Profit Growth Slows, CYBEX’s “Going Global” Drives Performance Growth

I. Financial Report Analysis: Revenue Slightly Up by 2.7%, Net Profit Returns to Average Range

On November 5, 2025, Goodbaby International released its financial report for the third quarter of 2025. As of September 30, 2025, the company achieved revenue of HKD 6.42 billion, a year-on-year decrease of 1.1%. The combination of international exchange rate fluctuations and intensified industry competition has pushed Goodbaby into a performance adjustment period.

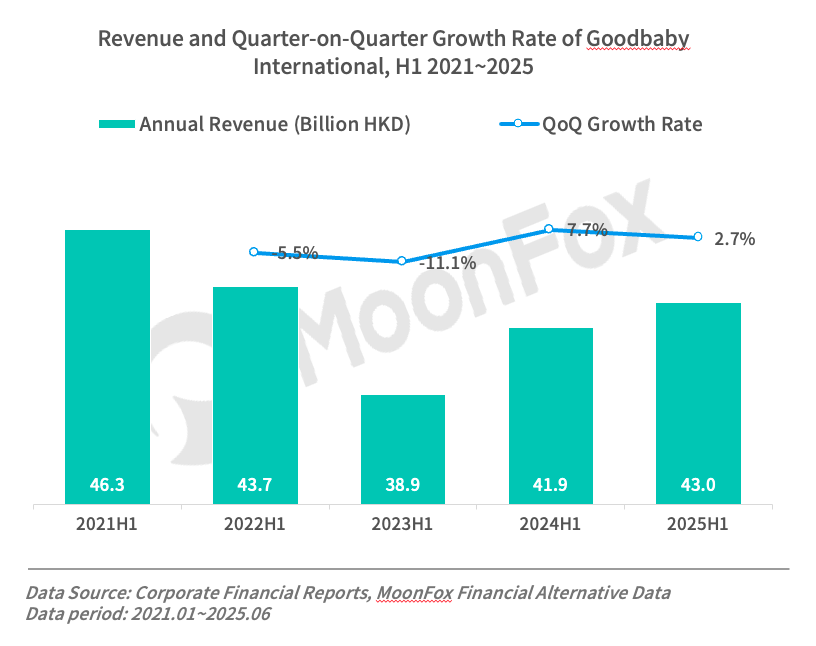

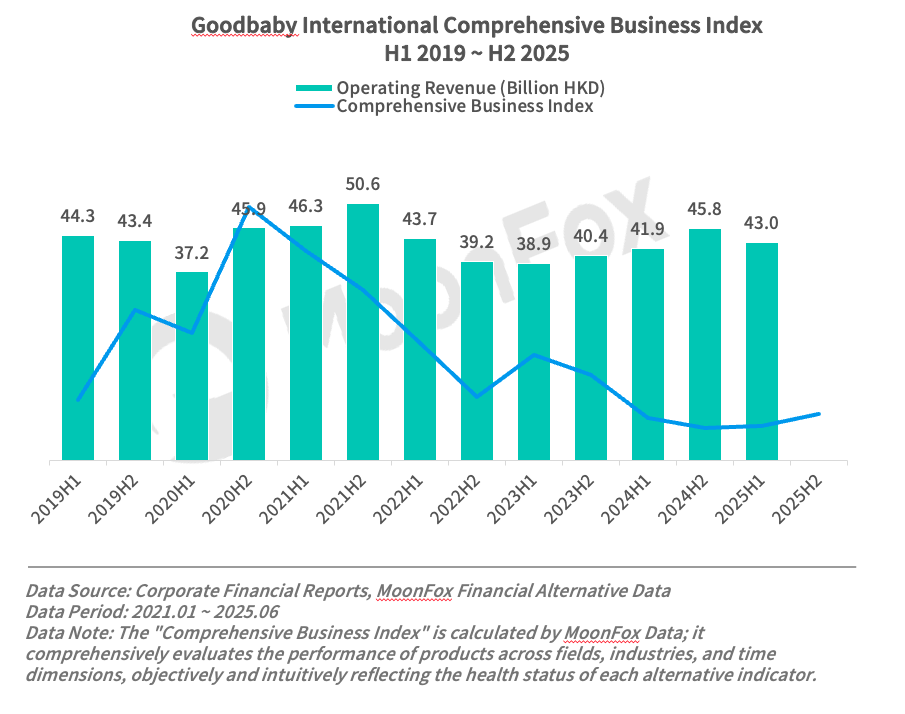

From the semi-annual data, Goodbaby International recorded operating revenue of HKD 4.3 billion in the first half of 2025, continuing the growth trend of the same period in 2024, but with a slower pace. The quarter-on-quarter growth was 2.7%, which is close to the 2% predicted by MoonFox Data iApp Financial Alternative Edition. Goodbaby Group is a global leader in children’s products, with innovation, quality, and globalization as its core competitiveness. The company responds to challenges by optimizing the supply chain, adjusting product structure, and expanding into emerging markets. However, in the context of a global economic downturn and lack of growth momentum in birth rates, the company is also facing the dilemma of declining performance.

