Chow Tai Fook’s Transformation Shows Initial Results, Profitability Improves in Fiscal Year 2026

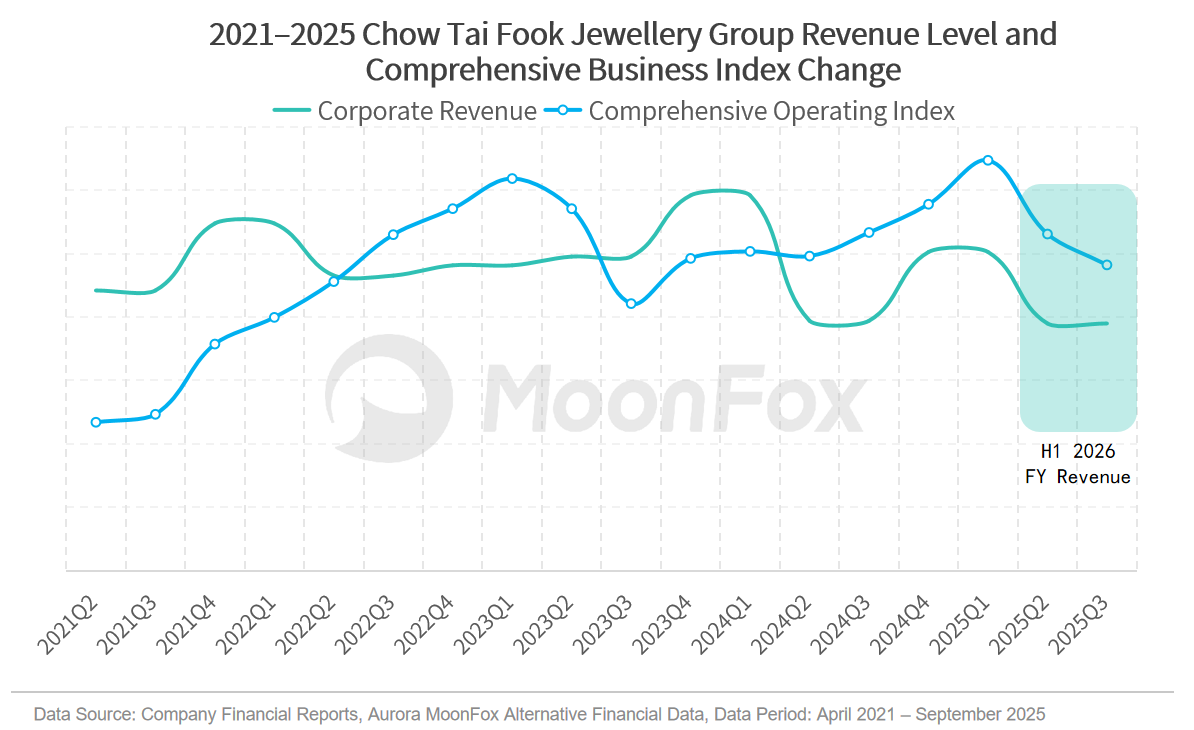

In late November, Chow Tai Fook released its interim results for fiscal year 2026 (covering April to September 2025). The group’s overall performance showed a steady recovery, with same-store sales growth across markets. The brand’s transformation towards the high-end segment is showing initial results, and changes in product pricing and channel layout are continuously delivering positive effects on group profitability.

Ⅰ. Overall Performance: Revenue Decline Slows, Cost Reduction and Efficiency Stabilize Profitability

