Ctrip Q2 Revenue & Profit Growth: Globalization and Holiday Economy to Drive Q3 Momentum

I. Financial Performance: Solid Growth in Q2 Revenue and Profit

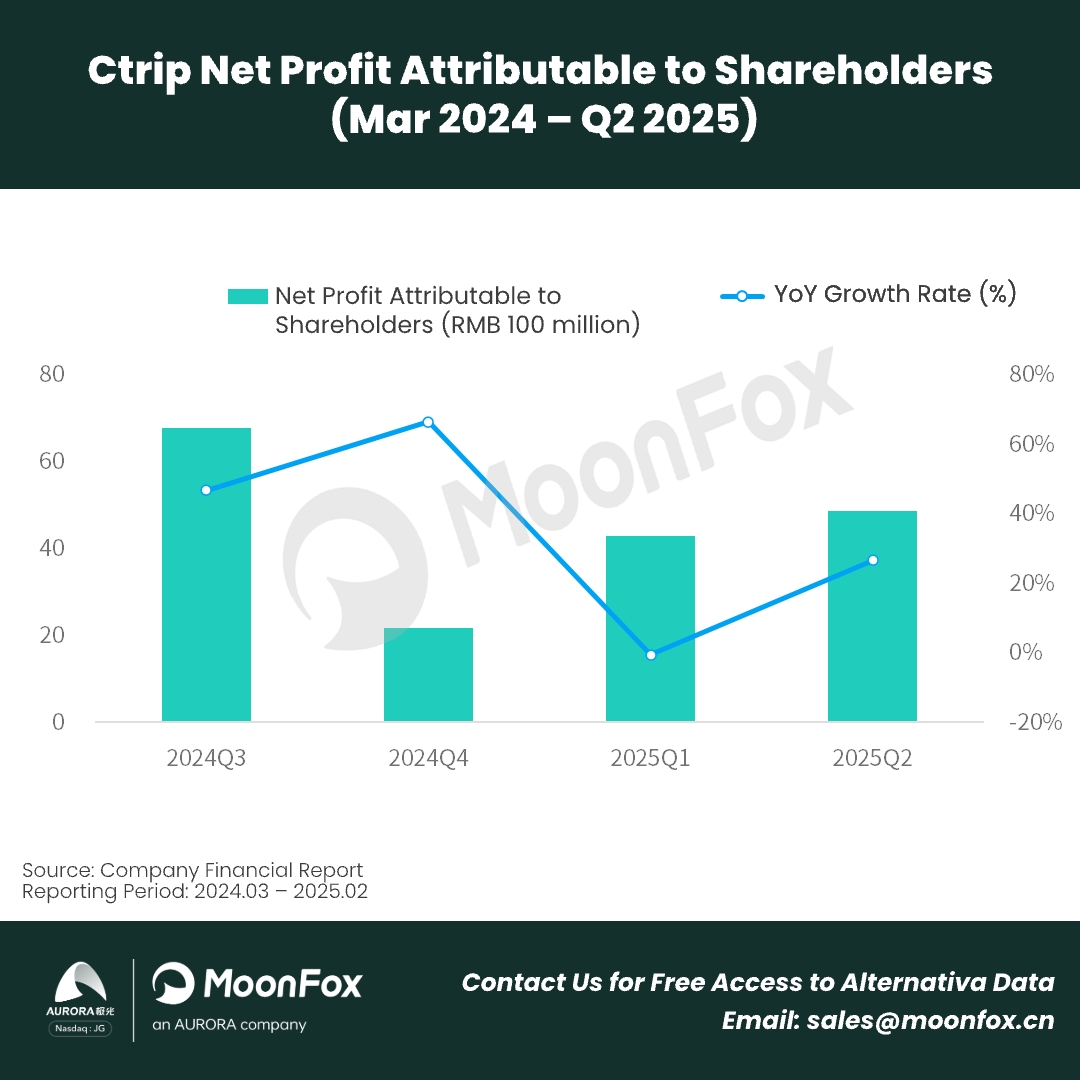

In 2025, the global travel market continued its recovery, with upgraded consumer demand and easier cross-border travel fueling a high-quality development cycle for online travel. According to Ctrip’s financial report, Q2 2025 net revenue grew 16.2% year-on-year to RMB 14.8 billion, with H1 revenue reaching RMB 28.7 billion. Net profit for Q2 was RMB 4.9 billion, up from both the previous quarter and the same period last year. Ctrip leveraged opportunities in outbound and inbound tourism, amplifying its supply chain advantages to achieve dual growth in revenue and profit, while investments in technology and globalization laid a solid foundation for long-term growth.

