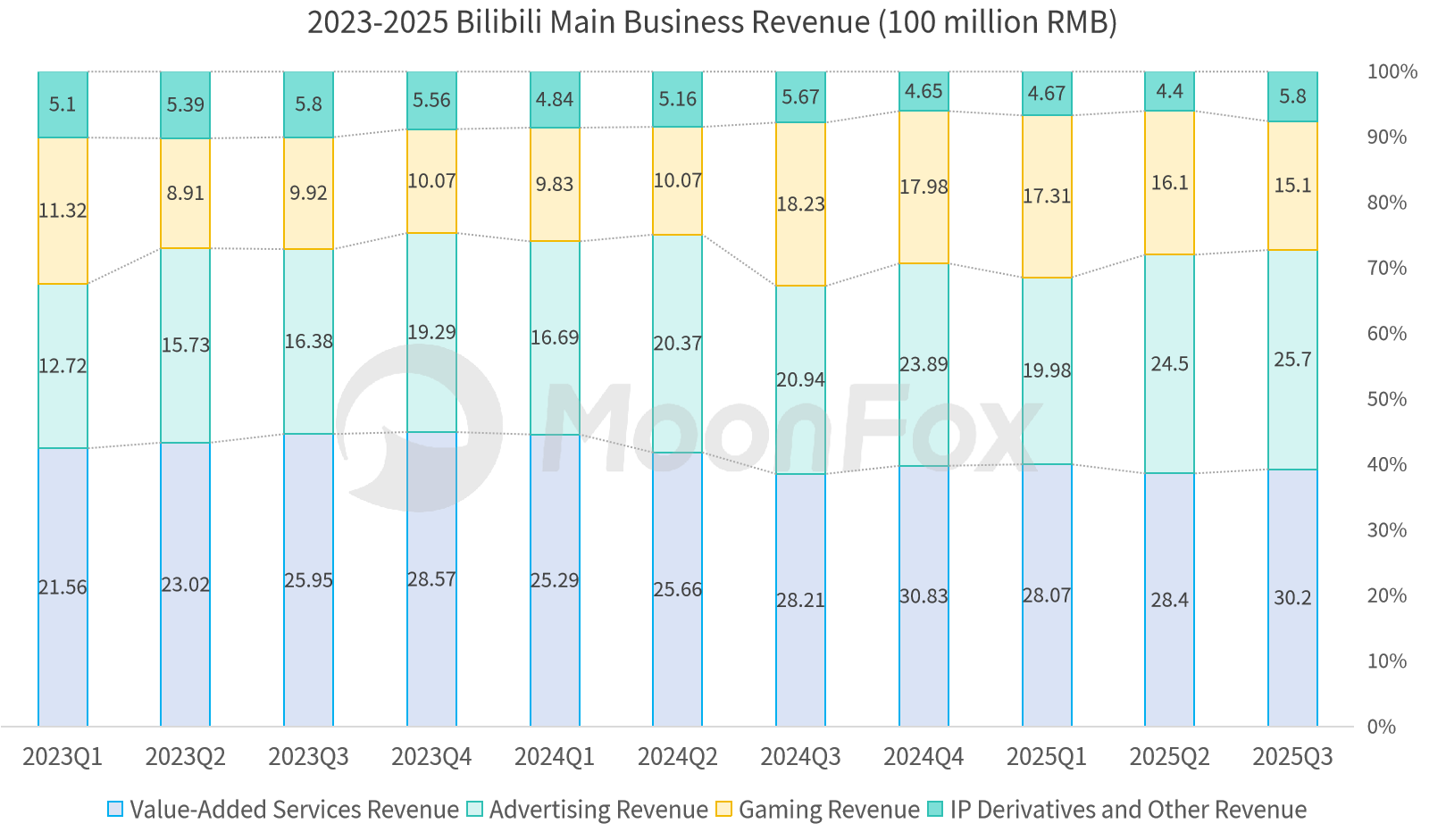

On a quarterly basis, both advertising and value-added services revenues have increased sequentially in 2025, with positive year-on-year growth. Gaming revenue has declined gradually since Q4 2024 but still shows a strong cumulative year-on-year increase. The rapid growth of advertising revenue is crowding out the share of other businesses in total revenue, making it the company’s new growth engine.

