Leapmotor Continues to Lead Among New Energy Vehicle Startups, with Q4 Profit Expected to Double

Ⅰ. Outstanding Performance in Q3, Securing a Leading Position Among New Energy Vehicle Startup Brands

In the third quarter, Leapmotor (Stock Code: 002594.SZ, 1211.HK) achieved operating revenue of 19.45 billion yuan (approximately 2.70 billion US dollars), a year-on-year increase of 97.3%. Net profit was 150 million yuan (approximately 21 million US dollars), marking a turnaround from a loss to a profit compared to the same period last year, and maintaining profitability for multiple consecutive quarters.

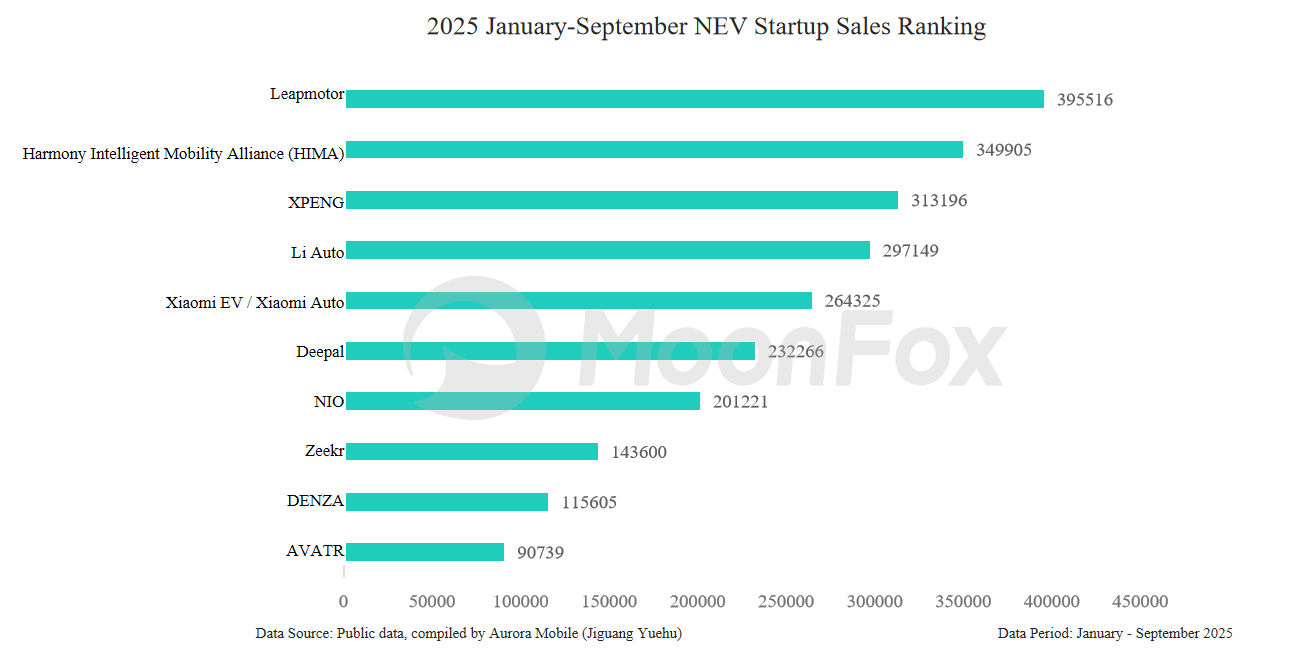

Leapmotor's total deliveries reached 173,852 units, a year-on-year increase of 101.8%, securing the top position in sales among Chinese new energy vehicle startup brands.

