Red Star Macalline Q1-Q3 2025: New Businesses Expected to Cushion Profit Decline

Since initiating its strategic repositioning in 2024, Red Star Macalline (1528.HK) has been steadily building a new home furnishing ecosystem to reverse its revenue decline. Financial data for the first three quarters of 2025 show a stable to slightly rising gross margin, but revenue and net profit continue to decline, with growth pressures from non-operating factors yet to ease. However, excluding short-term fluctuations, the core business stability is gradually improving, with new business development and cost control delivering significant results. This injects momentum for sustainable growth and offers valuable insights for the home furnishing industry’s transformation.

Ⅰ. Overall Performance: Stable Quarterly Revenue but Profit Under Pressure, Operational Quality Improves

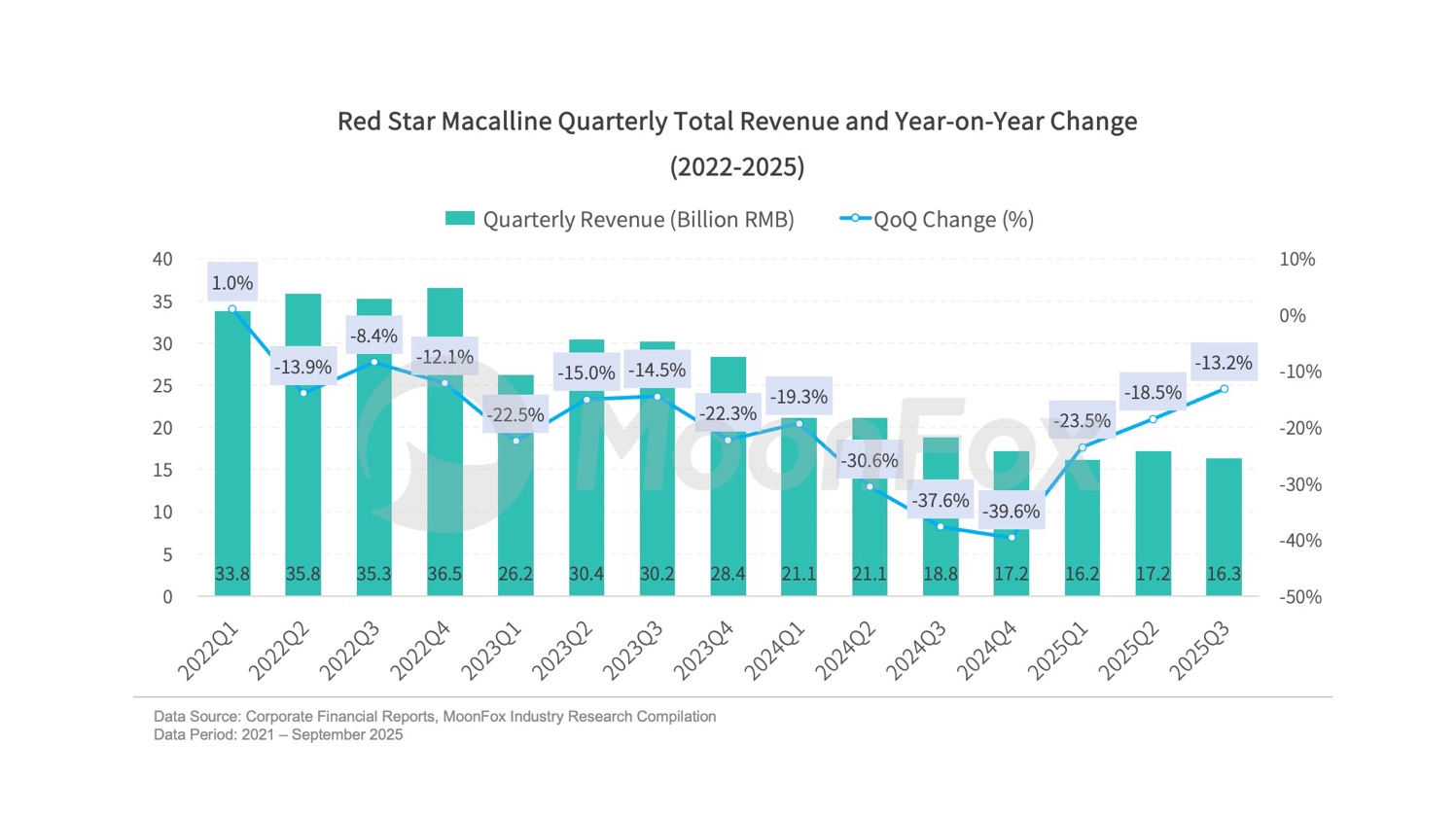

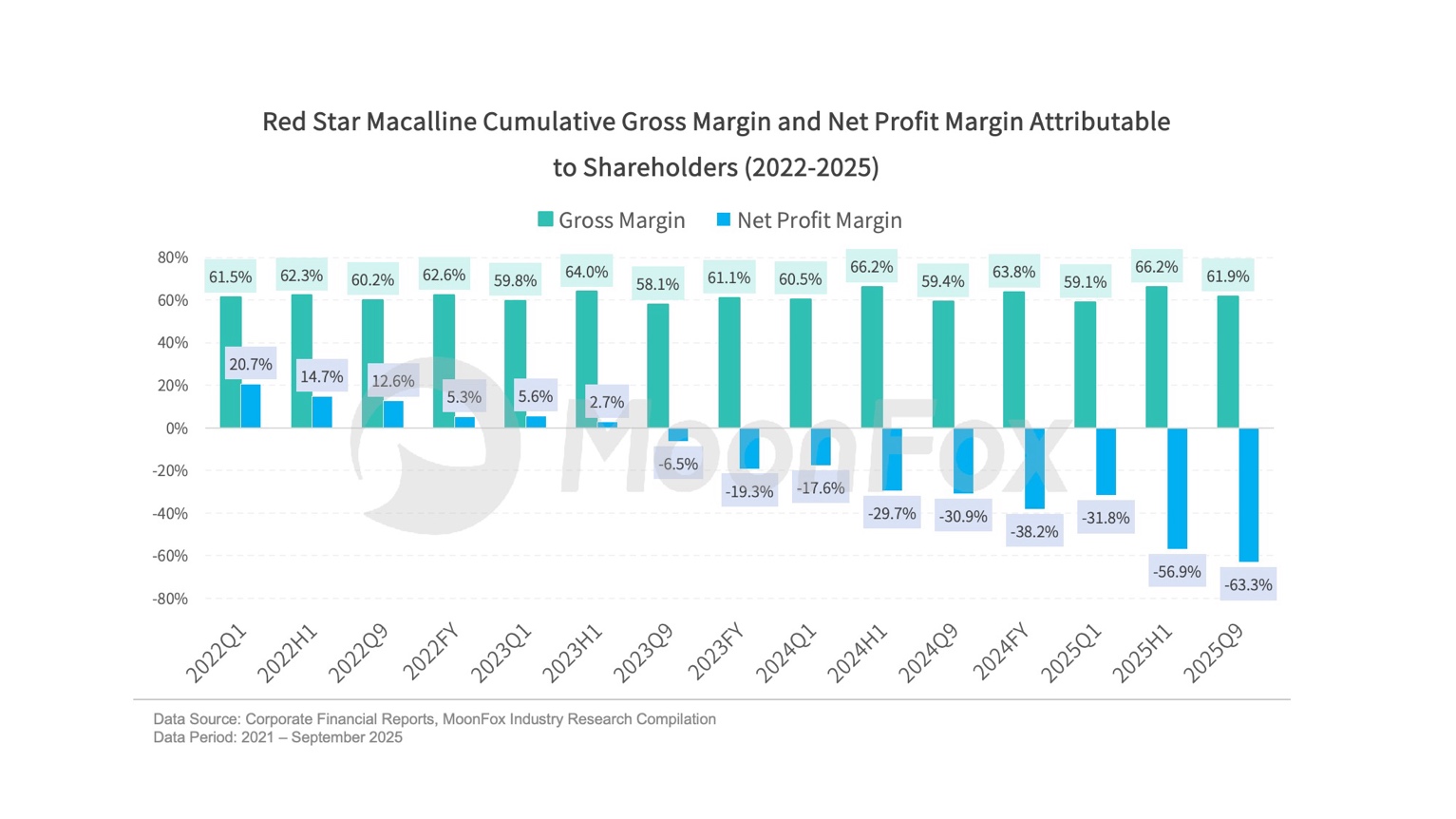

In the first three quarters of 2025, Red Star Macalline reported cumulative revenue of RMB 4.969 billion, down 18.6% year-on-year. Quarterly revenues from Q1 to Q3 remained relatively stable, with the rate of decline slowing each quarter. The gross margin reached 61.9%, up 2.5 percentage points year-on-year. However, the net profit attributable to shareholders was -63.3%, down 32.4 percentage points year-on-year. This sharp decline was mainly due to two factors:

1. Fair value changes in investment properties caused significant accounting losses:

In the first three quarters of 2025, the fair value of the company’s investment properties decreased, resulting in a fair value loss of approximately RMB 3.33 billion. The third quarter alone accounted for RMB 1.231 billion of this loss, with RMB 2.042 billion in the first half. This factor directly led to the company’s profit loss and is primarily influenced by fluctuations in the real estate market, making short-term recovery difficult.

2. Various impairment losses totaling about RMB 170 million:

This includes credit impairment losses of RMB 100 million and asset impairment losses of RMB 74 million.

