Yum China Q3 2025: Ongoing Optimization, “Cost Reduction & Efficiency + Steady Expansion” Drive Profit Growth

Ⅰ. Financial Overview: Q3 Revenue Rebounds to Annual High, Profitability Continues to Improve

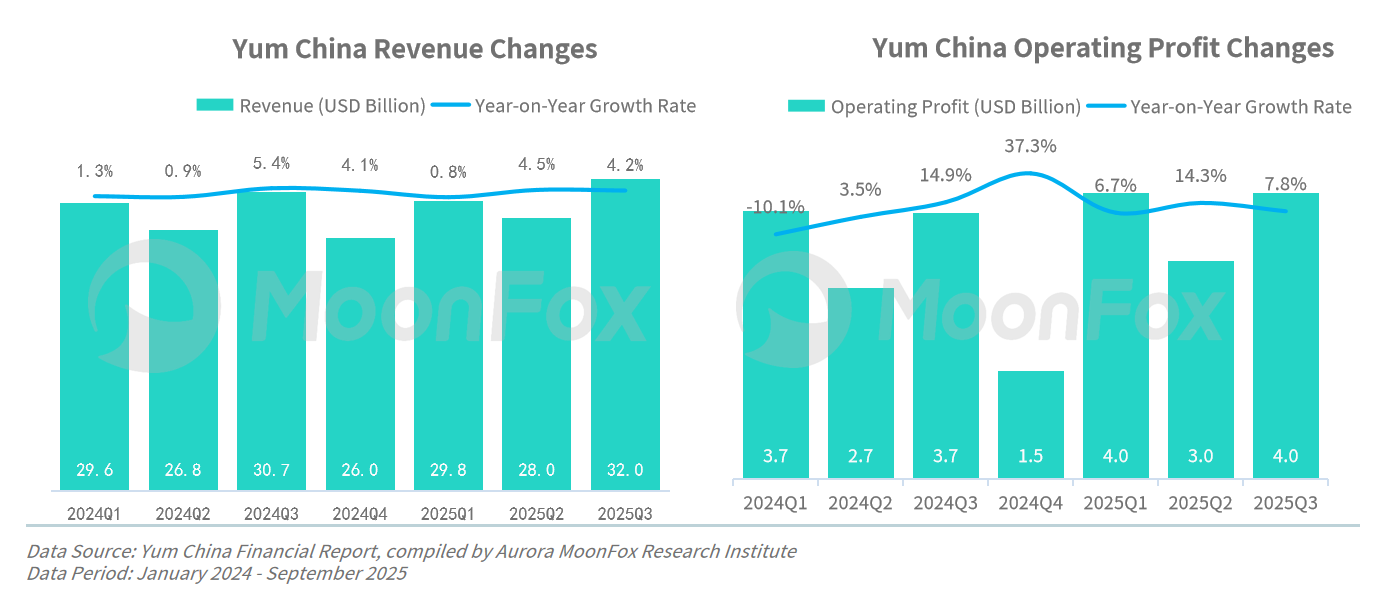

In Q3 2025, Yum China maintained its “quarterly volatility, annual stability” operating pattern. Benefiting from back-to-school consumption and the Mid-Autumn Festival, core performance indicators rebounded significantly compared to Q2. Q3 2025 revenue reached USD 3.2 billion, up 4% year-on-year, marking a new high for 2025 and surpassing the Q1 peak of USD 2.981 billion. System sales increased by 4% YoY, mainly driven by a 4% net increase in store count and a 1% rise in same-store sales. The momentum of consumer recovery continues to be evident.

Profitability also improved in tandem. Q3 2025 operating profit grew by 8% YoY to USD 400 million. Core operating profit also increased by 8% YoY; the operating margin reached 12.5%, and restaurant margin climbed to 17.3%, both hitting new quarterly highs for the year. This performance was driven by both peak-season consumption and refined cost management, significantly enhancing core business profitability.