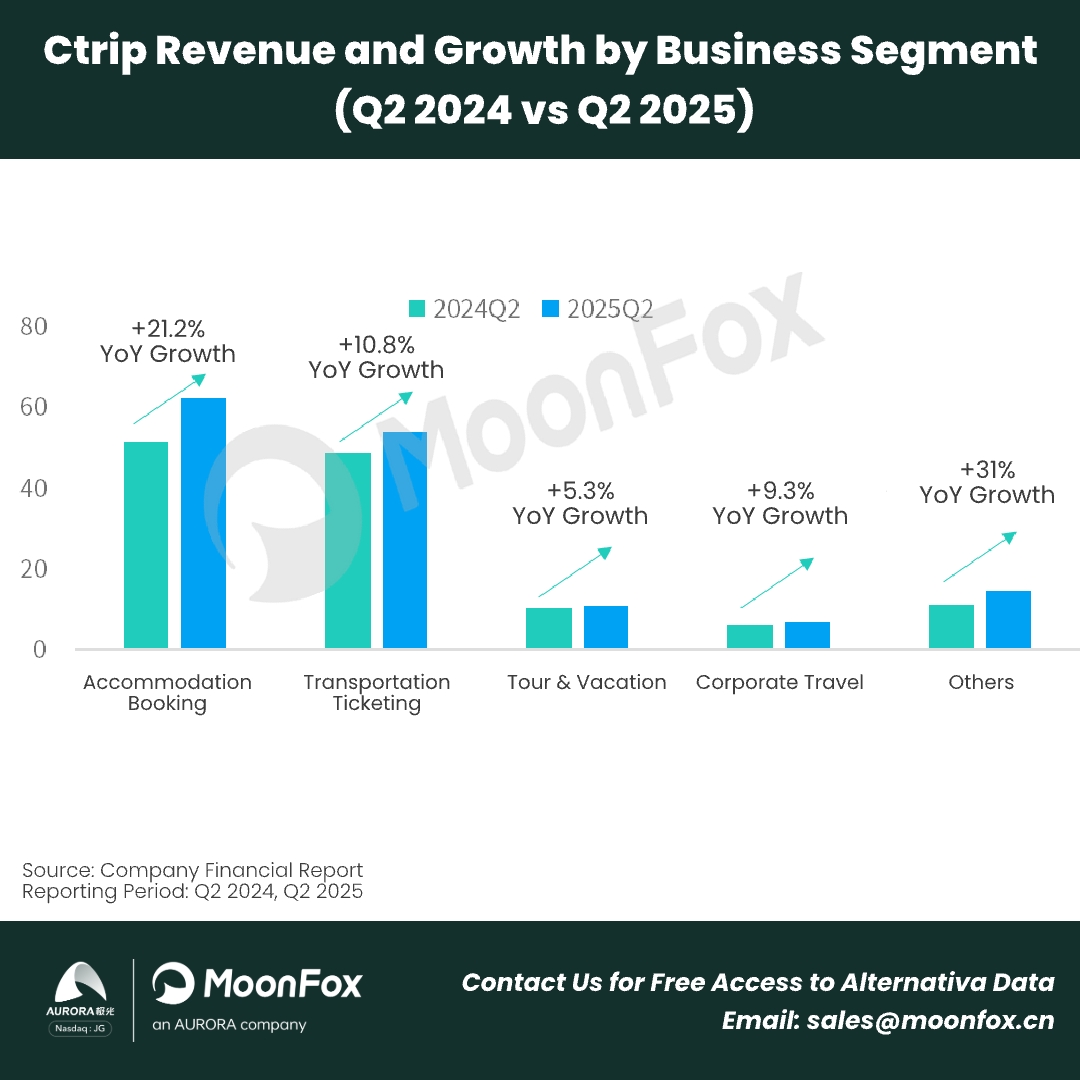

Q2 revenue growth was mainly driven by accommodation bookings and international business. Accommodation bookings, Ctrip’s main revenue source, grew 21.2% year-on-year to RMB 6.225 billion, accounting for 42% of total revenue. International OTA bookings rose over 60% year-on-year, inbound travel bookings more than doubled, and outbound hotel and flight bookings in Q2 reached 120% of 2019 levels—30–40 percentage points higher than the overall market.

Gross margin in Q2 stood out at 81%, maintaining a high level above 80%. Operating costs rose 22% to RMB 2.8 billion, in line with business expansion. Product R&D expenses increased 17% to RMB 3.5 billion (24% of total revenue), supporting technology-driven growth. Sales and marketing expenses reached RMB 3.3 billion, accelerating international expansion, while general and administrative expenses grew just 2% year-on-year, reflecting effective cost control. Adjusted EBITDA was RMB 4.9 billion, up about 10% year-on-year, with a healthy EBITDA margin of 33%.

II. Business Insights: Globalization & Intelligence, Tapping into Silver Generation and Inbound Tourism

Accelerated International Business & Inbound Tourism Breakthroughs

Ctrip deepened its global partnerships in Q2, collaborating with the Malaysia Ministry of Tourism and expanding across the Asia-Pacific. The company hosted a global partner conference, forging alliances with travel groups from Thailand, Malaysia, Indonesia, and more, driving mutual growth through joint marketing and service upgrades. Ctrip also launched tailored services for inbound travelers, converting half-day tours into repeatable, in-depth experiences. International business now accounts for around 30% of revenue, with inbound bookings more than doubling year-on-year.

Focusing on the Silver Generation and Young Travelers, Strengthening High-End Hotel Differentiation

Ctrip’s “Laoyouhui” brand for senior travelers saw membership and transaction volume more than double since late 2024, reflecting rising engagement and purchasing power among older consumers. Tailored products—ranging from cultural tours to wellness and hiking—offer small-group, personalized experiences. The first flagship store opened in Shanghai in June, boosting offline brand presence. For younger users, “travel + entertainment” products, such as concerts and live events, drove over 100% year-on-year revenue growth in Q2.