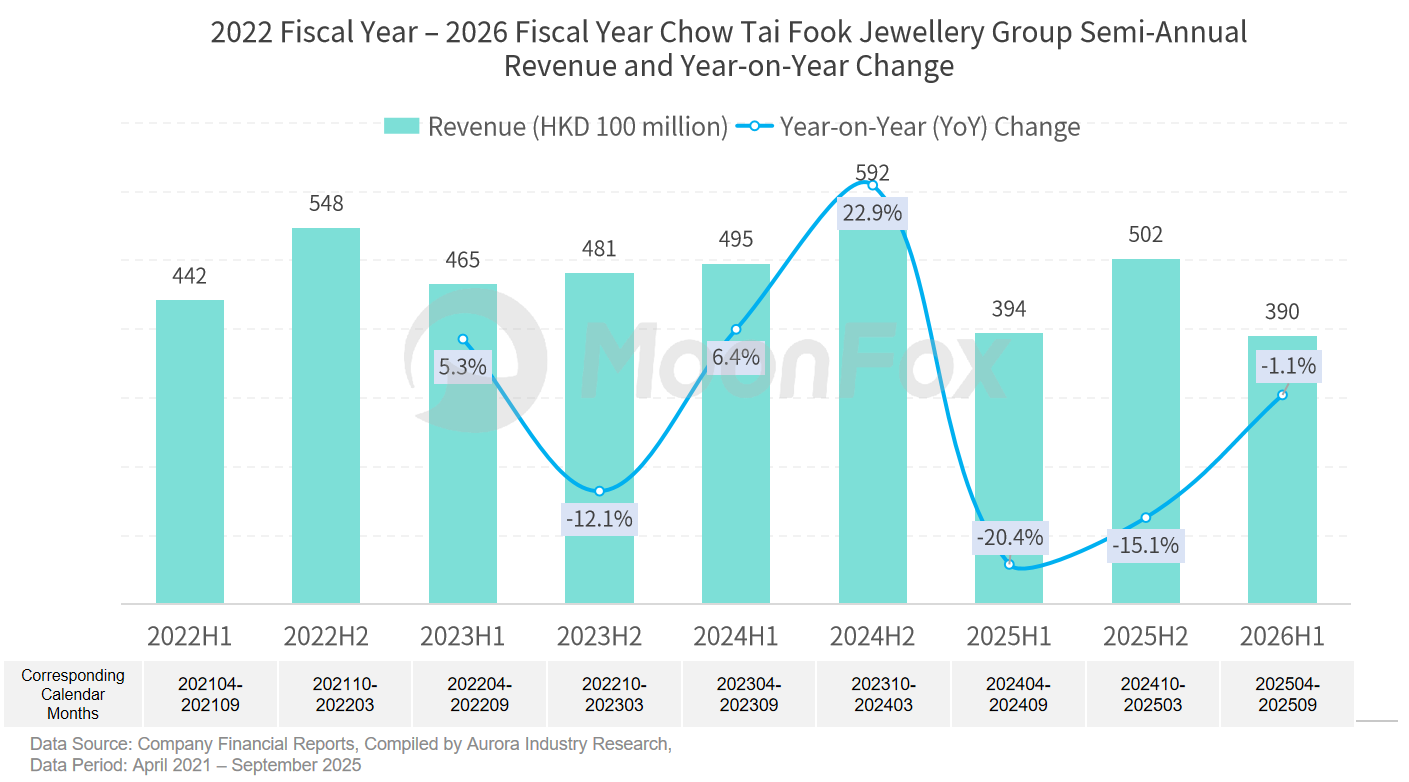

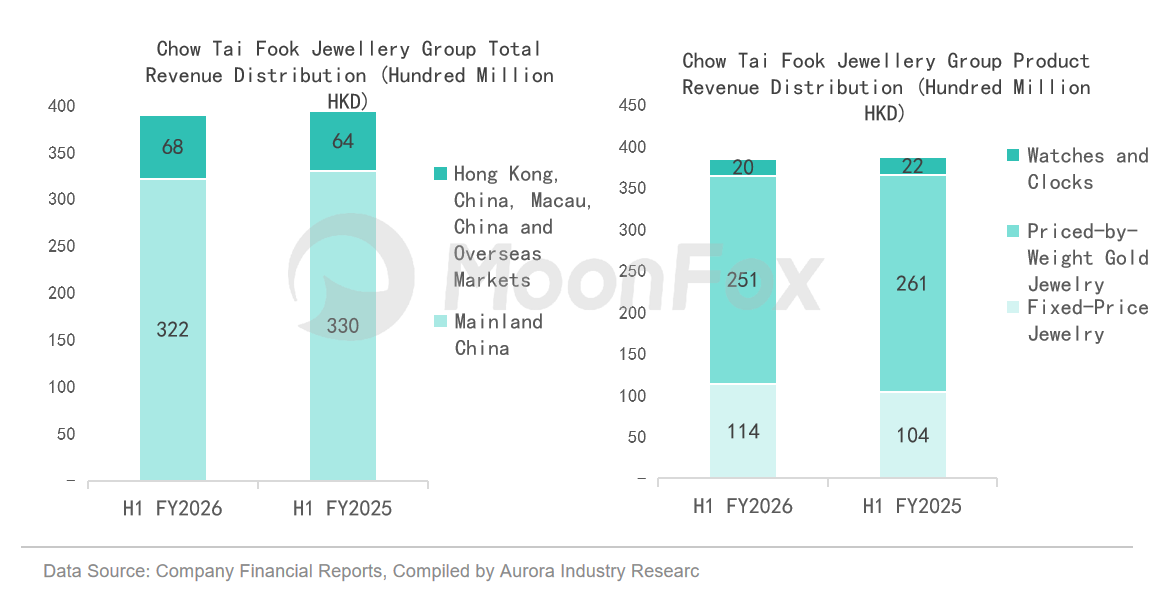

Since 2024, Chow Tai Fook Jewellery Group’s semi-annual revenue has continued to decline. In fiscal year 2025 (April 2024 to March 2025), total revenue was HKD 89.6 billion, down 17.5% year-on-year. From April to September 2025, total revenue reached HKD 39 billion, a year-on-year decrease of 1.1%, with the pace of decline significantly slowing.