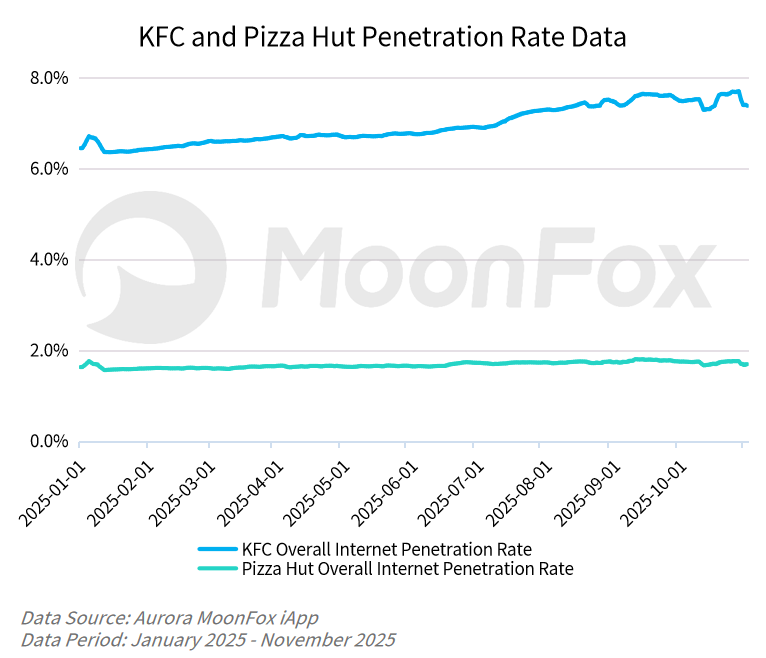

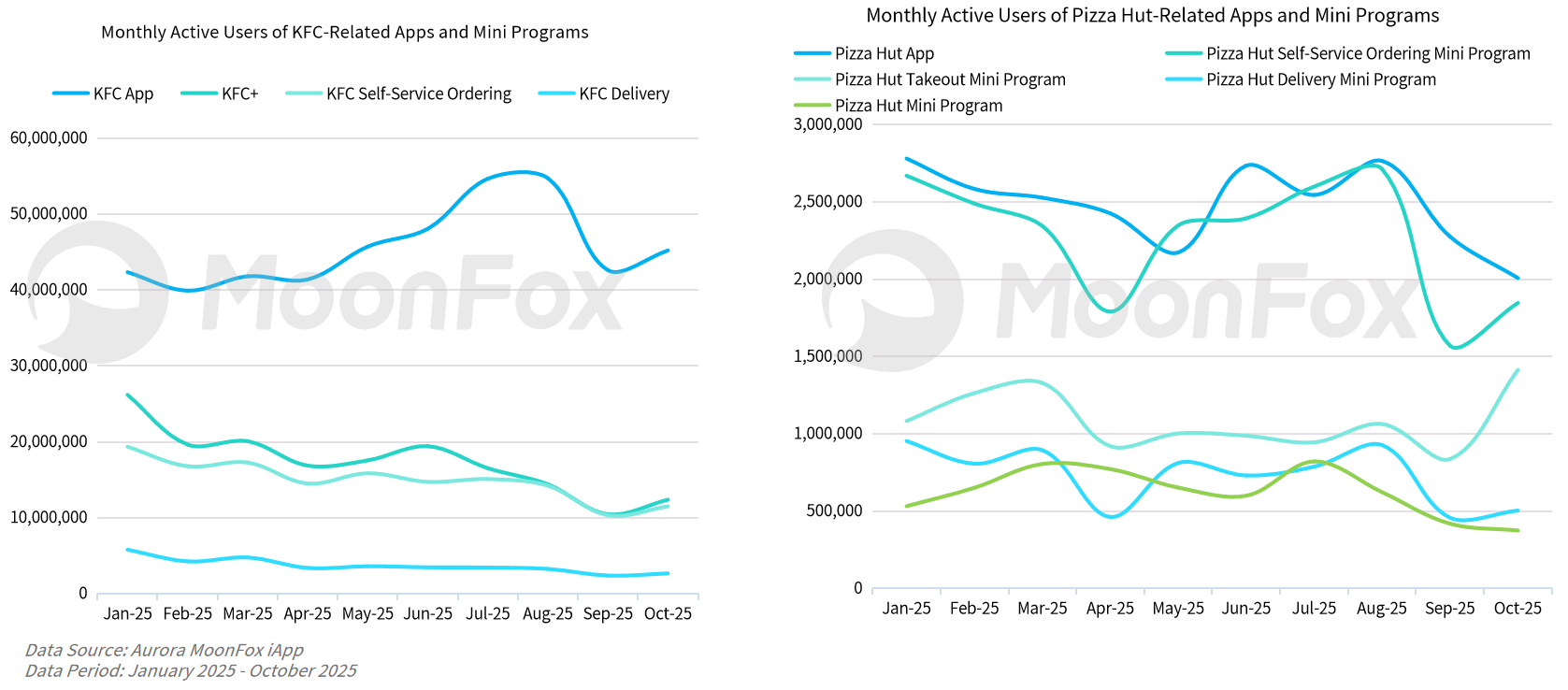

According to MoonFox iApp data, Yum China’s related app penetration rate continues to grow. Due to the summer holiday, monthly active users (MAU) for Yum China’s apps peaked in July and August.

The KFC app’s MAU surpassed 50 million during the summer, setting a record high, with YoY growth rates of 29.8% in July and 24.7% in August. In September and October, MAU declined but remained above 40 million.

The Pizza Hut app’s MAU in August was the second highest in 2025, up 1.5% YoY.

In contrast, Yum China’s related mini-programs saw a decline in MAU during Q3, but began to rebound in early Q4.

Ⅱ. Business Status: Accelerated Store Expansion, Ongoing Cost Structure Optimization

1. Core Business Remains Robust, Balanced Volume-Price Strategy Proves Effective

KFC and Pizza Hut remain Yum China’s revenue pillars, contributing about 95% of Q3 revenue—showing strong stability. In Q3, KFC’s system sales rose 