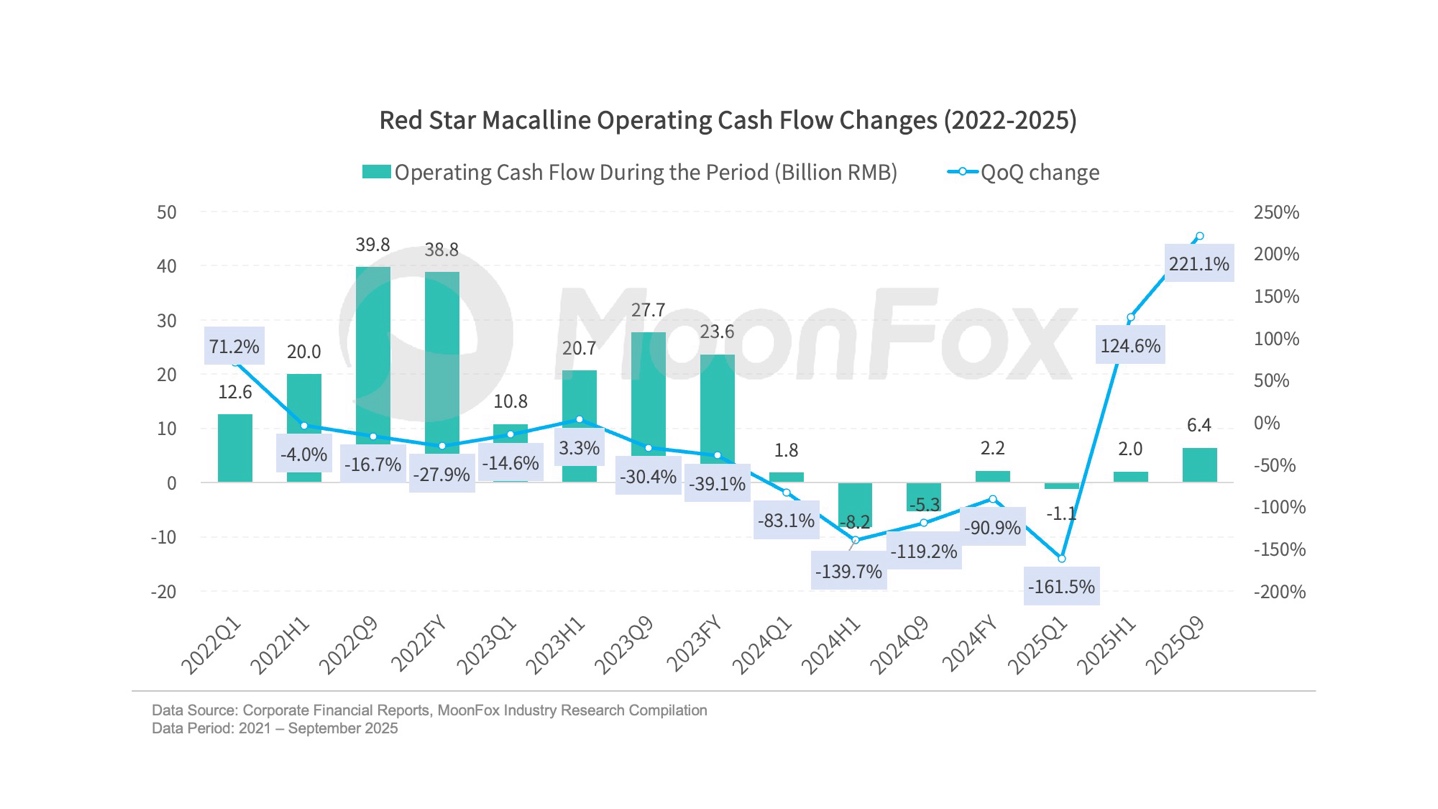

Cash flow and debt structure show positive changes, reflecting marked improvement in Red Star Macalline’s operational quality in 2025.