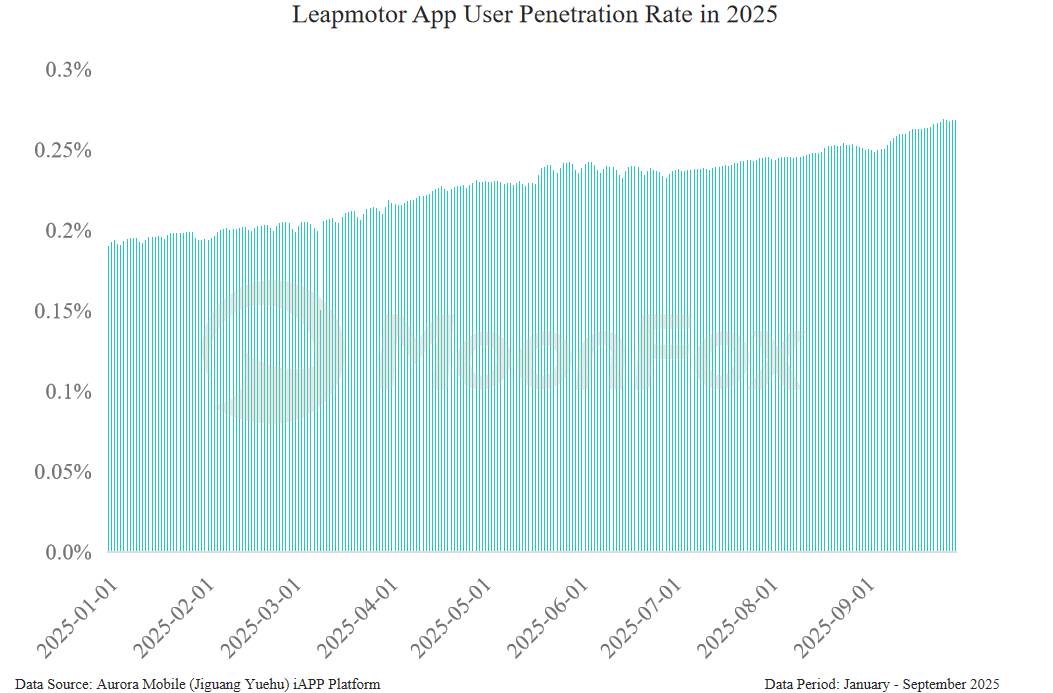

Supported by rapidly growing sales, Leapmotor's user base is also expanding rapidly.

Ⅱ. Outstanding Performance in Overseas Markets, Expanding to 30 Markets Globally

In terms of overseas markets, Leapmotor has delivered an outstanding performance with significant achievements. Its export volume reached 17,400 units in the third quarter of 2025, and the cumulative export volume from January to September further climbed to 37,800 units, firmly securing the top position in exports among new energy vehicle startup brands.

Leveraging product competitiveness and precise market strategies, Leapmotor has consistently made breakthroughs in key overseas markets such as Europe, the Middle East, and Southeast Asia, steadily increasing its international brand recognition. Notably, in September, within mainstream European markets like Germany and Italy, Leapmotor successfully ranked among the top three Chinese new energy brands in sales, thanks to its excellent product performance, accessible pricing strategy, and reliable quality assurance, earning high recognition and preference from local consumers.

As of the end of September, Leapmotor International had completed its expansion into approximately 30 global markets, establishing a network of over 700 sales and service outlets.

Ⅲ. Core Models Such as C10 and C11 Lead the Market Segment Below 200,000 RMB

At the core model level, Leapmotor has established a robust competitive barrier in the new energy vehicle market segment priced below 200,000 yuan (approximately 27,800 USD). Models such as the C10 and C11, empowered by the "value-for-money" strategy driven by full-domain in-house research and development, continue to lead their market segments and have become blockbuster products.

The C10 precisely balances high performance with an accessible price point. It not only features excellent power output and ride comfort but also achieves an exceptional level of intelligent technology integration. Advanced driver assistance systems and convenient smart connectivity functions comprehensively cater to the diverse mobility needs of family users and young consumers. For family scenarios, its 2825mm wheelbase provides spacious cabin room and abundant safety features, ensuring ample comfort for family trips. For young users, its fashionable exterior design and tech-oriented interior layout strongly align with their individualistic consumption preferences.

As a perennial bestseller for the brand, the C11 continues to earn market recognition with its outstanding range performance and excellent handling. The upgraded 2026 model further strengthens its product competitiveness. The sustained popularity of these core models has effectively solidified Leapmotor's leading position in the sub-200,000 yuan (approximately 27,800 USD) market segment, providing essential support for its overall sales growth.

Ⅳ. Core Strength: Full-Domain In-House R&D + Supply Chain Integration, Building a Moat of Value-for-Money Excellence

Leapmotor's ability to continually break through in the fiercely competitive new energy vehicle market relies on the dual empowerment of full-domain in-house research and development (R&D) and supply chain integration, building a differentiated competitive advantage.