5% YoY, same-store sales increased 2%, and same-store transactions grew 3%, while average ticket size dropped 1% YoY (to RMB 38). Pizza Hut’s same-store transactions surged 17% YoY, system sales rose 4%, and average ticket size dropped 13% YoY (to RMB 70), offering more value-for-money products. The value pricing strategy successfully boosted traffic and offset competitive pressure from lower-tier markets.

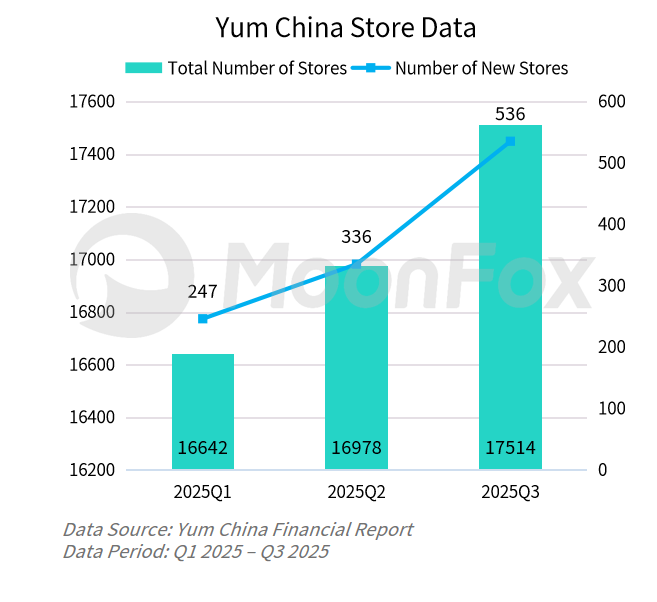

2. Store Expansion Accelerates Toward Annual Targets, Growth Pace Well Managed

Yum China accelerated store expansion in Q3. By the end of Q3 2025, total stores reached 17,514, up 872 from the end of Q1 (16,642). Q3 alone saw 536 new stores, a 59.5% increase over Q2, significantly contributing to the annual target of 1,600–1,800 new stores. KFC now has 12,640 stores, Pizza Hut 4,022. COFFii & JOY has surpassed 1,800 locations, and KPRO, focusing on power bowls and superfood shakes, has opened over 100 stores in top-tier cities, bringing new growth potential.