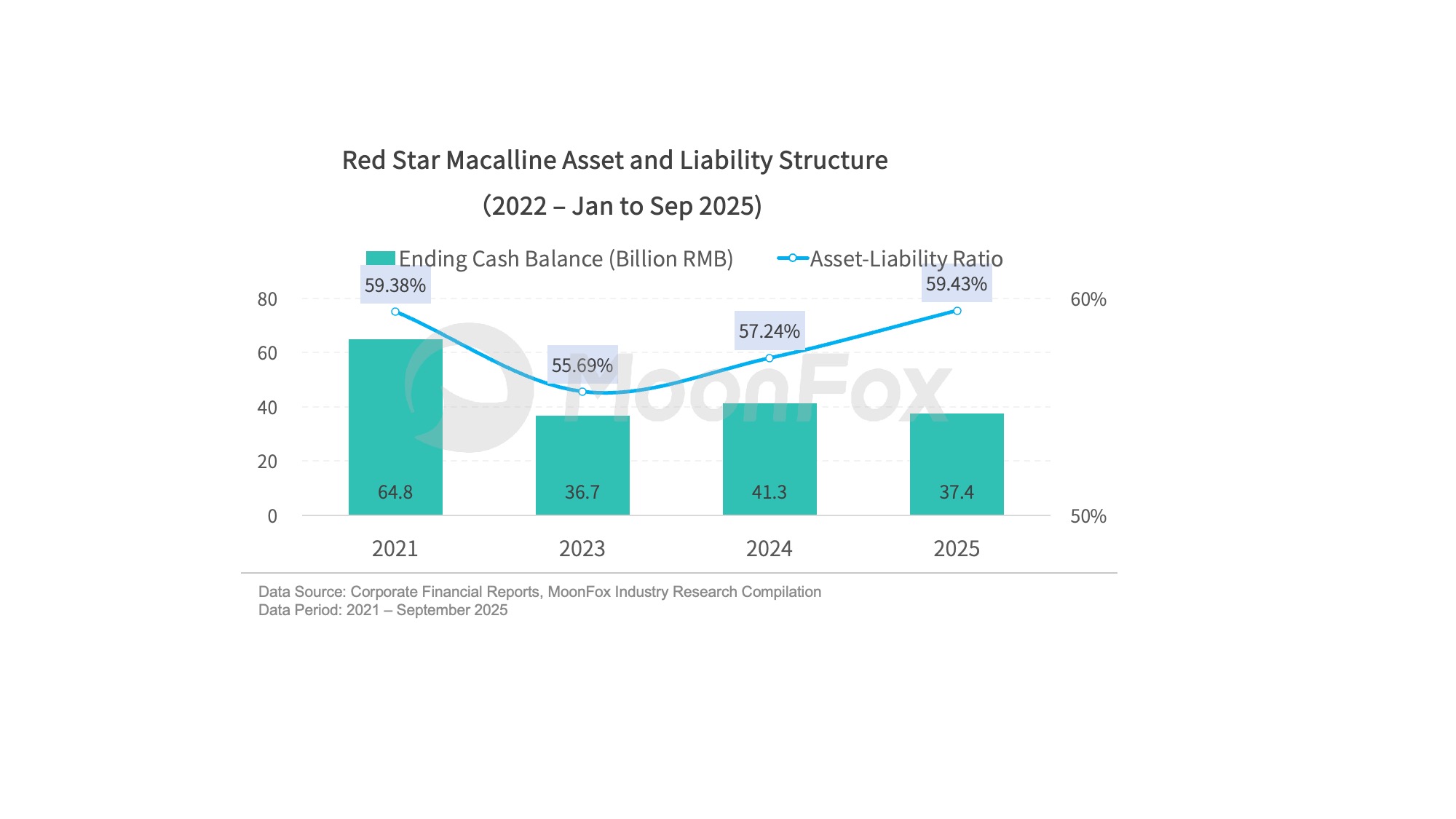

Operating cash flow turned positive in the first three quarters, increasing 221.1% year-on-year, indicating gradual business recovery. As of September 30, the company’s cash and cash equivalents reached RMB 3.74 billion. The asset-liability ratio rose by 2 percentage points year-on-year, while short-term borrowings and non-current liabilities due within one year decreased by RMB 3.277 billion compared to year-end 2024. Cash reserves are sufficient to cover short-term debts, although debt pressure remains elevated.

Ⅱ. Operational Highlights: Initial Scale in Appliances and Automotive Sectors, Effective Cost Control

Excluding non-operating factors, Red Star Macalline’s core business—shopping mall leasing and operations—generated operating profit of approximately RMB 200 million in the first three quarters of 2025, doubling the roughly RMB 100 million profit from the same period last year. The profitability of core operations has significantly improved.

Optimized Revenue Structure of Core Business:

