MIXUE Group’s Revenue and Profit Both Increased, Highlighting Supply Chain Advantages

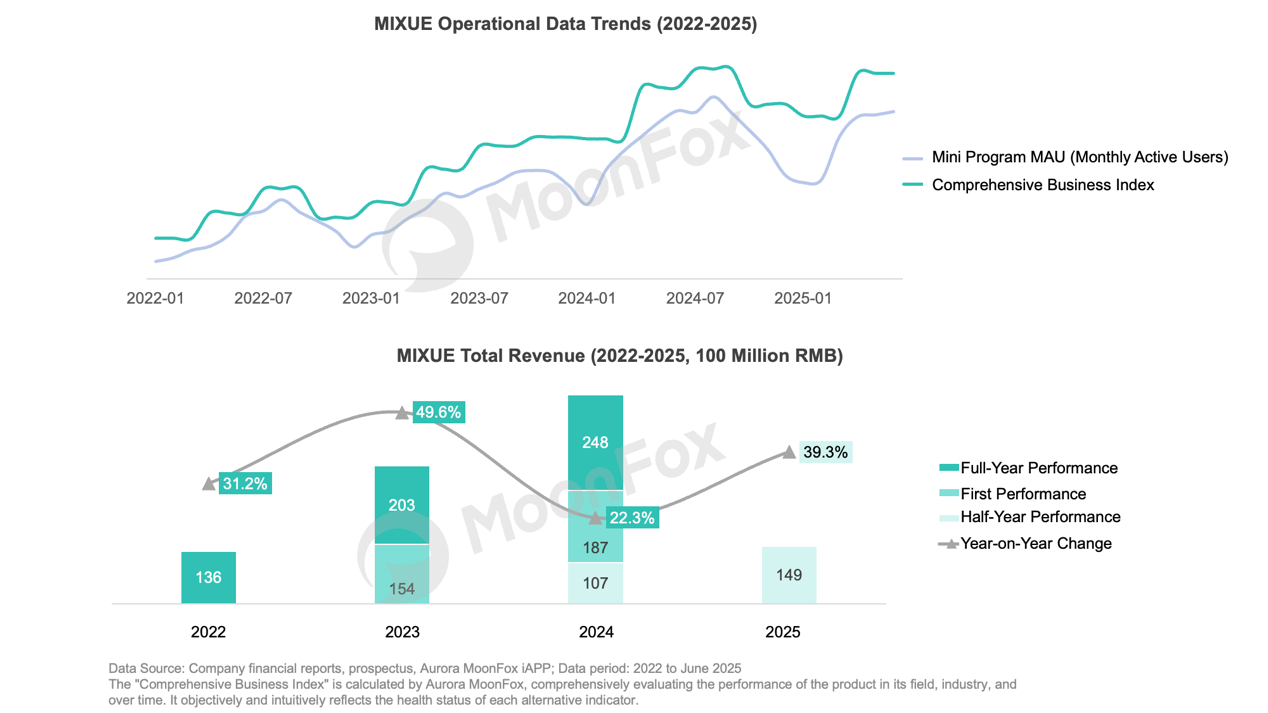

On June 30, 2025, MIXUE Group (2097.HK) delivered its first performance report since going public. In the first half of the year, MIXUE Group achieved revenue of 14.87 billion yuan (approximately USD 2.07 billion, a year-on-year increase of 39.3%), gross profit of 4.71 billion yuan (approximately USD 656 million, a year-on-year increase of 38.3%), and a gross profit margin that remained stable at 32% compared to the same period last year. Net profit reached 2.72 billion yuan (approximately USD 379 million, a year-on-year increase of 44.1%). Additionally, 9,796 new stores were added in the first half of 2025 compared to the same period last year, accounting for 18.5% of the global store count.