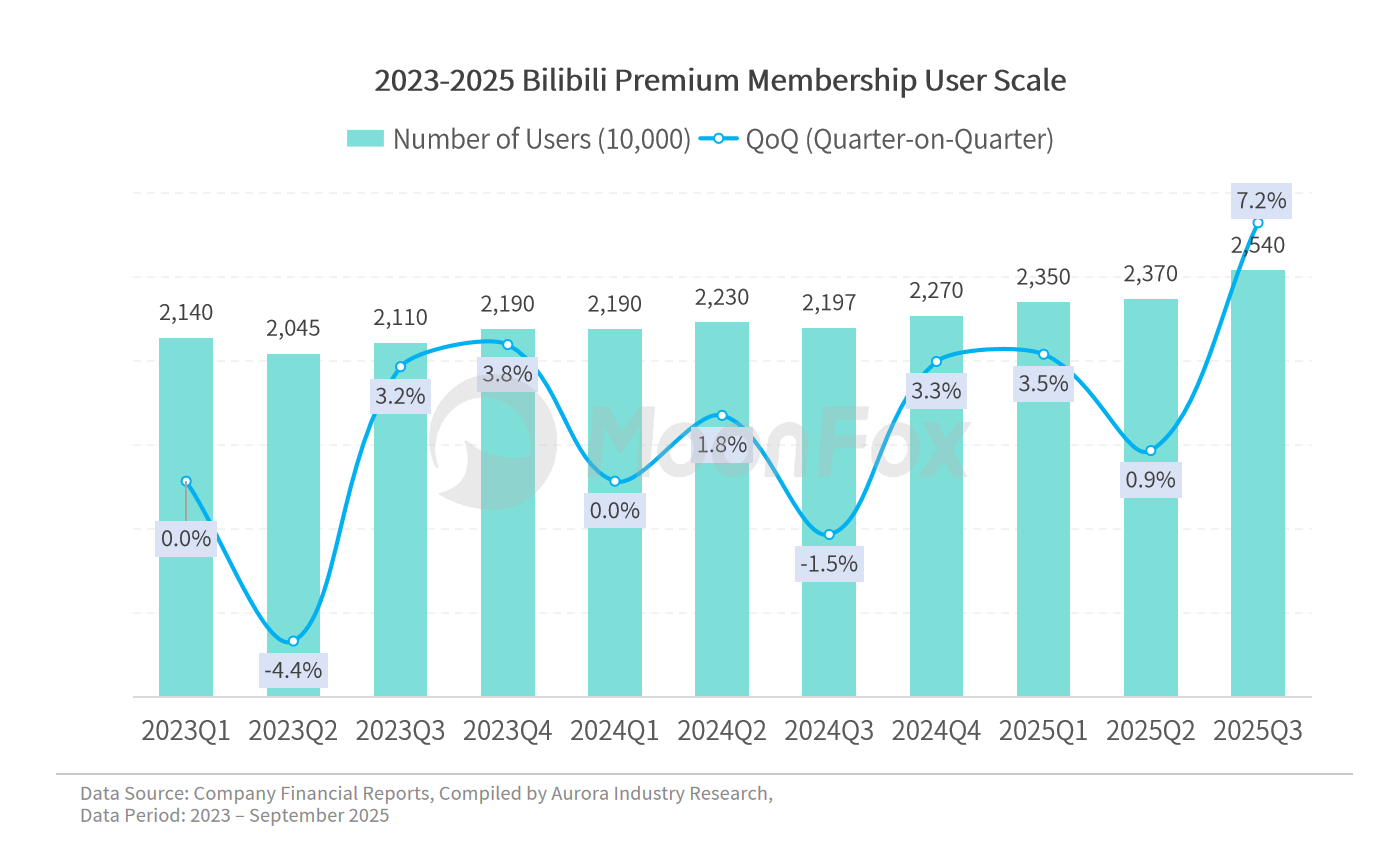

In Q3 2025, average monthly paying users increased by 17% year-on-year to 35 million, with premium members reaching 25.4 million. Increased user willingness to pay has driven value-added services revenue growth. The rapid expansion of the paying user base reflects the platform’s user value and content value. In Q3, advertising revenue grew by 23% year-on-year, laying the groundwork for multiple major promotional campaigns in Q4.

Due to the high base effect from the hit game “Total War: Three Kingdoms” in the same period of 2024, gaming revenue continued to decline in Q3, but long-term titles such as “Fate/Grand Order” still contributed stable income. The newly launched “Escape from Duckov” sold over 3 million copies in three weeks after its October release, providing a strong foundation for future revenue.