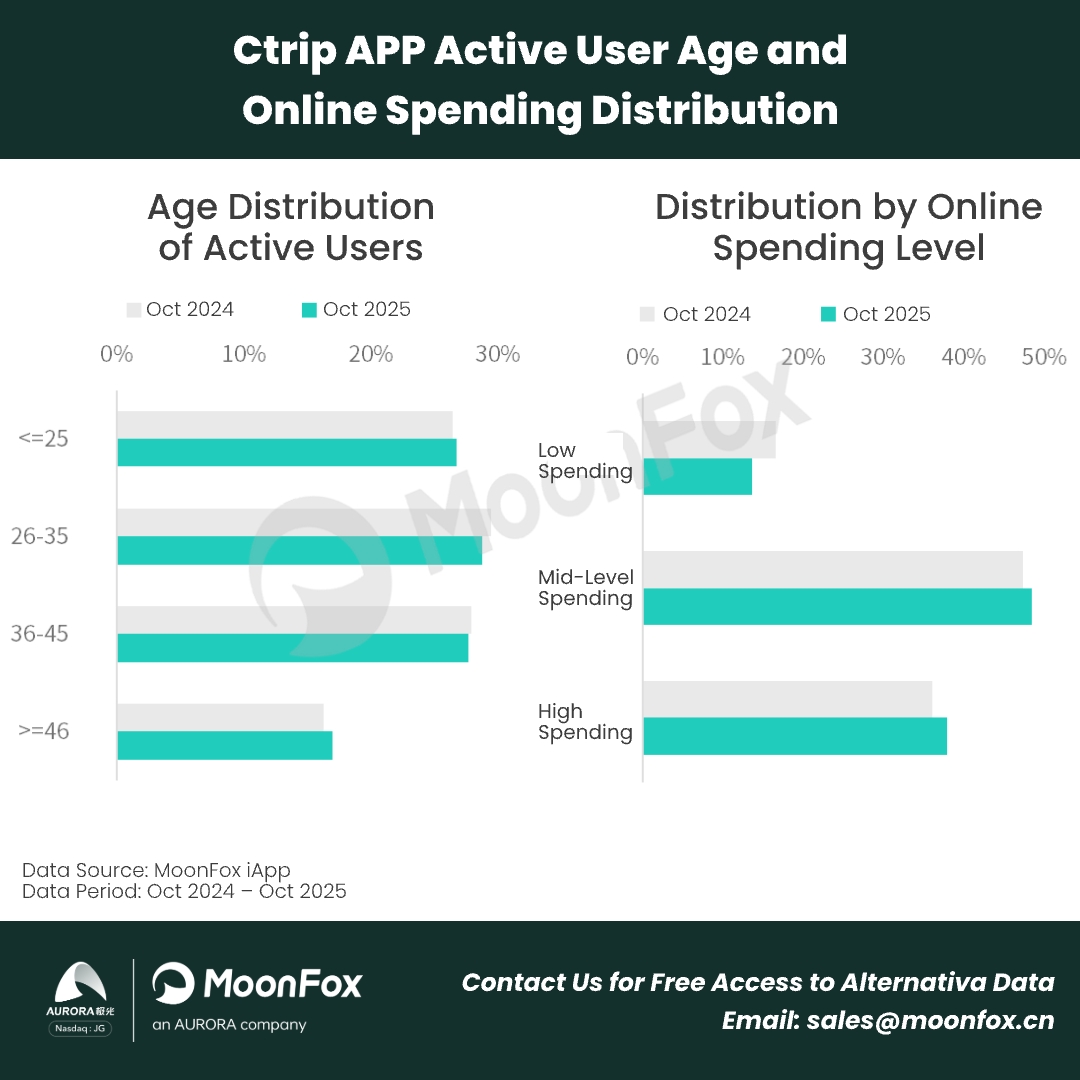

Ctrip’s strong partnerships with international hotel chains reinforce its leadership in the high-end segment. Hotel bookings made up 41% of Q2 revenue, with high-star hotels as a core profit driver. According to Aurora MoonFox data, in October 2025, Ctrip’s app saw significant activity among users under 25 and over 46, as well as high-spending customers, further strengthening its differentiated market positioning.

Deepening AI Innovation for Both Consumers and Businesses

Ctrip advanced its AI capabilities in Q2, enhancing both consumer and business services. Upgraded AI trip planning now generates personalized itineraries based on user preferences, leveraging millions of data points for trusted recommendations. The company reported that AI has significantly improved data processing efficiency and content automation, boosting customer satisfaction and loyalty. For business partners, Ctrip’s Intellitrip suite provides AI-powered tools—such as real-time business insights and AI content generators—to help hotels better serve inbound travelers and improve operational efficiency.

III. Strategic Outlook: Q3 Focus on Inbound Tourism and Holiday Marketing

In Q3, Ctrip is ramping up inbound tourism, launching a one-stop inbound travel center in August and collaborating with local governments to enhance city appeal. Its “GoChina” campaign achieved over 500 million global impressions, while free city half-day tours in Beijing, Shanghai, and Hong Kong have welcomed visitors from 100+ countries.

During the summer, family travel orders accounted for 35% of bookings, with self-drive rentals up 77% year-on-year. Ahead of the Mid-Autumn Festival and National Day holidays, Ctrip coordinated with multiple regions to capture peak demand, and its “919 Global Travel Festival” offered promotions with over 4,000 travel brands worldwide. Ctrip Financial’s installment and “buy now, pay later” services further stimulated holiday travel spending, with hotel pre-sale orders up 30% and serving over 500,000 users.

