BYD Maintains Top Position in New Energy Sector with Strong Performance in Overseas Markets

BYD (Stock Code: 002594.SZ, 1211.HK), as a leading enterprise in the industry, is intensifying its efforts to expand into overseas markets while actively investing in R&D funds to enhance its technological capabilities and address the increasingly fierce domestic market competition, thus driving forward on both fronts.

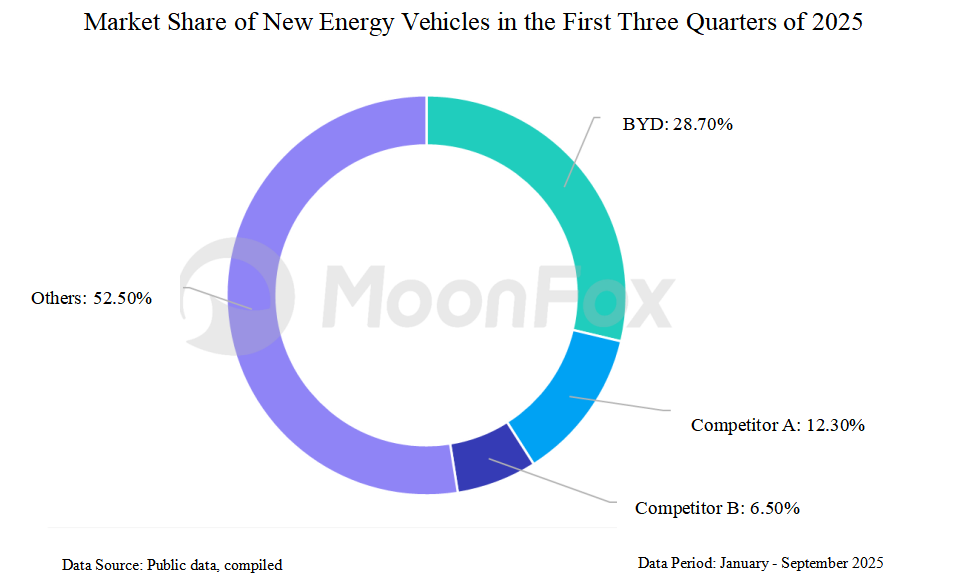

Ⅰ. BYD firmly remains at the top of the new energy sector with a market share of 28.7%.

Based on public data compiled by Aurora Mobile (Jiguang Yuehu), BYD currently occupies the top position in the new energy vehicle market with an absolute advantage.

Judging by target completion, BYD's cumulative sales from January to September 2025 reached 3.26 million vehicles, achieving 71% of its annual target of 4.6 million vehicles.

Its overseas market performance is strong, with cumulative exports exceeding 700,000 vehicles from January to September, accounting for 22% of the group's total sales.

Ⅱ. Q3 Financial Data Analysis: BYD Continues to Expand Its Market Presence Overall

In the first three quarters of this year, BYD's revenue reached 566.27 billion yuan (approximately 78.68 billion US dollars), representing a year-on-year increase of 13%. Net profit was 23.333 billion yuan (approximately 3.25 billion US dollars), a year-on-year decrease of 7.55%. R&D expenses amounted to 43.75 billion yuan (approximately 6.09 billion US dollars), a year-on-year increase of 31%.

Currently, the domestic new energy vehicle market is undergoing profound changes, with a penetration rate exceeding 35%, signaling a gradual shift from a stage of incremental competition to one of stock competition.

Against this backdrop, market competition has become increasingly fierce, with price wars emerging as a crucial strategy for major automakers to capture market share. Domestic independent brands such as Geely and Great Wall, as well as foreign brands like Tesla and Volkswagen, have all joined the price war, continuously rolling out price reductions that cover the core price range from 100,000 yuan (approximately 14,000 US dollars) to 300,000 yuan (approximately 42,000 US dollars). Some models have even seen price cuts of 30,000 to 50,000 yuan.

As a leading enterprise in the industry, BYD is intensifying its efforts to expand into overseas markets while actively investing in R&D funds to enhance its technological capabilities and address the increasingly fierce domestic market competition, thus driving forward on both fronts.

Data shows that the overseas market has now become a significant growth engine for BYD's sales. From January to September this year, BYD's overseas sales reached 701,600 vehicles, a year-on-year increase of 132%, surpassing the total overseas sales for the entire year of 2024. Currently, BYD's products are available in 117 countries and regions worldwide.