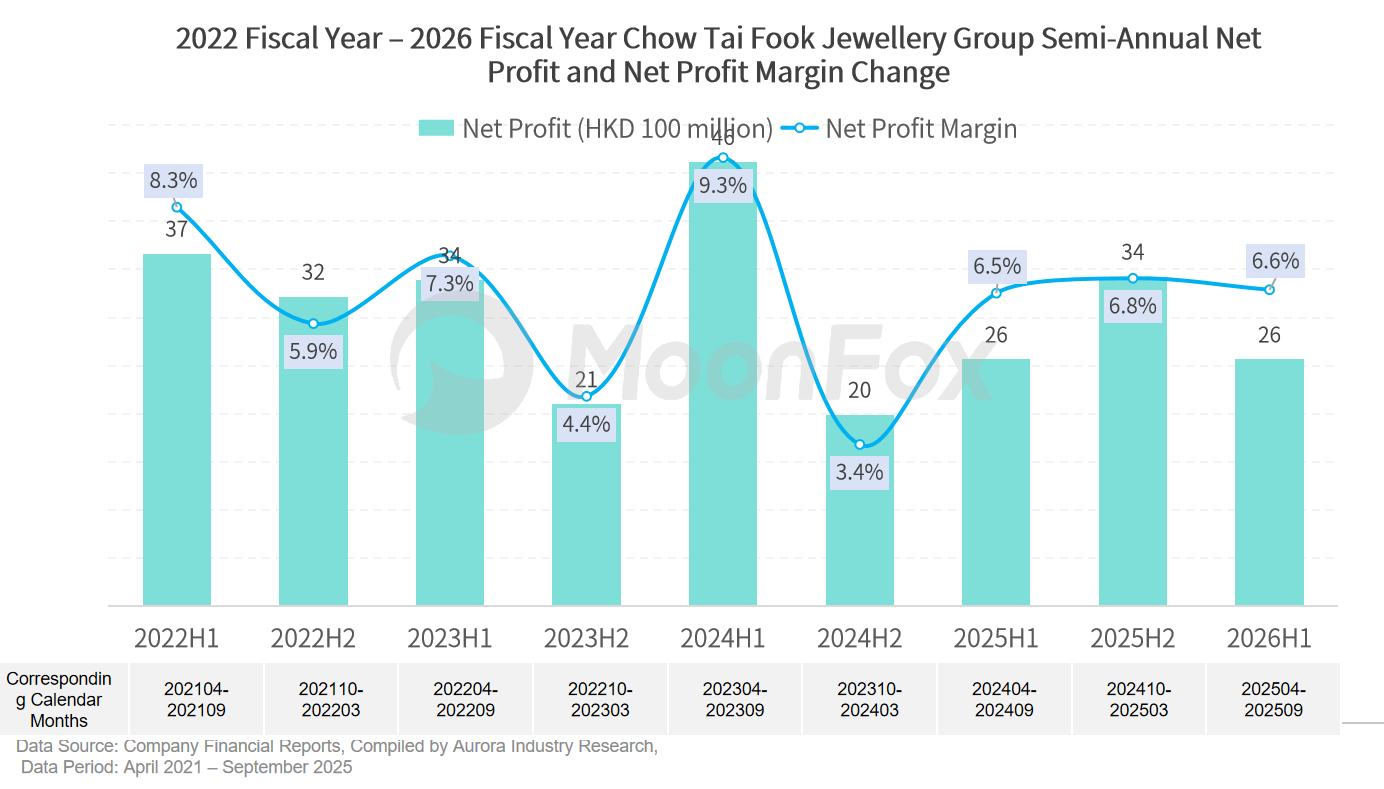

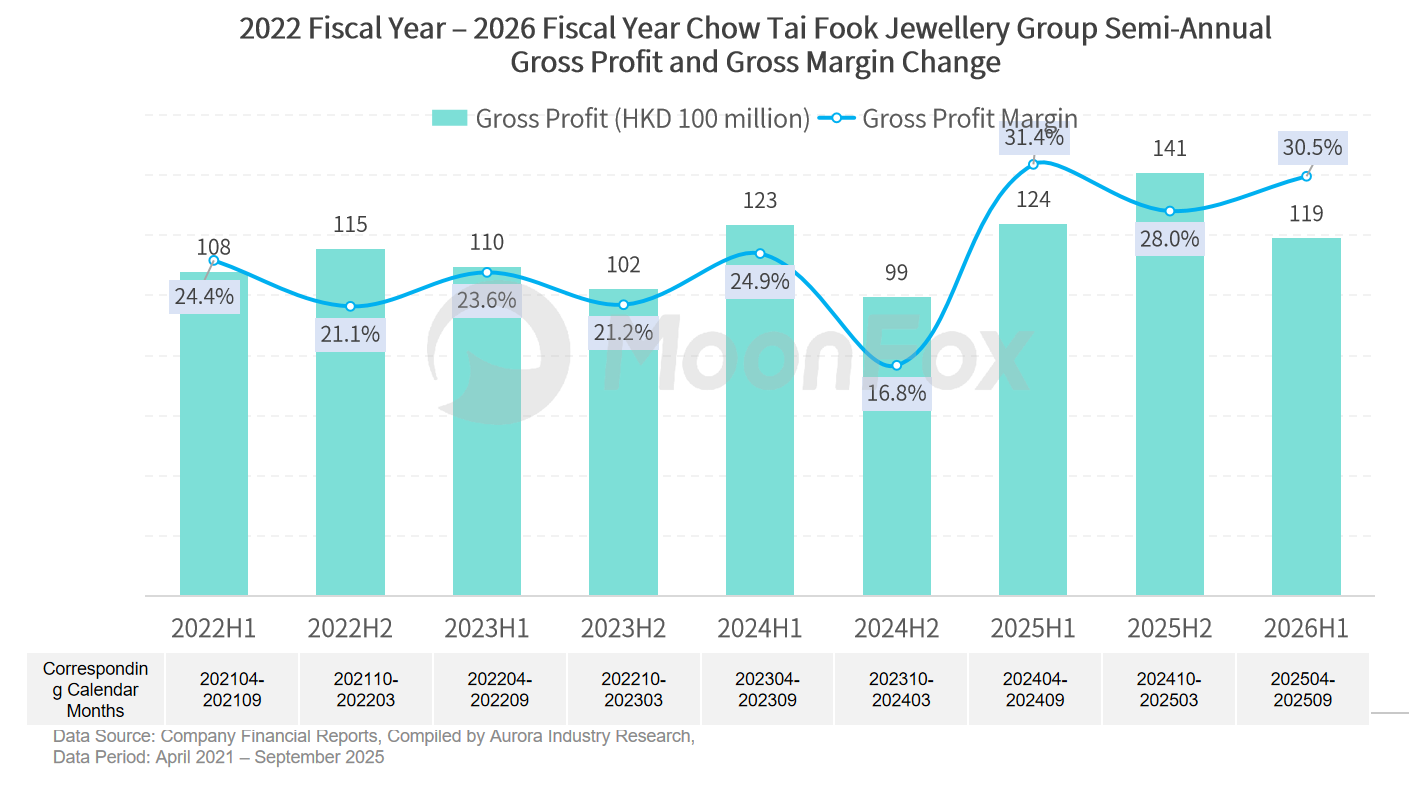

From April to September 2025, the group’s net profit was flat year-on-year, with a net profit margin of 6.6%. Gross profit decreased by HKD 500 million year-on-year, and gross margin dropped by 0.9 percentage points compared to the same period last year.

Additionally, this financial report shows that Chow Tai Fook’s operating profit reached HKD 6.8 billion, up 0.7% year-on-year, and net profit margin improved by 0.3 percentage points.

Despite the pressure of declining revenue, profitability remains stable, indicating the company’s advantages in cost control and business structure.