Ⅲ. Future Development: Dual Drivers of Technological and Content Innovation

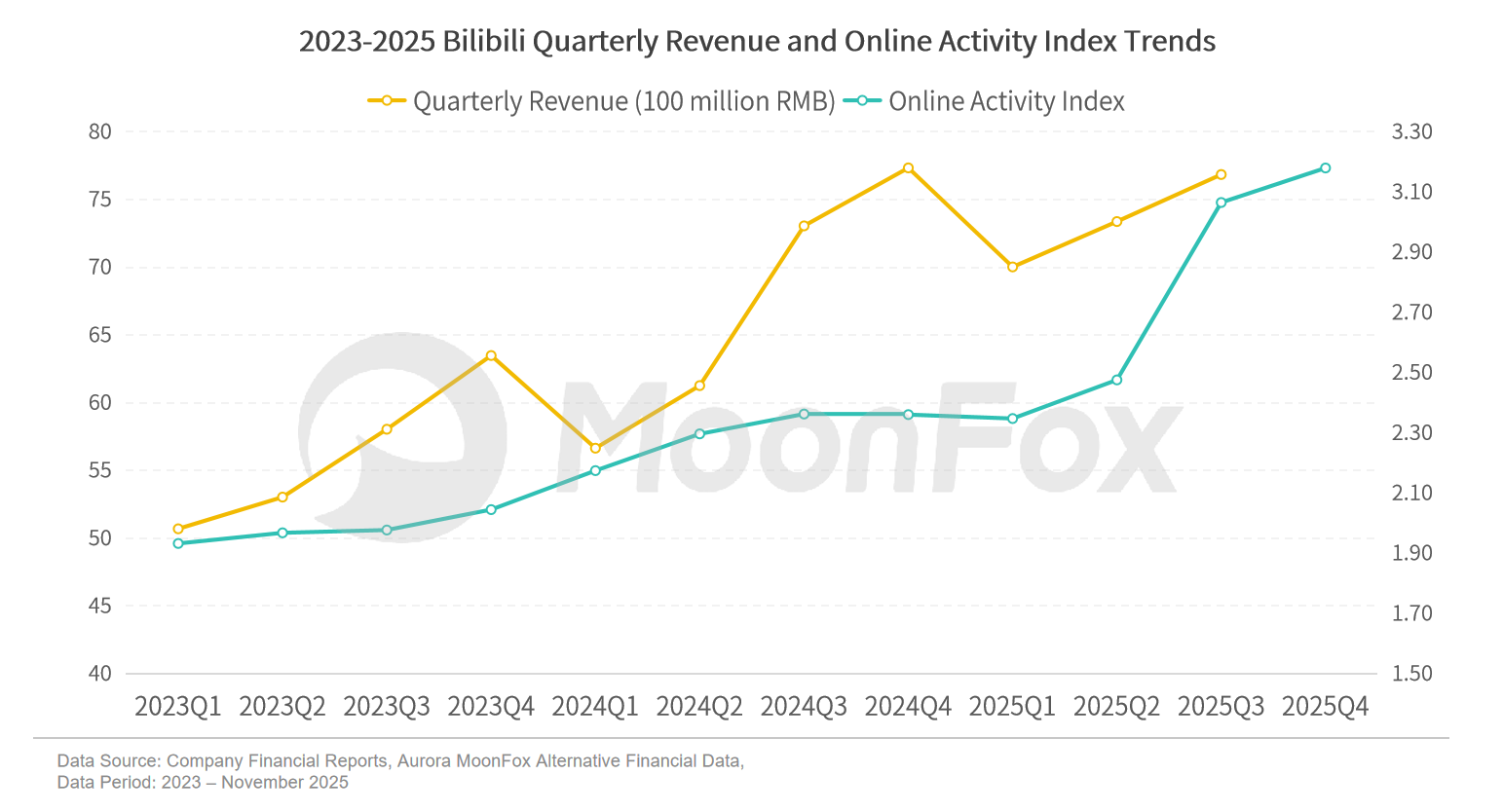

According to Aurora MoonFox alternative financial data, Bilibili’s quarterly revenue continues to grow in tandem with a steady increase in its online activity index.

Bilibili is deepening its application of AI across multiple domains. On one hand, AI-generated covers and automated ad placements are reducing advertising costs and improving efficiency. On the other hand, AI-generated content has seen rapid growth in viewing time for three consecutive quarters, highlighting the platform’s content advantage in technology verticals.