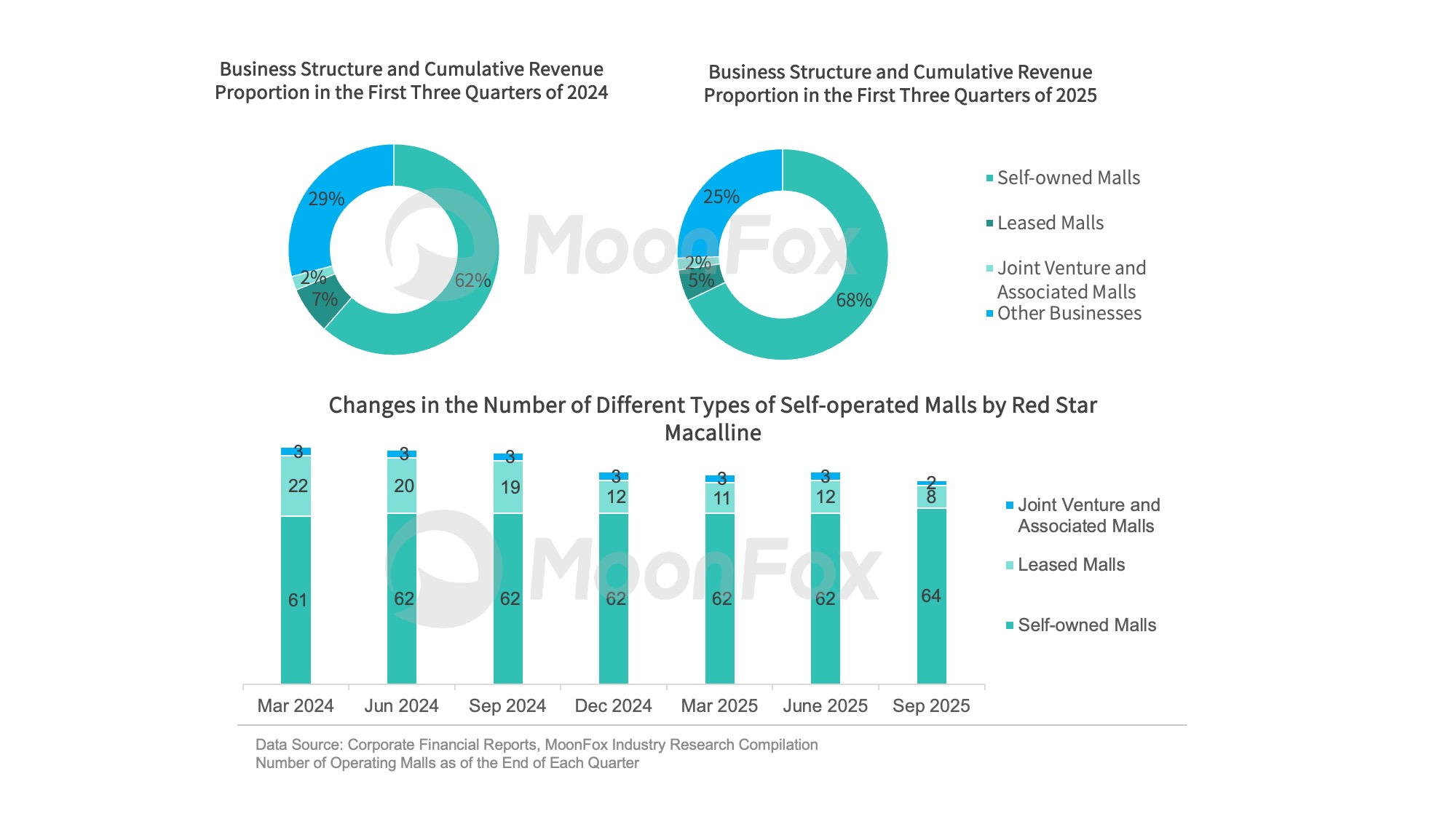

The revenue share from self-owned malls increased by 6 percentage points year-on-year in the first three quarters of 2025, while revenue from other malls and businesses declined. Public quarterly reports show the company continues to reduce the number of leased malls, mostly by not renewing leases or early termination, focusing more resources on operating self-owned malls.

New Business Layout Gains Scale:

Following the “3 + Star Ecosystem” strategy introduced in 2024, by September 30, 2025, Red Star Macalline has established significant presence in appliance and automotive sectors, as well as a high-end design center, laying the foundation for its transformed business model:

Appliance business area now exceeds 10%. Since the end of 2024, in partnership with Jianda Light Industry, the company has expanded into high-end home appliances and new energy vehicles.

By June 2025, the M+ Design Center covers 731,000 square meters, hosting over 1,000 design studios and nearly 5,000 designers, positioning high-end design as a business hub.

The automotive sector operates over 260,000 square meters across 44 cities nationwide, collaborating with more than 30 car manufacturers and platforms. In the first half of 2025, Red Star Macalline launched the “3100 Plan” for automotive business, aiming to incubate new automotive business tracks and expand total automotive operating area beyond 1 million square meters within three years.

Outstanding Cost Control:

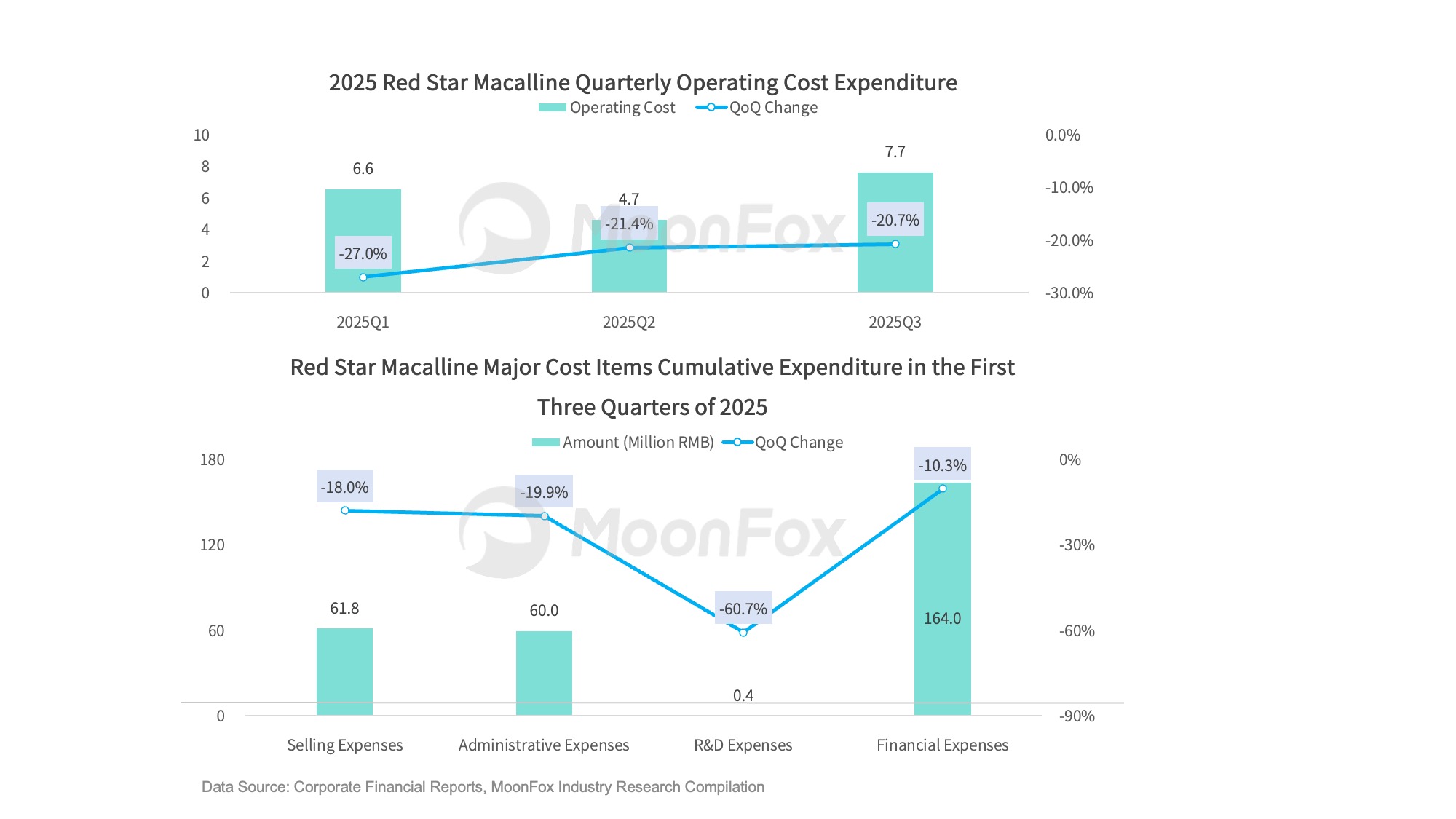

Operating costs declined significantly year-on-year in each quarter of the first three quarters of 2025. Sales expenses dropped 18%, mainly due to tighter control of advertising and energy maintenance costs. Administrative expenses fell 19.9%, driven by reductions in labor and office expenses. Financial expenses decreased 10.3%, primarily from lower financing costs reducing interest expenses.