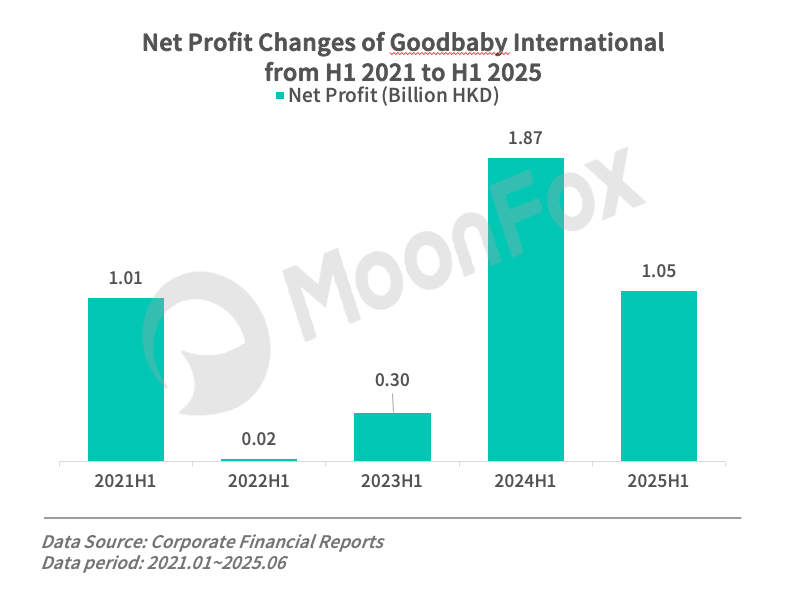

In the first half of 2025, Goodbaby International’s net profit declined but remained at a relatively high level. The adjusted net profit was HKD 105 million, still showing significant growth compared to 2023.

On one hand, additional tariffs caused by China-US trade frictions directly increased the cost of product exports, becoming the primary factor eroding profits. On the other hand, to meet new regulatory standards from the US Consumer Product Safety Commission (CPSC), R&D and production costs for some branded car seats increased significantly, and intensified promotions of older products further compressed profit margins. Overall, the degree of net profit decline is close to the 40% predicted by MoonFox Data iApp Financial Alternative Edition.

II. Business Status Interpretation: CYBEX Expands in Europe, Evenflo Enters TIME’s “Best Inventions” List

Goodbaby International’s main business is the design, development, manufacturing, and marketing of strollers and child car seats, forming a global layout centered on China, the US, and Germany. At the product level, this includes the high-end, fashion-focused brand Cybex; the mid-to-high-end, value-for-money car seat brand Evenflo; and the Chinese domestic brand gb Goodbaby, which covers all price ranges and types of baby products.

