POP MART’s Q2 Results Ease Market Concerns with Strong Revenue and Profit Growth

Pop Mart International Group Ltd (9992.HK) delivered a robust Q2 performance, alleviating market anxiety with both revenue and profit reaching new highs. The POP MART theme park’s visitor numbers in H1 2025 have already surpassed the full-year total for 2024, and the park is currently expanding and upgrading its attractions. Domestically, the brand has launched POP MART COLLECTION premium stores in Chengdu SKP and Beijing SKP-S, strategically targeting high-end consumer venues and enhancing its cultural and experiential appeal. In June, its jewelry brand popop opened in Shanghai Plaza 66 and Beijing China World Mall, further accelerating POP MART’s commercial expansion.

However, there are still concerns about the sustainability of POP MART’s future performance. Despite stellar results in H1, the long-term popularity of hit IPs like LABUBU remains uncertain. On the stock market, POP MART’s share price performed strongly in H1 2025, but every dip triggered debates about a potential “POP MART bubble.”

Therefore, it’s essential to analyze POP MART’s performance from multiple angles and uncover the underlying drivers of its high growth.

I. Strong Profitability, Operational Efficiency, and Member Stickiness as the Foundation

POP MART’s H1 2025 report shows inventory turnover days dropped to 83 (from 102 YoY), and trade receivables turnover shortened to 10 days, accelerating cash flow. Membership grew to 59.12 million, contributing 91.2% of sales, with a repeat purchase rate of 50.8%. The company leverages points, birthday gifts, and discounts to boost member loyalty.

By continuously improving operational efficiency and member engagement, POP MART enables rapid product iteration, reduces inventory pressure, and strengthens sales capacity, maintaining high profitability.

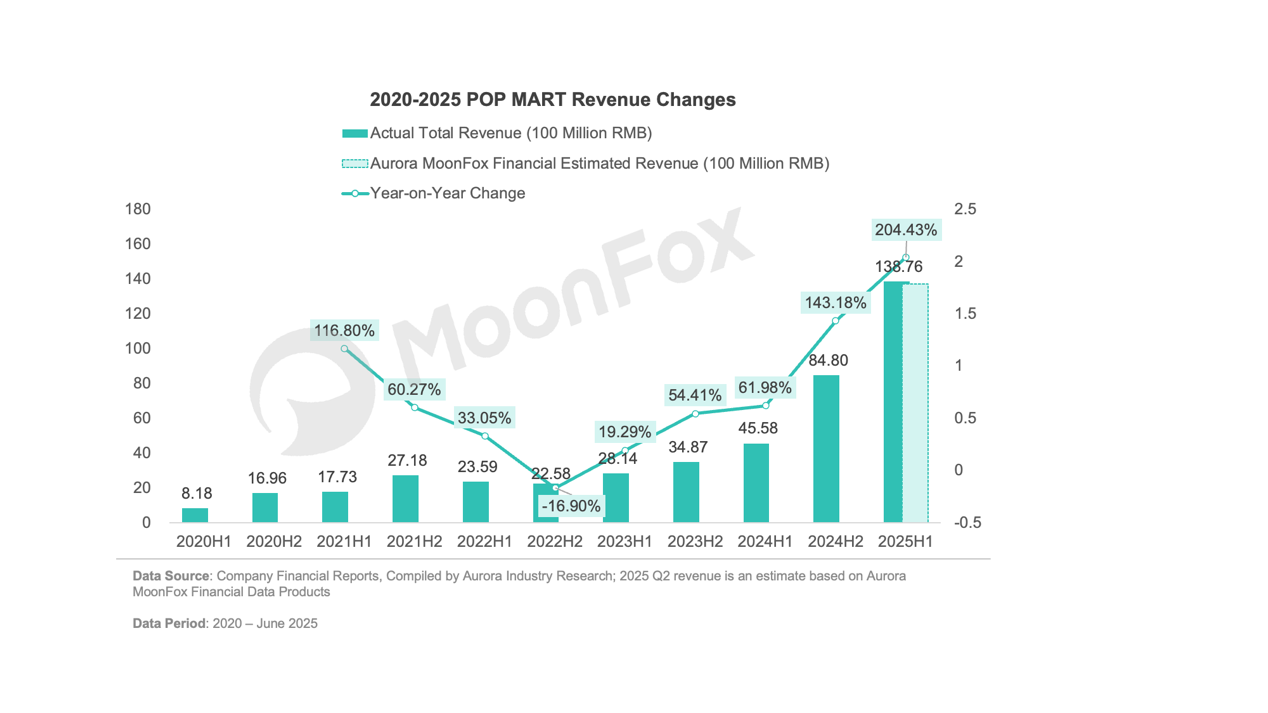

In H1 2025, revenue soared to RMB 13.876 billion, up 204.5% YoY—already surpassing the full-year 2024 figure (RMB 13.038 billion). Q2 revenue was a major driver, and operating profit reached RMB 6.044 billion, a fivefold increase YoY and well above the 2024 full-year level (RMB 4.154 billion).