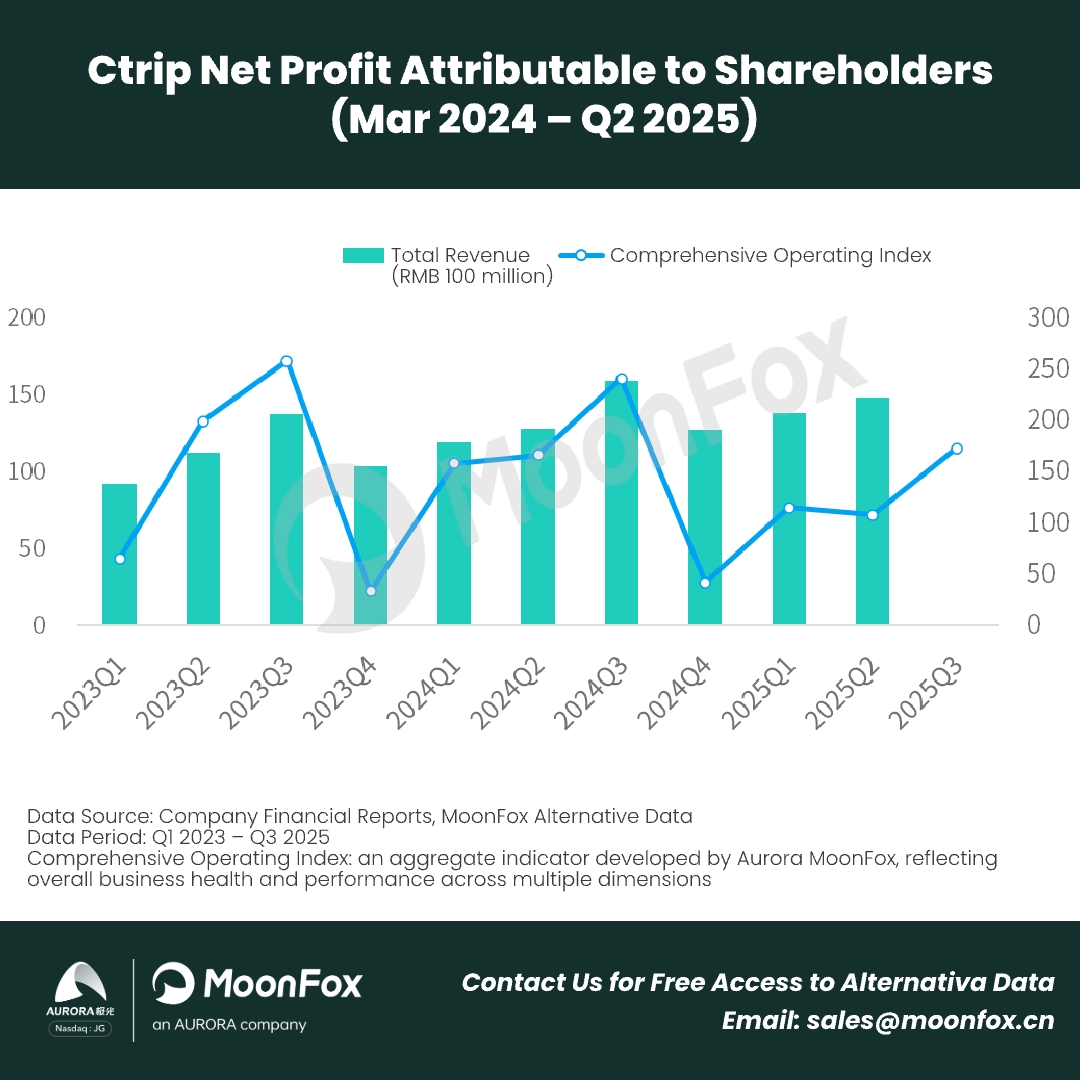

According to Aurora MoonFox Financial Alternative Data, Ctrip’s composite operating index is set to rise further in Q3. Performance will hinge on holiday and international business sales, as well as effective strategies against cross-sector competition. While regulatory pressures persist, Ctrip’s supply chain, high-end hotel, and AI strengths—alongside its “Great Quality & Globalization” (G2) strategy—position the company for resilient, sustainable growth.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

2025 Internet Industry Annual Review Research Report

Bilibili: A "Forever Young" Platform with a Long-term Vision

Pop Mart Business Decoded: Measuring the Value of Emotional Consumption