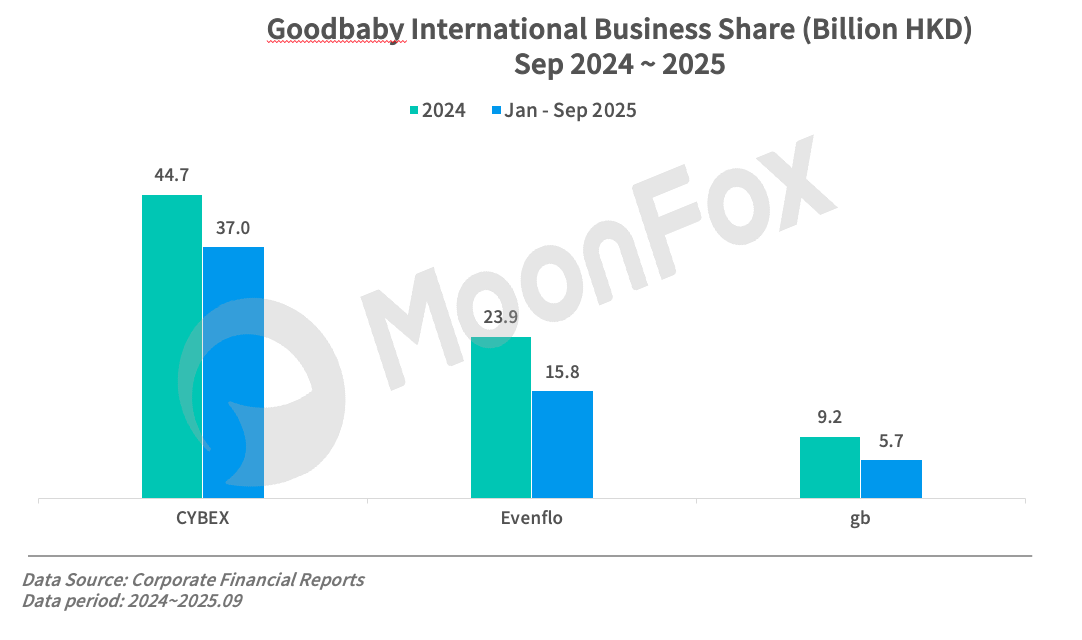

Comparing the revenue of each product line in 2024, by September 2025, the performance of each brand maintained steady growth. Among them, CYBEX is close to the full-year level of 2024 and is expected to achieve significant year-on-year growth in 2025; Evenflo’s growth is relatively weak and is expected to remain flat year-on-year in 2025.

Focusing on the actual performance of each business line, as the company’s high-end brand, CYBEX continued its strong growth momentum in the third quarter of 2025. As of September 2025, CYBEX achieved revenue of HKD 3.7 billion, a year-on-year increase of 11.7%, and is expected to achieve significant year-on-year growth in 2025, surpassing HKD 4.47 billion in 2024. Its growth drivers come from two aspects: first, global channel expansion, with Goodbaby actively expanding overseas markets during the reporting period and opening a flagship store in Paris to enter strategically important cities; second, breakthroughs in regional markets, with Cybex consolidating its market share in core markets such as Europe and North America. Its “technology-lifestyle” brand positioning enables it to maintain growth amid deteriorating consumer sentiment.

In contrast, the other two brands’ revenue growth remains weak. First, Evenflo’s growth slowed in 2025. As of September 30, 2025, Evenflo achieved revenue of HKD 1.58 billion, a year-on-year decrease of 10.9%. The decline in revenue was mainly due to a drop in the car seat category. However, from a long-term perspective, we remain optimistic about Evenflo’s brand influence. In October 2025, the Evenflo Revolve180 LiteMax NXT rotating infant car seat, with its innovative SensorySoothe™ application, became the world’s only infant car seat with built-in sound and light soothing features, earning a spot on TIME Magazine’s 2025 Best Inventions list. There is still room for growth for mid-to-high-end baby products and car seats in overseas markets.

Finally, as the company’s core self-owned brand in the Chinese market, gb also lacks growth momentum. As of September 30, 2025, gb achieved revenue of HKD 571 million, a year-on-year decrease of 18.1%. The company stated that the decline in revenue was mainly due to the impact of wholesale channels, and competition in the domestic baby market has further intensified.