On October 9, BYD's 14 millionth new energy vehicle rolled off the production line at its Brazilian factory. At the recently opened Tokyo Motor Show, BYD launched the K-EV BYD RACCO, a model tailored for the Japanese market, and simultaneously introduced a "pure electric + hybrid" dual-line strategy. It also officially introduced its first plug-in hybrid model for the Japanese market, the Seal 06 DM-i, accelerating the expansion of its vehicle lineup in Japan.

Ⅲ. Main Brand Vehicle Models Maintain Stable Market Performance, with Dynasty Series Showing Outstanding Results.

The BYD Dynasty series serves as the mainstay of the brand's mid-to-high-end market, covering various models including sedans and SUVs. Leveraging profound technological accumulation and brand influence, it has achieved outstanding sales performance in both domestic and international markets, becoming a significant driving force behind the brand's sales growth.

The Song PLUS achieved sales of 179,300 units in the first three quarters of 2025, a year-on-year increase of 22%, firmly placing it at the forefront of the domestic SUV market. Its success is attributed to a comprehensive upgrade in product capabilities, featuring the "God's Eye" intelligent driving system that enables L2+ level intelligent assisted driving. The exterior adopts the "Dragon Face" family design language, while the interior emphasizes luxury and technological sophistication, equipped with the DiLink 4.0 intelligent connectivity system. This system integrates rich multimedia entertainment and vehicle control functions, meeting users' demands for a smart cockpit.

As a representative plug-in hybrid SUV in the Dynasty series, the Song Pro focuses on the family user market, with sales of 138,200 units in the first three quarters of 2025, an 18% year-on-year increase. The Song Pro is powered by the fifth-generation DM-i Super Hybrid system, offering a low fuel consumption of 3.79L/100km under depleted battery conditions and a comprehensive range of up to 1,400km, effectively alleviating user range anxiety. In terms of intelligent configurations, over 90% of mid-to-high-end models are equipped with the "God's Eye" intelligent driving system, featuring functions like intelligent navigation and traffic sign recognition, thereby enhancing driving safety and convenience.

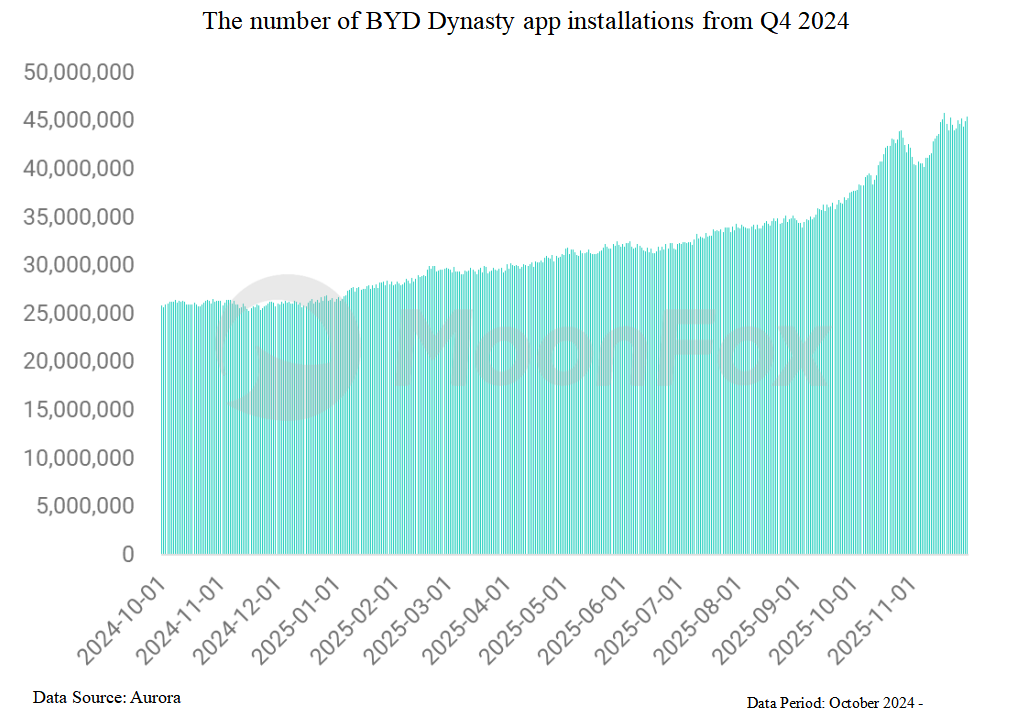

Benefiting from the sustained popularity of its vehicle models, the user installation base of the BYD Dynasty app has steadily increased.