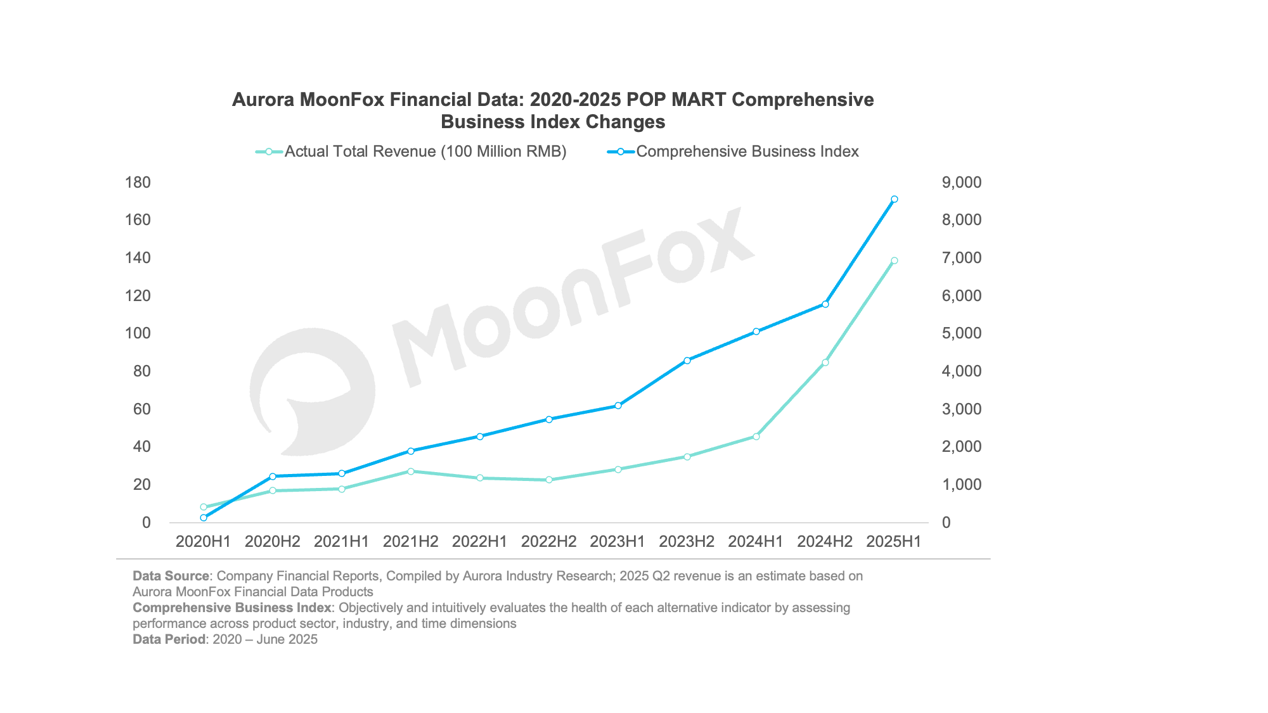

Aurora MoonFox’s comprehensive business index, integrating offline foot traffic and online data, objectively reflects brand health. Financial data shows steep growth in H2 2023 and H1 2025, with a revenue turnaround in 2023 and explosive growth from H2 2024 through H1 2025. The business index closely tracks actual financials and even predicts key inflection points in POP MART’s revenue growth.

II. Ongoing Globalization and Synergistic Domestic-International Growth

China remains POP MART’s main revenue driver. In H1 2025, domestic revenue reached RMB 8.28 billion (up 135.2% YoY), with over 60% from offline channels.

By end-June, mainland China had 409 stores (net increase of 35 YoY); Hong Kong, Macau, and Taiwan had 34 stores (up by 9). Domestic offline revenue was RMB 5.08 billion, up 117.1% YoY.

Online channels also excelled, with H1 revenue up 212.2% YoY to RMB 2.937 billion, mainly driven by self-operated blind box machines. During the 618 shopping festival, POP MART ranked No.1 on Tmall, Douyin, and JD.com

International markets became a new growth engine in H1 2025, with revenue of RMB 5.593 billion (up 439.34% YoY), surpassing POP MART’s global H1 2024 revenue.

Asia-Pacific revenue: RMB 2.85 billion (up 257.8% YoY), with 5 new stores (total 69), focusing on tourism retail at major destinations and airports.

Americas revenue: RMB 2.26 billion (up 1142.3% YoY), with 19 new stores (total 41); online revenue reached RMB 1.327 billion (up 1977.4% YoY).

Europe & other regions: RMB 480 million (up 729.2% YoY), with 4 new stores (total 18); online sales, especially via the official website, led growth.

III. IP Portfolio: “One Superstar, Many Strong Performers” & Plush Category Boom

The superstar LABUBU from THE MONSTERS series contributed RMB 4.81 billion (up 668% YoY), accounting for 34.7% of total revenue.

Four classic IPs—Molly, SKULLPANDA, CRYBABY, DIMOO—each generated over RMB 1 billion in revenue, maintaining high growth.

Emerging IPs: 13 IPs including HIRONO, Star People, Zsiga, PUCKY, and HACIPUPU each exceeded RMB 100 million in revenue, creating a healthy, diversified portfolio.

Product structure shifted dramatically in H1 2025: plush product revenue soared from RMB 446 million (H1 2024) to RMB 6.139 billion (H1 2025), a 1276.2% increase. Plush products contributed 44.2% of revenue, surpassing figurines for the first time. LABUBU plush toys, in particular, often sold out immediately, reflecting strong demand. MEGA category revenue grew 71.8%, and collaborations with luxury brands further highlight POP MART’s successful pricing and product strategies.

Conclusion

In summary, POP MART achieved remarkable results in H1 2025 through IP-driven innovation, product and channel expansion, and globalization. Looking ahead, the brand is poised to continue benefiting from global pop culture trends.

2025 Internet Industry Annual Review Research Report

Bilibili: A "Forever Young" Platform with a Long-term Vision

Pop Mart Business Decoded: Measuring the Value of Emotional Consumption