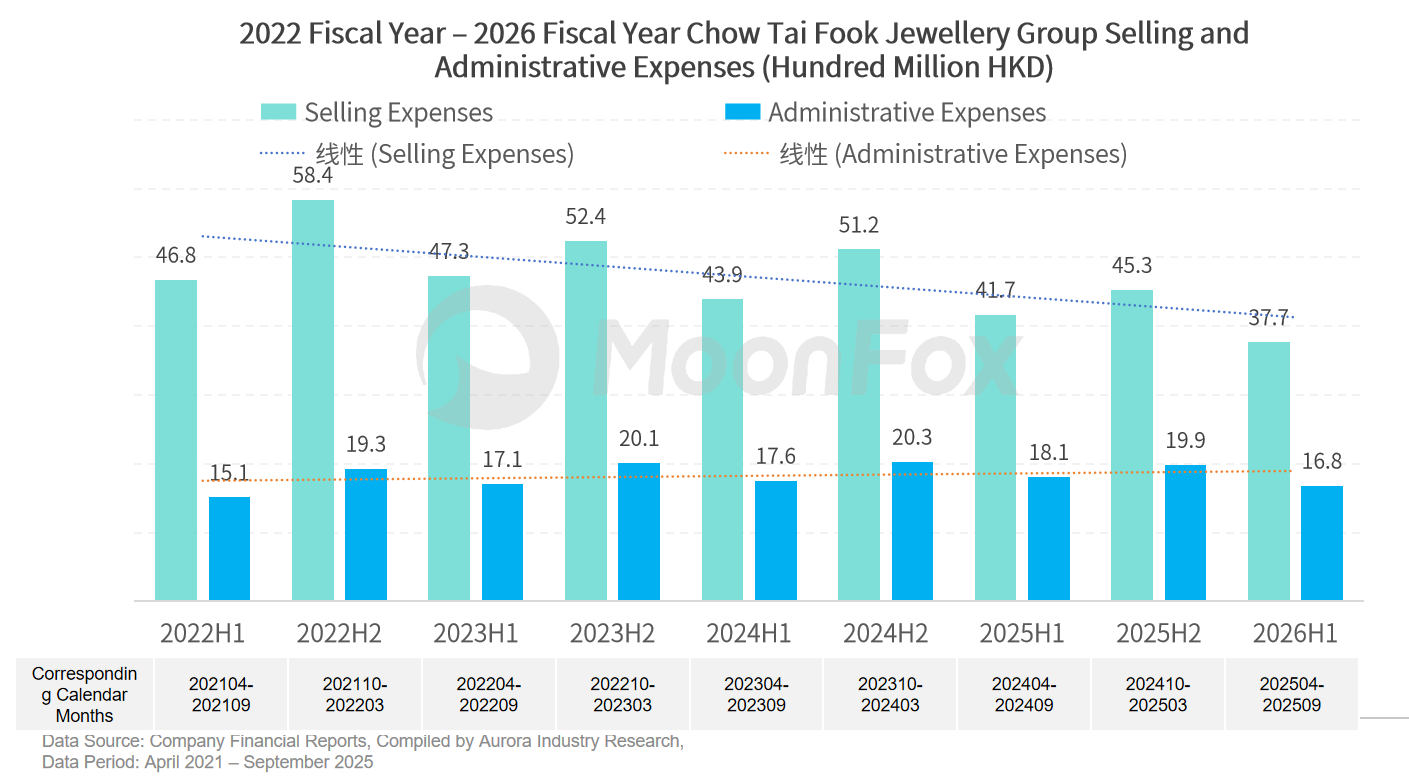

The chart of selling and administrative expenses from FY2022 to FY2026 shows that Chow Tai Fook has continuously reduced sales costs while maintaining stable administrative expenses. From April to September 2025, selling and administrative expenses totaled HKD 5.45 billion, down 8.8% year-on-year. This significant result comes from optimizing offline stores, gradually closing low-efficiency stores, and reducing rent and labor costs.