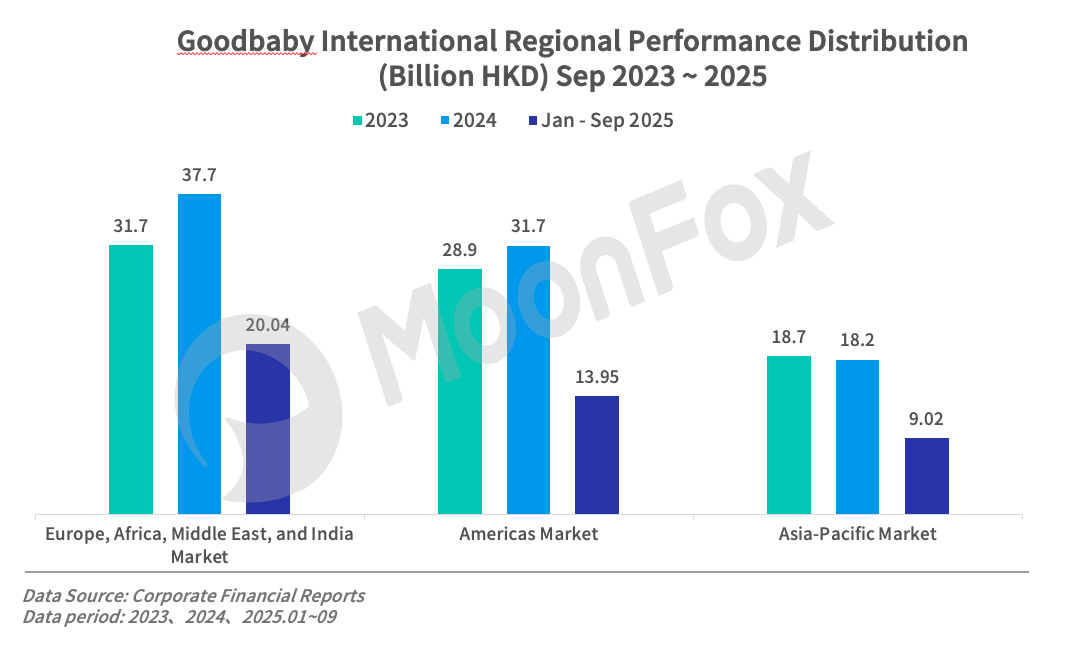

From a regional perspective, Goodbaby International’s main source of income is overseas markets. Among them, the Europe, Middle East, and India markets accounted for the highest proportion, reaching HKD 2.004 billion as of September 2025; the Americas remain a major market, with revenue of HKD 1.395 billion in the same period. In contrast, the Asia-Pacific market had the lowest share, recording HKD 902 million in the same period. Although the share is slightly lower, there is still room for growth.

Overall, the European market, as Goodbaby International’s core profit pool, provides stable growth and profit support; the Americas market is under short-term pressure but still has long-term development potential; the Asia-Pacific market (especially China) is in a period of strategic adjustment, while emerging markets such as Southeast Asia are gradually becoming new growth engines.

III. Business Development Outlook: Staged Growth Strategy Expected to Reshape a New Cycle of Corporate Development

Based on financial data and performance, we believe that Goodbaby International’s future business development will show multi-stage growth characteristics: short-term growth will rely on peak season sales, mid-term will benefit from capacity release and brand transformation, and long-term sustainable competitiveness will be built through high-end and localization strategies.

According to MoonFox Data Financial Alternative Edition’s forecast, since the COVID-19 pandemic in 2020, Goodbaby International’s comprehensive business index has continued to decline, which is consistent with the company’s fluctuating revenue. MoonFox Data Financial Alternative Edition predicts that the company’s comprehensive business index will rebound in the second half of 2025.

Overall, although short-term regional geopolitical conflicts and international situations bring uncertainties, coupled with inflationary pressures in European and American markets leading to continued low consumer confidence, and European market demand already showing signs of fatigue, conservative consumer sentiment may force the company to adopt more cautious pricing strategies, further affecting gross margin levels. However, in the long run, with the three-tier drive of peak season catalysts, mid-term capacity release and brand improvement, and long-term strategic positioning, the company is expected to return to a growth cycle.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

2025 Internet Industry Annual Review Research Report

Li Auto’s Performance Plunges, BEV Transition Faces Formidable Headwinds

XPeng Motors’ Breakneck Run Continues, but Concentrated Lineup Risks Loom

Bilibili Q3 2025: Enhanced Profitability and Optimized Revenue Structure