Revenue in the first half of 2025 has already far exceeded the total revenue for 2022. From both offline and online operational perspectives, the brand's user coverage and consumer enthusiasm have maintained steady growth for several consecutive years. According to Aurora MoonFox data, the comprehensive business index for the second quarter of 2025 increased by 211% compared to the same period in 2022, and the monthly active user scale of MIXUE mini-program increased eightfold.

The "food delivery war" in the second quarter impacted the tea and coffee industry, putting significant pressure on offline stores. From a performance perspective, MIXUE was undoubtedly a beneficiary in this battle.

So, as a representative brand breaking out from lower-tier markets, how does MIXUE maintain relatively stable growth over the long term? What are its current brand development status and capability barriers?

I. Significant Scale Effect in Domestic Store Expansion, Overseas Footprint Expands

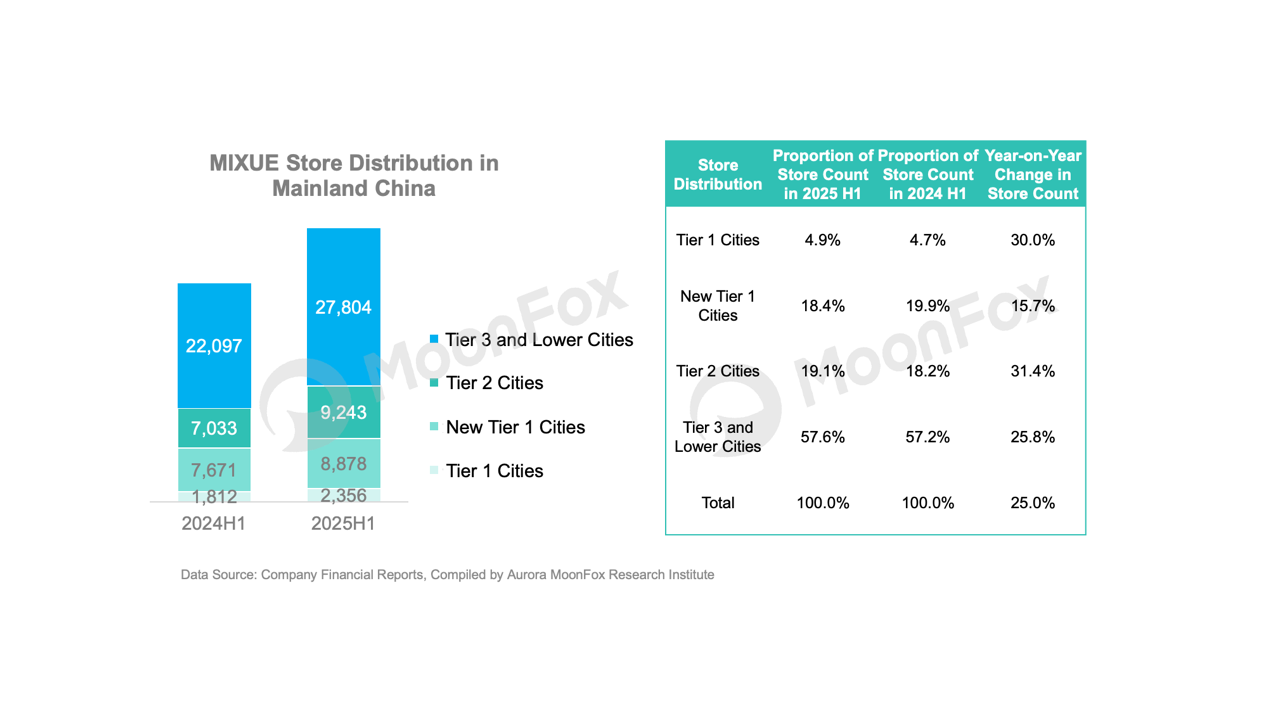

In mainland China, MIXUE continues to strengthen its layout in lower-tier markets. In the first half of 2025, the number of new stores in second-tier cities increased the most, with a year-on-year growth of 31.4%.