Ⅱ. Financial Health: Gold Price Fluctuations, Operating Cash Flow Drops Sharply

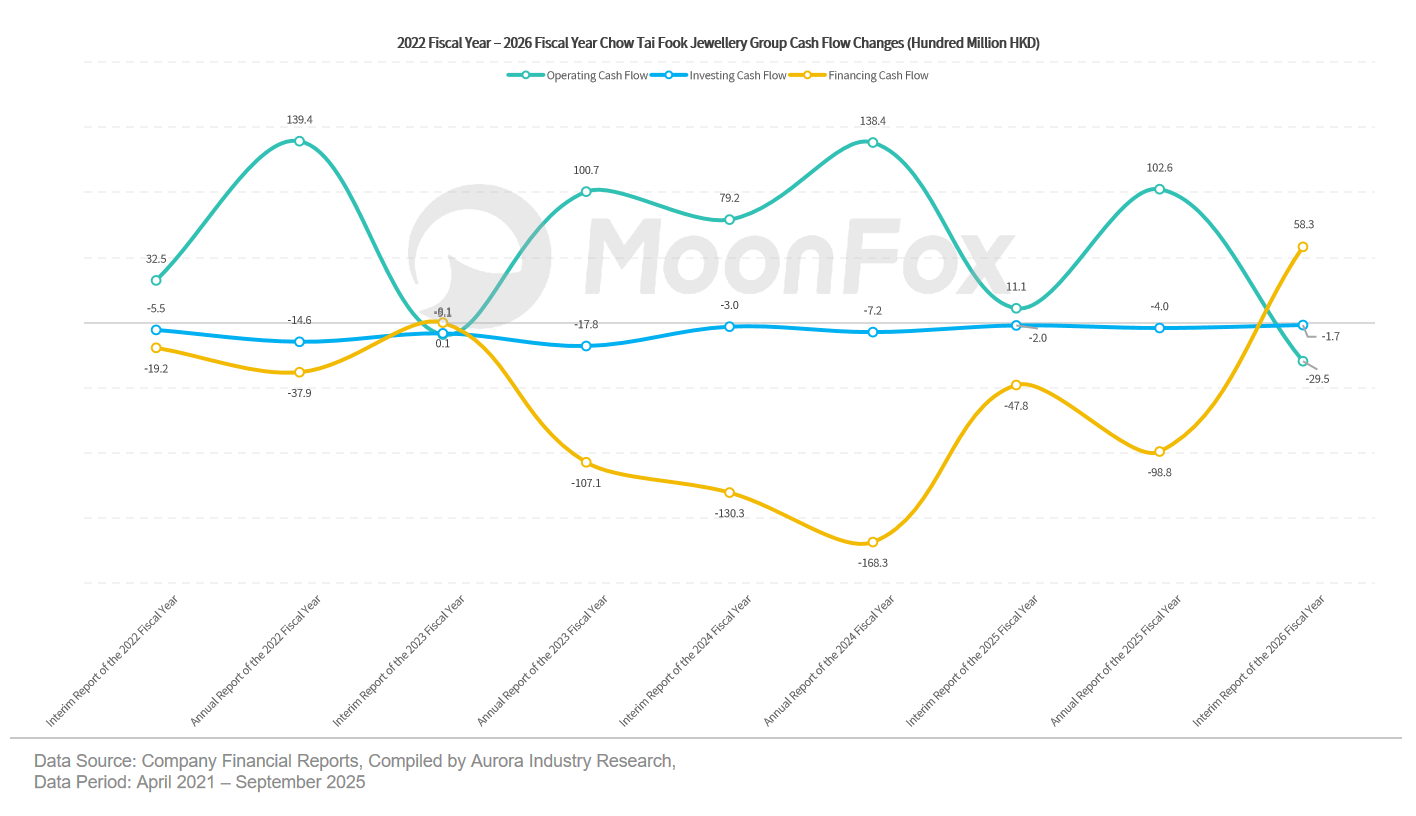

The latest financial report shows significant fluctuations in Chow Tai Fook’s cash flow: financing cash flow surged, while operating cash flow dropped sharply, with net cash outflow from operating activities at HKD 2.95 billion. This seemingly contradictory financial feature is not a simple sign of operational crisis, but the inevitable result of the jewelry industry’s characteristics, gold price cycles, and the company’s strategic transformation.

In mid-2025, the London gold spot price rose by over 30%, and domestic gold prices rose by over 20%. This trend created a double squeeze: on one hand, to ensure the supply of core gold products, Chow Tai Fook had to lock in raw material inventory in advance, greatly increasing the scale of self-procurement of priced jewelry and gold materials; on the other hand, rising gold prices directly increased the book value of inventory.

By the end of September 2025, the group’s total assets were HKD 76.5 billion, with HKD 67.6 billion in current assets, and inventory of HKD 55.4 billion, accounting for 72.4% of total assets. Huge funds are tied up in gold inventory, and this “passive capital occupation” directly leads to a mismatch in the timing of operating cash inflows and cost outflows, becoming the main reason for the decline in operating cash flow.

It is worth noting that Chow Tai Fook’s inventory assets fell by 10.7% from HKD 62.1 billion at the beginning of the year, reflecting improvements in inventory management. During the reporting period, the group’s inventory turnover days dropped from 457 days in the same period last year to 424 days, a decrease of 33 days year-on-year.

The sharp increase in financing cash flow mainly stems from the group’s strategic transformation and preparations for external risks.

Ⅲ. Main Business: Priced Gold Grows Rapidly, Cultural Integration and IP Innovation Drive Growth

1. Optimizing Product Portfolio Strategy and Pricing Structure

In the first half of FY2026, Chow Tai Fook Jewellery Group continued to use signature products (priced jewelry) as the sales growth engine. In the mainland market, the retail value of priced jewelry increased by 16% year-on-year: priced gold jewelry accounted for 66%, up 9.2 percentage points year-on-year, while the proportion of gem-set jewelry, platinum, and K-gold jewelry retail value declined accordingly. This structural optimization not only improved gross margin but also enhanced the company’s ability to withstand gold price fluctuations.

