BYD Q2 2025 Revenue to Surge 21% YoY, Firmly Holding Top Spot in New Energy Vehicles

Against the backdrop of the global automotive industry accelerating its transition to new energy, BYD, as a key player in the new energy vehicle (NEV) sector, has drawn significant attention to its development trajectory.

In recent years, the NEV market has experienced explosive growth. Governments worldwide have introduced various incentive policies to address energy crises and environmental pollution, promoting the adoption of NEVs. Leveraging its deep accumulation in battery technology, vehicle manufacturing, and industrial chain integration, BYD has rapidly risen to occupy a crucial position in the market.

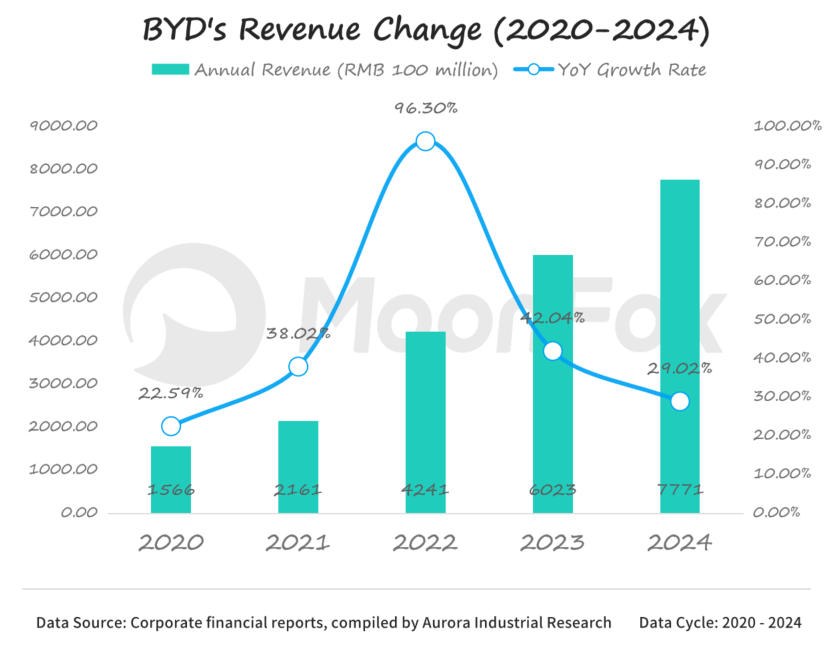

I. BYD's 2024 Revenue Exceeds 770 Billion CNY, Up 26% Year-over-Year

In 2024, BYD achieved operating revenue of 777.102 billion CNY, a year-over-year increase of 26.9%, demonstrating strong growth momentum. This growth was primarily driven by the continuous climb in NEV sales.

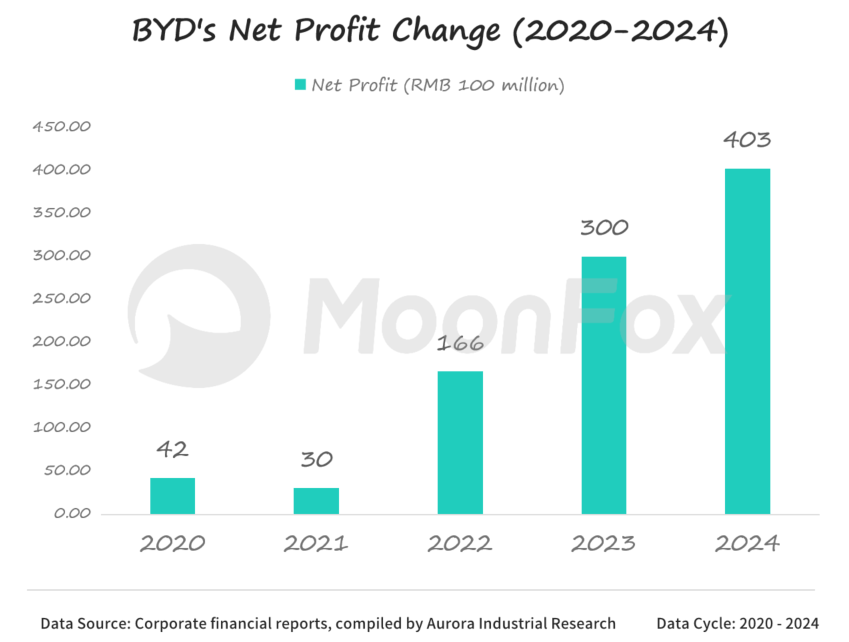

In 2024, BYD's net profit attributable to shareholders of the listed company was 40.254 billion CNY, a year-over-year increase of 31.8%. The growth in net profit was attributable to both the rapid revenue growth, which realized economies of scale and reduced unit costs, and significant achievements in cost control. Through vertical integration of its supply chain, the company controls the production of core components such as batteries, motors, and electronic controls, reducing external procurement costs and effectively enhancing profit margins.