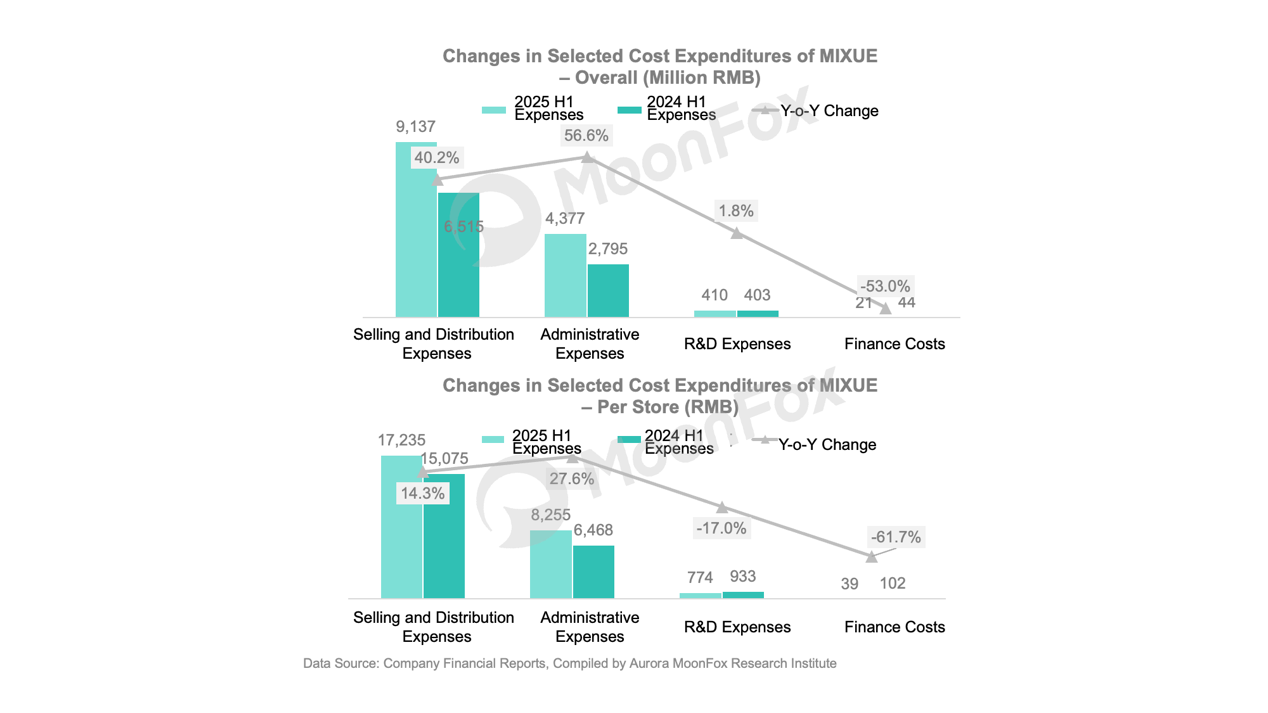

By densely opening stores in lower-tier markets, MIXUE effectively diluted costs in procurement, logistics, marketing, and other areas through scale effects. The cost increase per store was lower than the overall level, and some cost items even declined, thereby driving overall profit growth. In the first half of 2025, due to rising raw material costs, the gross profit margin for product and equipment sales slightly declined from 30.5% in the same period last year to 30.3%. However, the gross profit from franchising and related services increased year-on-year, with the gross profit margin rising from 81.7% in the same period last year to 82.7% this year.

The franchise model is the main means of brand expansion. Currently, 99% of offline stores are franchises, especially in overseas markets, where the brand can quickly integrate into local markets through local partners. As of June 30 this year, there were 4,733 stores outside mainland China (a year-on-year increase of 2.8%).

In terms of overseas expansion, MIXUE remains focused on the Southeast Asian market:

In April this year, MIXUE opened its first store in Kazakhstan, marking its expansion into the Central Asian market.