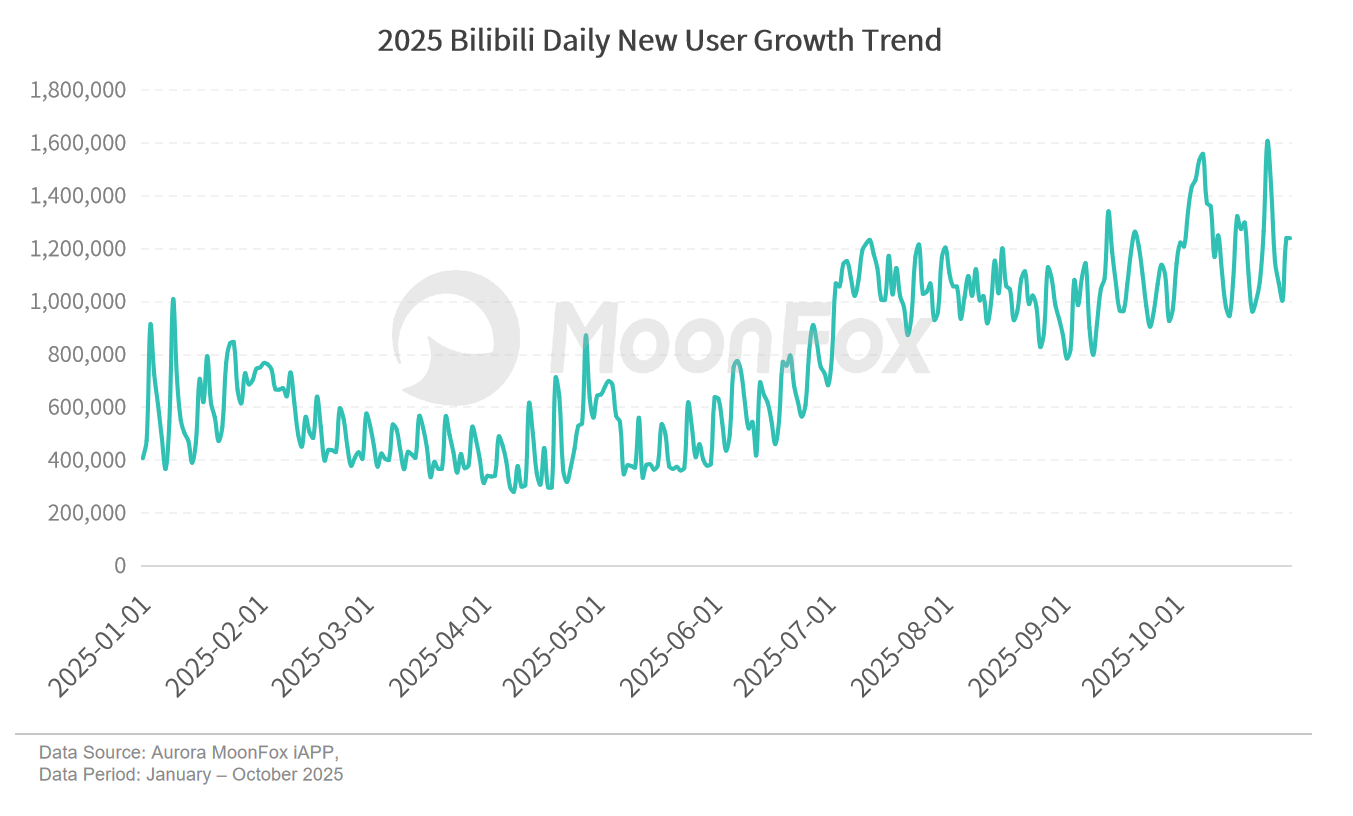

Content innovation and new game launches are accelerating community expansion. Aurora MoonFox iAPP data shows that Bilibili’s daily new user additions in the second half of the year significantly outpaced the first half, with October setting a new annual record.

The newly launched game “Escape from Duckov” has already demonstrated blockbuster potential, and the new Three Kingdoms IP game “Three Kingdoms: Hundred Generals” is expected to launch in Q1 2026, underscoring the platform’s commitment to building an IP matrix. On the content side, as competition in short videos intensifies, Bilibili’s launch of video podcasts—a new form of long-form content—has attracted considerable attention. “Premiumization” remains the main direction for Bilibili’s content development.

From a business perspective, the continued expansion of advertising, the momentum from new game releases, and enhanced cost control capabilities are expected to drive further growth in Bilibili’s profit scale and margins in the short term.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

2025 Internet Industry Annual Review Research Report

Bilibili: A "Forever Young" Platform with a Long-term Vision

Pop Mart Business Decoded: Measuring the Value of Emotional Consumption