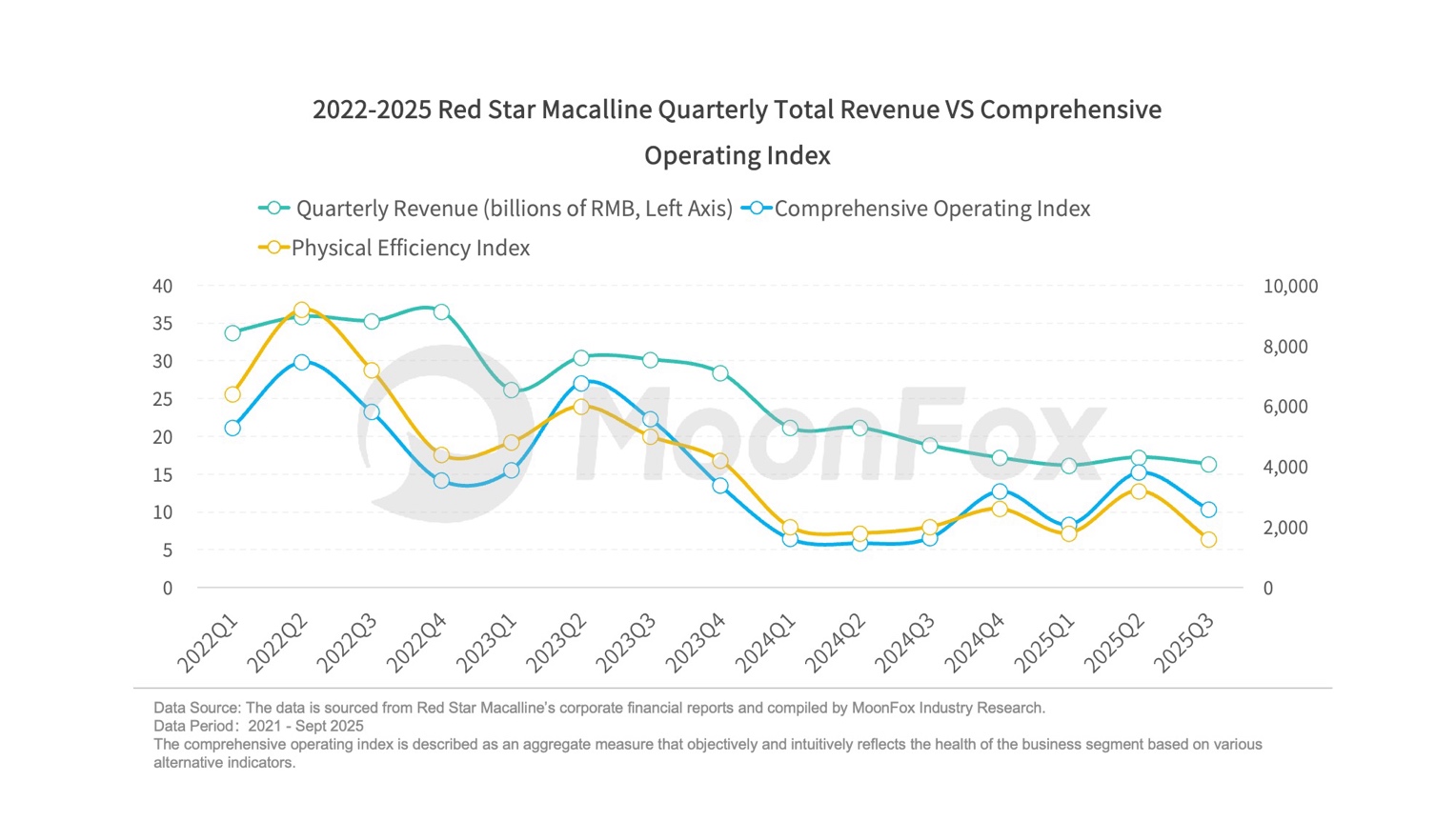

MoonFox Data’s Financial Alternative Edition shows clear signs of recovery in Red Star Macalline’s physical store efficiency index and comprehensive business index in 2025 compared to 2024, reflecting improvement in core offline business. Although quarterly revenue continues to decline, the rate of decline is slowing. With ongoing transformation strategies and cost control, Red Star Macalline’s core business is expected to rebound, providing a stronger buffer against profit decline.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

2025 Internet Industry Annual Review Research Report

Li Auto’s Performance Plunges, BEV Transition Faces Formidable Headwinds

XPeng Motors’ Breakneck Run Continues, but Concentrated Lineup Risks Loom

Bilibili Q3 2025: Enhanced Profitability and Optimized Revenue Structure