Its new brand "Lucky Coffee" officially entered the overseas market in August this year, with its first store debuting in Malaysia.

II. High Subsidies from Delivery Platforms: A Double-Edged Sword for MIXUE's Revenue

MIXUE's brand communication has strong viral capabilities. In the first half of 2025, MIXUE further strengthened its IP operations. Consumers, attracted by the "Snow King" mascot and the brand's extreme cost-effectiveness, spontaneously shared their purchase experiences and store photos on social media:

"Snow King" parades and "Global Snow King Exhibitions" were held in various locations across the country as immersive-themed events.

At the beginning of the year, MIXUE opened its flagship store at its headquarters in Zhengzhou, which enhanced IP cultural dissemination and became a new tourist landmark during the May Day holiday.

In May, the animated series "The Snow King Arrives" was released in multiple languages, including English, French, and Portuguese, for global distribution.

In the first half of 2025, the domestic "instant retail" battle gained momentum, disrupting the previously stable tea and coffee industry landscape. On one hand, food delivery orders surged significantly; on the other hand, it brought immense operational pressure to stores and impacted in-store consumption. MIXUE benefited from its high frequency, high standardization, and high scalability. However, as summer ends and the unsustainability of "high subsidies" from platforms becomes apparent, the second half of the year may see some subsidy-dependent consumers reduce their purchase frequency, affecting store delivery revenue and potentially impacting overall performance.

III. Digitalization + Scalability + Supply Chain Advantages: Effectively Mitigating the Risk of Raw Material Cost Fluctuations

Since 2024, the negative impact of rising costs for various raw materials has significantly affected brands in the tea and coffee industry. Starting in 2024, coffee bean prices began a continuous upward trend, which accelerated in 2025. According to the International Coffee Organization's January 2025 report, the coffee price index rose by 75.8% compared to the same period last year. Additionally, prices for commonly used raw materials such as lemons, tea leaves, palm kernel oil, and coconut oil also increased to varying degrees. Fruit-based raw materials were further affected by seasonal and climatic factors, leading to significant fluctuations in supply stability and prices.

MIXUE's established "central factory & self-built logistics & global procurement" management model has become a risk barrier. Even during price hikes for lemons and tea leaves, the company has maintained stable product prices and profit margins:

The central factory provides a full range of beverage ingredient solutions, including sugar, milk, tea, coffee, and fruit, through a self-developed and self-produced system. Core beverage ingredients are 100% self-produced. By signing long-term procurement contracts with production areas and stockpiling raw materials in advance, MIXUE buffers the impact of raw material price fluctuations.

Additionally, MIXUE has signed guaranteed purchase agreements with local farmers and cooperatives, achieving a win-win situation for supporting agriculture and stimulating consumption. Its coffee brand "Lucky Coffee" incorporated seasonal fruits such as oranges, green grapes, guava, apples, pomegranates, passion fruit, lychees, and strawberries in the first half of the year to adjust costs through new seasonal products.

Overall, a solid supply chain foundation and strong supply chain control capabilities are key factors for tea and coffee companies to withstand market risks.

Conclusion

An in-depth analysis of MIXUE Group's performance in the first half of 2025 reveals that this tea and coffee giant has achieved growth in "market scale — brand marketing — supply chain capabilities" while forming a positive cycle of "market expansion — marketing empowerment — supply chain support." In the first half of the year, MIXUE Group maintained high growth rates in revenue and profit, with relatively stable gross profit margins. Innovative developments such as overseas expansion, new category construction, and IP operations have brought positive benefits.

2026 年 1 月 AI 应用榜单解析:赛道分层竞逐,新锐势力强势突围

2026年春节AI应用市场大PK:豆包、元宝、千问、DeepSeek谁更强?

APP + 小程序双榜 TOP100 出炉,AI 赛道成最大黑马