In Q1 2025, BYD's revenue reached a new high of 170.36 billion CNY, a year-over-year increase of 36.35%, with growth rate higher than the full year of 2024. Net profit attributable to the parent company was 9.155 billion CNY, a year-over-year increase of 100.38%, achieving doubled growth. Net profit after deducting non-recurring gains and losses reached 8.172 billion CNY, a year-over-year increase of 117.80%, indicating a significant enhancement in the profitability of its core business.

The substantial growth in revenue and profit was mainly benefited from the strong performance of the NEV business. On one hand, market demand for NEVs remained robust; BYD seized market opportunities, intensified marketing efforts, and further enhanced brand awareness and market influence. On the other hand, the company continuously launched new models and upgraded existing ones, meeting the increasingly diverse needs of consumers.

II. Market Share Continues to Grow, Ranking First Domestically

In the domestic NEV market, BYD's market share has shown a steady upward trend. In 2024, BYD's market share in the domestic NEV market reached 25.6%, an increase of 3.8 percentage points from 2023. In Q1 2025, the market share further increased to 28.4%.

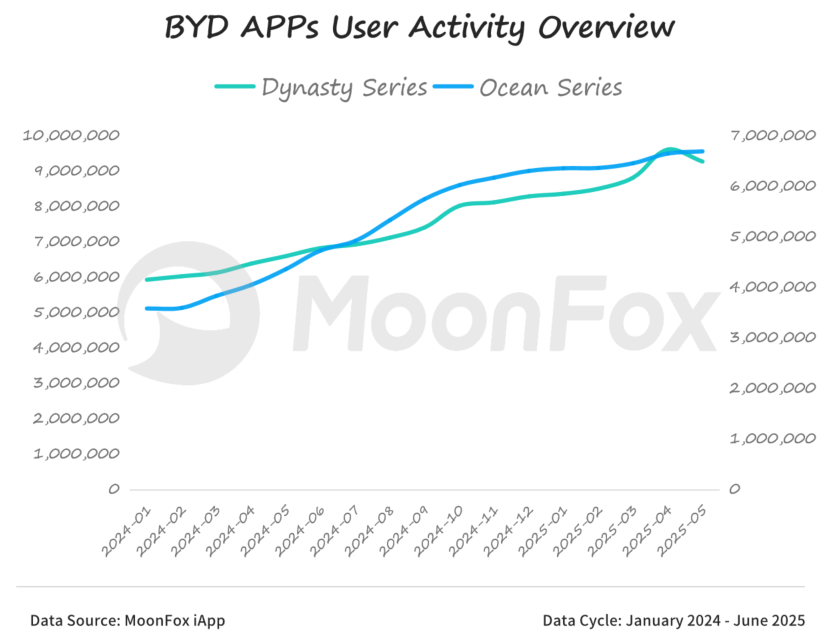

As the market scale rapidly expands, BYD's user base is also continuously growing.

This is primarily due to BYD's diverse product lineup, leading technology, and strong brand reputation. BYD covers various models including sedans, SUVs, and MPVs, catering to the needs of different consumers. Technologically, BYD holds advantages in core technologies such as batteries, motors, and electronic controls, with product performance and quality gaining consumer recognition. Through years of marketing and brand building, BYD has established a positive brand image, with continuously increasing brand awareness and reputation.

III. Rapid Increase in Technology Investment, Maintaining a Leading Trend

In 2024, R&D investment reached 54.2 billion CNY, a year-over-year increase of 36%, accounting for 6.97% of operating revenue. In Q1 2025, R&D expenditure was 14.223 billion CNY, a year-over-year increase of 34.04%. Sustained high investment provides solid financial support for technological innovation.

Years of R&D investment have enabled BYD to achieve substantial technological results.