Supported by its full-stack in-house R&D strategy, Leapmotor achieves a self-developed rate of over 65% for core components, placing it among the leaders in the new energy vehicle sector. It has realized independent R&D and production in key areas ranging from core electric drive systems and battery management systems (BMS) to domain controllers, significantly reducing reliance on external component suppliers.

This full-stack in-house capability not only grants Leapmotor absolute initiative in technological innovation, enabling rapid responses to market demands and user feedback for swift technology iteration and product upgrades, but also enhances cost control through vertical integration. By directly managing the production costs of core components, it effectively mitigates risks associated with price fluctuations from external suppliers. Ultimately, this approach allows for a significant reduction in the final vehicle price while ensuring product quality, delivering high value-for-money products to consumers.

On the production and manufacturing front, Leapmotor implements a platform-based production model through its LEAP 3.5 technology architecture, greatly increasing parts commonality across different vehicle models. This architecture not only effectively shortens new model development cycles but also achieves precise reductions in manufacturing costs. For example, compared to traditional development models, this platform approach reduces development cycles by approximately 30% and cuts manufacturing costs by about 20%. This highly efficient production model enables Leapmotor to quickly respond to market dynamics, accurately launch models that meet consumer needs, further solidifying its product price competitiveness and laying a solid foundation for realizing economies of scale.

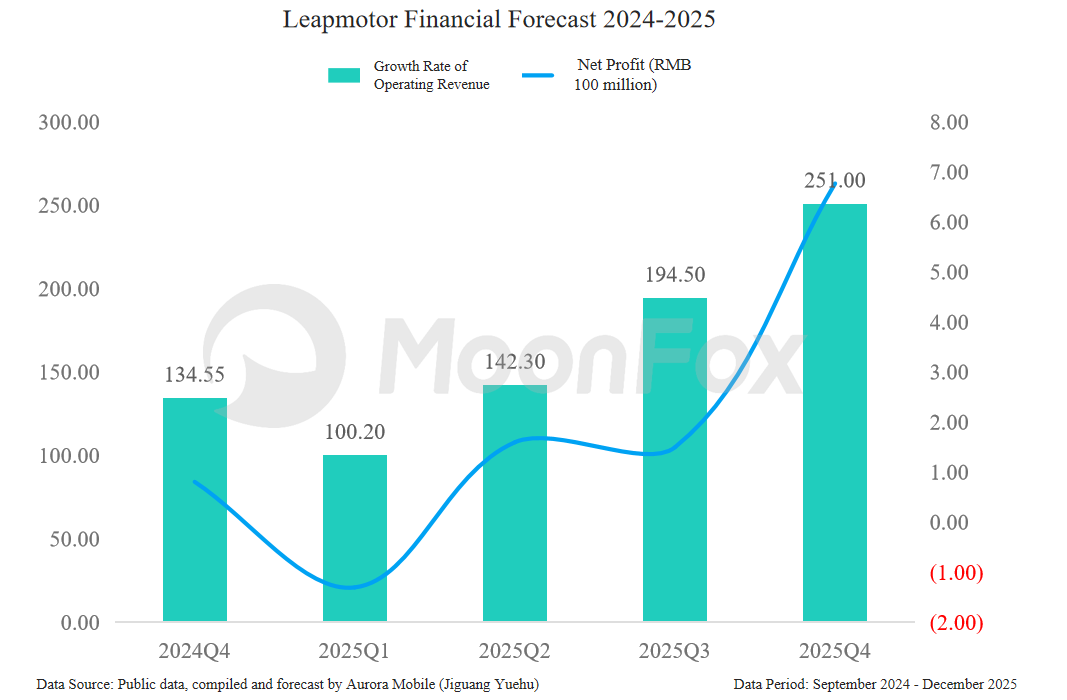

Ⅴ. Forecast: Q4 2025 Net Profit to Double

Aurora Mobile (Jiguang Yuehu) forecasts that Leapmotor's sales volume in the fourth quarter of this year will increase by 29% compared to the previous quarter, reaching 224,000 units. After factoring in potential carbon credit revenue of 500 million yuan (approximately 70 million US dollars), the firm expects net profit for the fourth fiscal quarter may surge 4.5 times compared to the previous quarter to 677 million yuan (approximately 94 million US dollars).

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

2025 Internet Industry Annual Review Research Report

Li Auto’s Performance Plunges, BEV Transition Faces Formidable Headwinds