The Ocean series, leveraging its fashionable design, advanced technology, and diversified positioning, comprehensively covers different market segments, meets diverse consumer demands, and has become a new engine for the brand's sales growth.

As a medium-sized pure electric SUV in the Ocean series, the Seal achieved sales of 68,200 units in the first three quarters of 2025, demonstrating outstanding performance in the medium-sized pure electric SUV market. Built on the e-Platform 3.0, it utilizes CTB (Cell-to-Body) battery integration technology to enhance body rigidity and safety. Combined with an eight-in-one electric drive system, it achieves efficient power output. In terms of range, the Seal is equipped with an 82.56 kWh lithium iron phosphate "Blade Battery," offering a maximum CLTC range of up to 715 km.

As a small pure electric vehicle in the Ocean series, the Seagull is positioned as an urban commuting tool. It achieved sales of 156,800 units in the first three quarters of 2025, with average monthly sales stabilizing around 17,400 units, making it a popular choice among young urban consumers and as a second car for families.

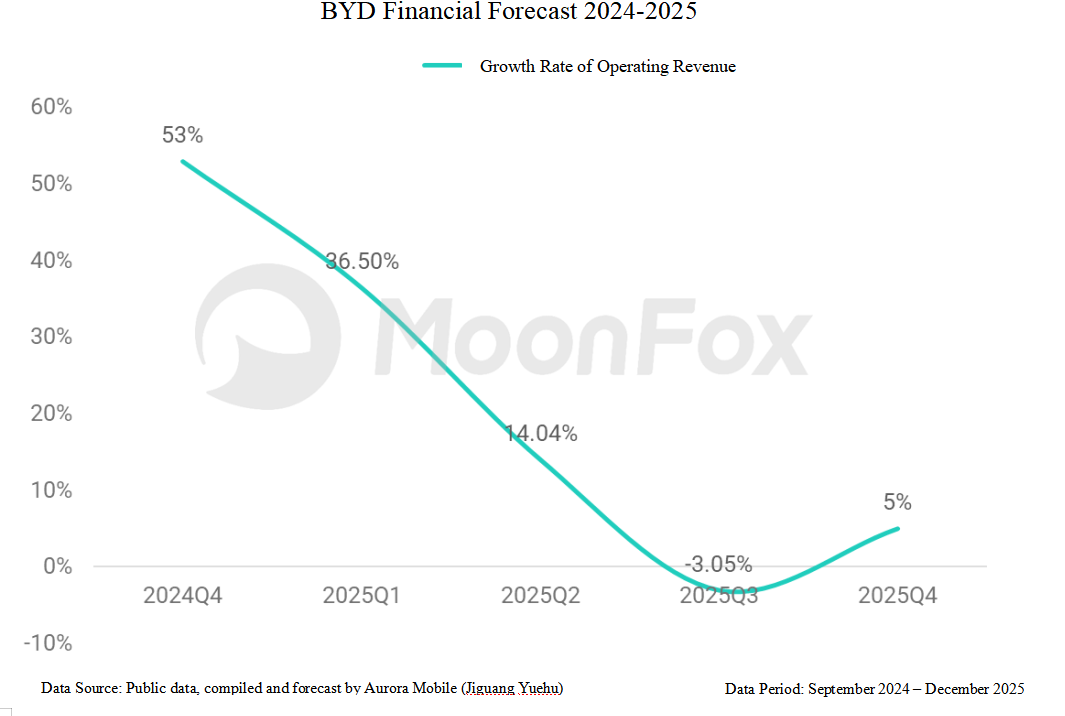

Ⅳ. Q4 Forecast: Operating Revenue Returns to Positive Growth

Based on BYD's leading technological capabilities and comprehensive product lineup, despite the increasingly fierce domestic market competition, Aurora Mobile (Jiguang Yuehu) has conducted a comprehensive analysis using market data and proprietary user data, and judges that BYD's revenue growth rate will return to a normal trajectory in the fourth quarter of 2025.

It is forecasted that in the fourth quarter of 2025, BYD's revenue will reach 288.6 billion yuan (approximately 40.11 billion US dollars), representing a year-on-year increase of 5%.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

2025 Internet Industry Annual Review Research Report

Li Auto’s Performance Plunges, BEV Transition Faces Formidable Headwinds

XPeng Motors’ Breakneck Run Continues, but Concentrated Lineup Risks Loom