In the first half of FY2026, revenue from priced jewelry rose by 9.3% year-on-year to HKD 11.4 billion, while revenue from weighted gold jewelry fell by 3.8% to HKD 25.1 billion, and watches dropped by 10.6%. The decline in weighted gold jewelry and watch revenue was the main reason for the overall revenue drop.

Additionally, the group attracted new-generation young customers through IP crossovers, making its debut at Bilibili World in 2025 and collaborating with the 15th National Games and the NBA to expand its influence.

In terms of product pricing, the average price of priced gold jewelry rose to HKD 6,300, up 18.9% year-on-year. The average price of priced gold jewelry in mainland China increased by 19% year-on-year, and by 20% in Hong Kong and Macau, bringing higher gross margins to the group.

2. Cultural IP Products Become a Core Growth Driver

Currently, Chow Tai Fook’s cultural IPs have formed a product matrix: the Chuanfu series launched in April 2024, the Palace Museum series in August 2024, and the Chuanxi series in April 2025…

In the first half of FY2026, the Palace Museum, Chuanfu, and Chuanxi series achieved total sales of HKD 3.4 billion, up 48% year-on-year. These products blend tradition with modern aesthetics, creating fine pieces with rich cultural meaning.

3. Breakthroughs in High Jewelry and Jadeite Products

In June 2025, Chow Tai Fook launched its first high jewelry collection “Harmony in the East,” selling nearly 200 pieces during the launch event in Hangzhou, fully demonstrating the brand’s potential in the high-end market.

In September 2025, the “Heaven and Earth” series was launched, along with IP collaborations with the Palace Museum and renowned fashion brand CLOT—thanks to continuous innovation, jadeite jewelry sales doubled year-on-year in the first half of FY2026.

Ⅳ. Development Trends: Seeking Opportunities in Transformation, Profitability Expected to Improve

1. Channel Structure Optimization, Improved Operational Efficiency

In the first half of FY2026, 57 new stores were opened, with average monthly sales exceeding HKD 1.3 million, up 72% year-on-year. The strategy of “closing low-efficiency, opening high-quality” stores has effectively improved overall channel efficiency. The company also plans to open 20 new concept stores throughout FY2026 to further strengthen brand image.

By city tier, the retail value share in tier 1 and 2 cities increased by 9.4 percentage points to 64.7%, while the share in tier 3 and 4 cities decreased by 3.4 and 5.9 percentage points, respectively—reflecting a strategic focus on core markets and brand positioning.

Overseas, the company plans to launch new concept stores in international markets in the second half of FY2026, focusing on premium locations in Southeast Asia, Oceania, and Canada.

2.Regional Recovery Differences

The mainland market remains Chow Tai Fook’s largest revenue source. In the first half of FY2026, revenue was HKD 32.2 billion, down 2.5% year-on-year, but the decline has narrowed significantly. Same-store sales in the mainland returned to positive growth: directly operated stores saw same-store sales rise by 2.6%, and franchised stores by 4.8%.

Revenue in Hong Kong, Macau, and overseas markets was HKD 6.8 billion, up 6.5% year-on-year, with Macau’s same-store sales surging 13.7%, mainly benefiting from the recovery in tourism.

For different regions, the group has adopted differentiated marketing strategies: in the mainland, the focus is on optimizing store structure and improving single-store efficiency; in other markets, sub-brands, new concept stores, and high-end stores are used to raise average transaction value and brand image.

About MoonFox Data

MoonFox Data, a subsidiary of Aurora Mobile (NASDAQ: JG), is a leading alternative data provider delivering actionable insights to global financial institutions and investment firms. Trusted by top 50 funds, MoonFox leverages proprietary big data and advanced analytics to help clients uncover market trends and drive smarter decisions across China and emerging markets.

2026 年 1 月 AI 应用榜单解析:赛道分层竞逐,新锐势力强势突围

2026年春节AI应用市场大PK:豆包、元宝、千问、DeepSeek谁更强?

APP + 小程序双榜 TOP100 出炉,AI 赛道成最大黑马