In battery technology, BYD launched the Blade Battery, leading industry trends with advantages such as high safety, high energy density, and long lifespan.

In the field of intelligent driving, BYD continuously promotes technological innovation, introducing the "Xuanji" (天神之眼) intelligent driving assistance system. It features various advanced functions such as adaptive cruise control, lane keeping, and automatic parking, enhancing driving safety and convenience. Furthermore, BYD has made a series of breakthroughs in core technology areas like motors and electronic controls, possessing multiple independent intellectual property rights.

These technological achievements have significantly enhanced the competitiveness of BYD's products.

The application of the Blade Battery gives BYD's NEVs distinct advantages in safety and range, attracting considerable consumer attention and purchases.

The integration of the "Xuanji" intelligent driving assistance system enhances the technological appeal and intelligent level of the products, meeting consumer demand for smart cars and further strengthening the product's competitiveness in the market.

In the domestic market, BYD achieves extensive market coverage through two main sales channels: the Dynasty Network and the Ocean Network. The Dynasty Network primarily targets the traditional fuel vehicle and NEV markets, covering multiple series such as Qin, Tang, Song, and Yuan, meeting the needs of different consumers.

The Ocean Network focuses on the NEV market, launching models like the Dolphin and Seal, attracting younger consumers with stylish designs and advanced technology. The two sales channels synergize, further enhancing BYD's sales capability and market share in the domestic market.

In overseas markets, BYD actively expands its business through a dual-drive model of "complete vehicle exports + localized production," having established production bases in regions such as Brazil, Thailand, and Hungary.

In the Southeast Asian market, BYD holds a 42.8% share of NEV sales. In the European market, quarterly deliveries exceeded 50,000 units, with the ATTO3 (Yuan PLUS) ranking as the leading pure electric SUV in the UK for three consecutive months.

BYD also plans to further expand into overseas markets, introducing its products to more countries and regions. Its market expansion strategy mainly includes product localization, establishing local sales and service networks, and strengthening cooperation with local governments and enterprises.

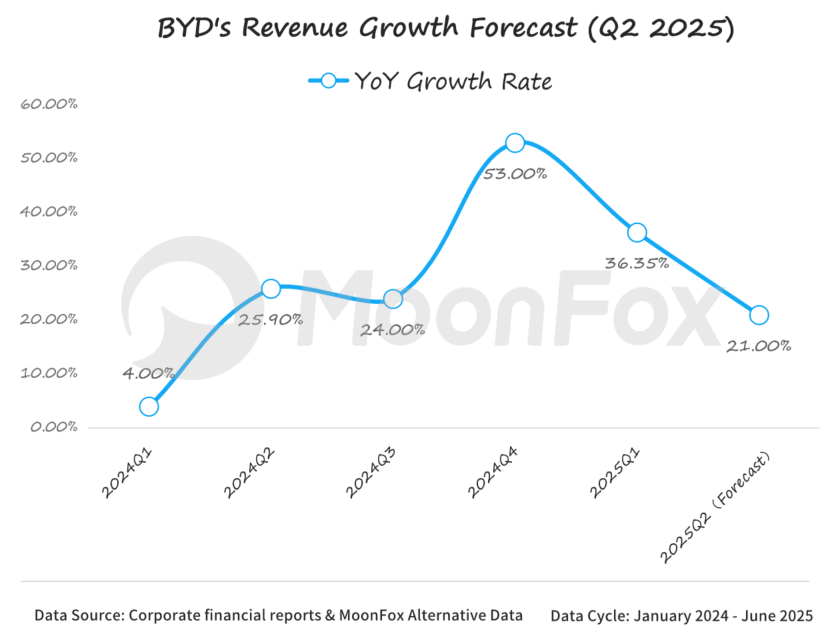

IV. Q2 2025 Revenue Expected to Grow 21% Year-over-Year

Looking ahead, with the continuous rapid development of the global NEV market, BYD is expected to achieve further growth leveraging its core advantages. It is projected that BYD's sales will reach around 5.5 million units in 2025, with revenue and profit maintaining growth.

MoonFox Alternative Data anticipates that BYD's automotive revenue will increase by 21% year-over-year in Q2 2025.

2025 Internet Industry Annual Review Research Report

Bilibili: A "Forever Young" Platform with a Long-term Vision

Pop Mart Business Decoded: Measuring the Value of Emotional Consumption