3. Deepening Cost Reduction and Efficiency Initiatives, Expanding Profit Margins

In Q3 2025, Yum China’s core business cost control delivered significant results. Through streamlined operations, supply chain optimization, and digital empowerment, profitability steadily improved. Restaurant margin rose 30 basis points YoY to 17.3%, and operating margin rose 40 basis points to 12.5%, highlighting effective cost-profit balance.

Key cost components—food & packaging, wages & benefits, rent & other operating expenses—totaled USD 2.479 billion, accounting for 77.3% of restaurant revenue. Cost structure is clear and well-managed. All major cost ratios declined YoY:

KFC’s restaurant expenses accounted for 95% of total business expenses and 80.16% of total revenue, down 0.28% YoY. Pizza Hut’s restaurant expenses accounted for 93.43% of total business expenses and 85.04% of total revenue, down 0.98% YoY.

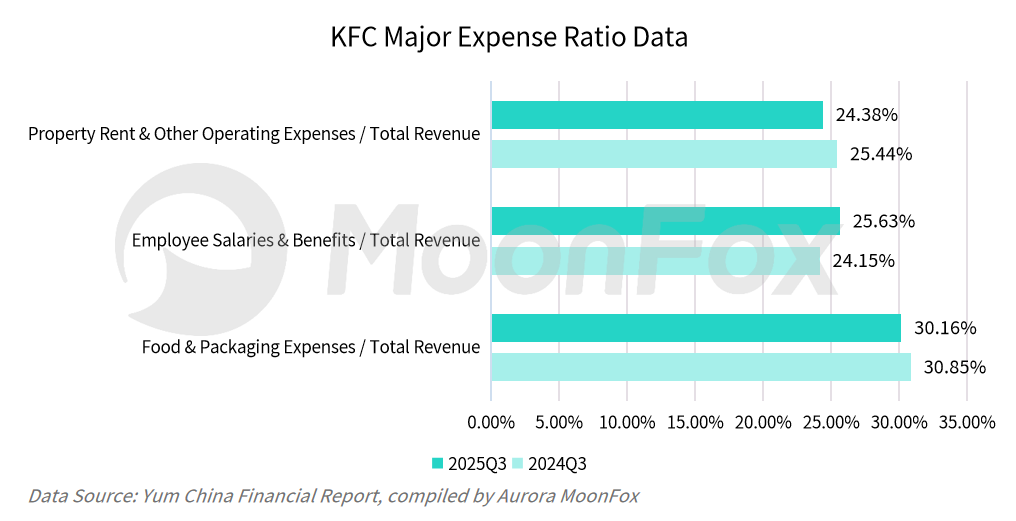

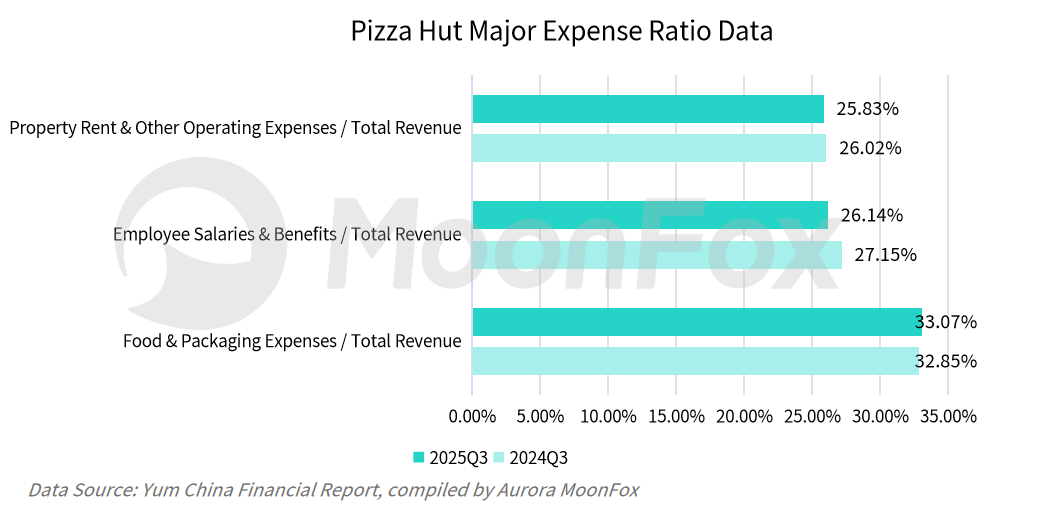

Food & packaging costs were slightly compressed, with KFC’s ratio down 0.69% and Pizza Hut’s up 0.22%, thanks to favorable raw material prices and nationwide procurement scale.

Wages & benefits for KFC rose 1.48% (mainly due to increased delivery rider costs as delivery share grew), while Pizza Hut’s fell 1.01%, ensuring team stability and service quality.

Rent & other operating expenses were well controlled, with KFC’s ratio down 1.06% and Pizza Hut’s down 0.19%, thanks to streamlined store operations and digital management.

Yum China’s refined management further offset cost pressures.

III. Business Outlook: Innovation Fuels Growth Amid Opportunities and Challenges

1. Multi-dimensional Innovation Continues to Expand Growth Boundaries

On the product side, Yum China remains committed to innovation, launching new items such as Crispy Golden Sand Chicken Wings and Handmade Thin-Crust Pizza in Q3, both surpassing classic products in sales. On the digital side, Yum China continues to invest in digitalization and smart technologies, with cost reduction and efficiency gains becoming increasingly evident. Q3 2025 digital order revenue reached USD 2.8 billion, accounting for 95% of restaurant revenue.

Competition in the fast-food sector intensified in Q3, with the “delivery wars” ongoing and high consumer price sensitivity. This brings both opportunities and challenges. Yum China’s Q3 delivery sales grew 32% YoY, accounting for 51% of restaurant revenue. However, maintaining profit stability while using low prices to attract customers—and avoiding a homogenized price war—remains a key challenge for KFC. With the year-end holiday season approaching, Yum China must further balance ticket size and transaction volume, leveraging product differentiation and service excellence to consolidate market position.

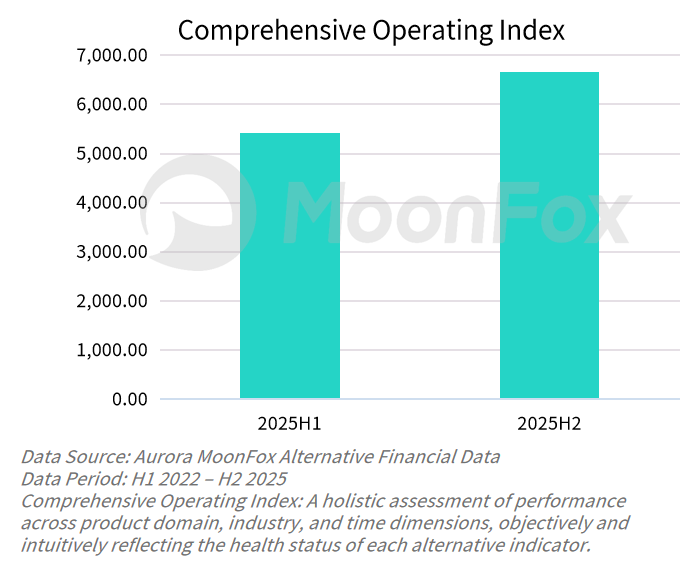

According to Aurora MoonFox alternative financial data, Yum China’s operating index for H2 2025 is projected to exceed H1 by 22.77%, reaching over 6,600.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

2025 Internet Industry Annual Review Research Report

Bilibili: A "Forever Young" Platform with a Long-term Vision

Pop Mart Business Decoded: Measuring the Value of Emotional Consumption