Kaisa Group Financial Report Analysis: Anticipated Performance Recovery in First Half of 2025

As a comprehensive investment group, Kaisa Group has faced severe challenges during the recent real estate industry adjustment period. However, its proactive asset-light transformation strategy and progress in debt restructuring still signal positive development trends. We will analyze the 2024 financial report and forecast the 2025 performance from three dimensions: financial data, business status, and future development predictions.

I. Interpretation of Current Financial Status:

Kaisa Group's financial performance has been affected by industry changes and its own debt issues in recent years. 2024 presented a complex picture of declining revenue, widening losses, but some indicators showing signs of stabilization.

Setbacks in Revenue and Profitability

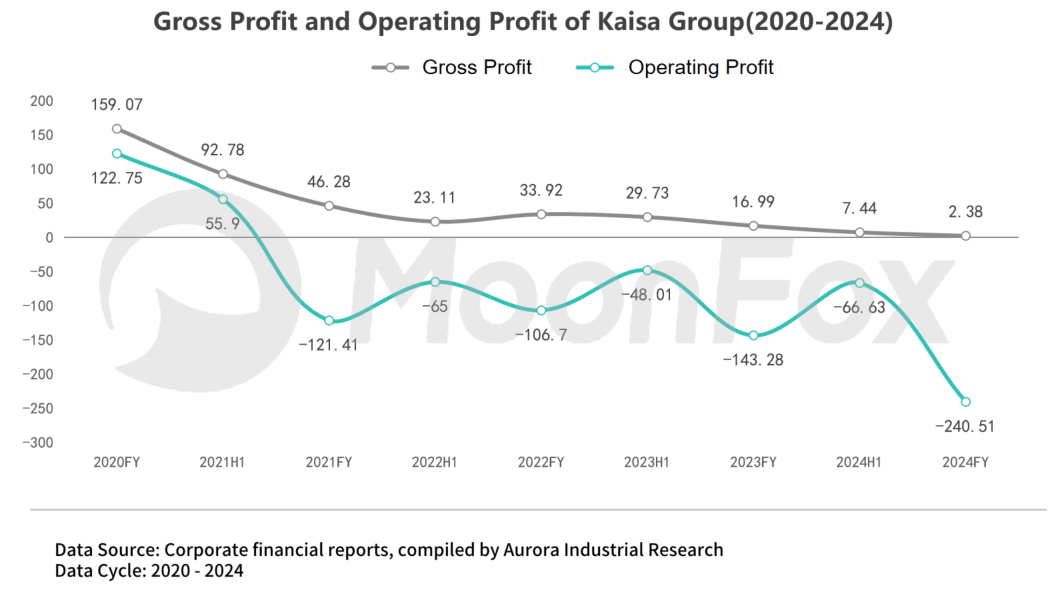

Looking at overall indicators, Kaisa Group's full-year 2024 revenue was approximately RMB 11.561 billion, a decrease of 55.8% year-on-year; gross profit was approximately RMB 238 million, a decrease of 86.0% year-on-year; and the annual loss was approximately RMB 29.229 billion, widening by 48.4% year-on-year. The interim 2024 results showed that the gross profit margin slightly recovered to 13.7% in the first half, compared to 2023. The operating loss for H1 2024 was RMB 6.6 billion, flat compared to H1 2023, but the loss further widened in H2 2024. The annual operating profit for 2024 reached negative RMB 24.05 billion.

Intensified Losses and High Debt Pressure

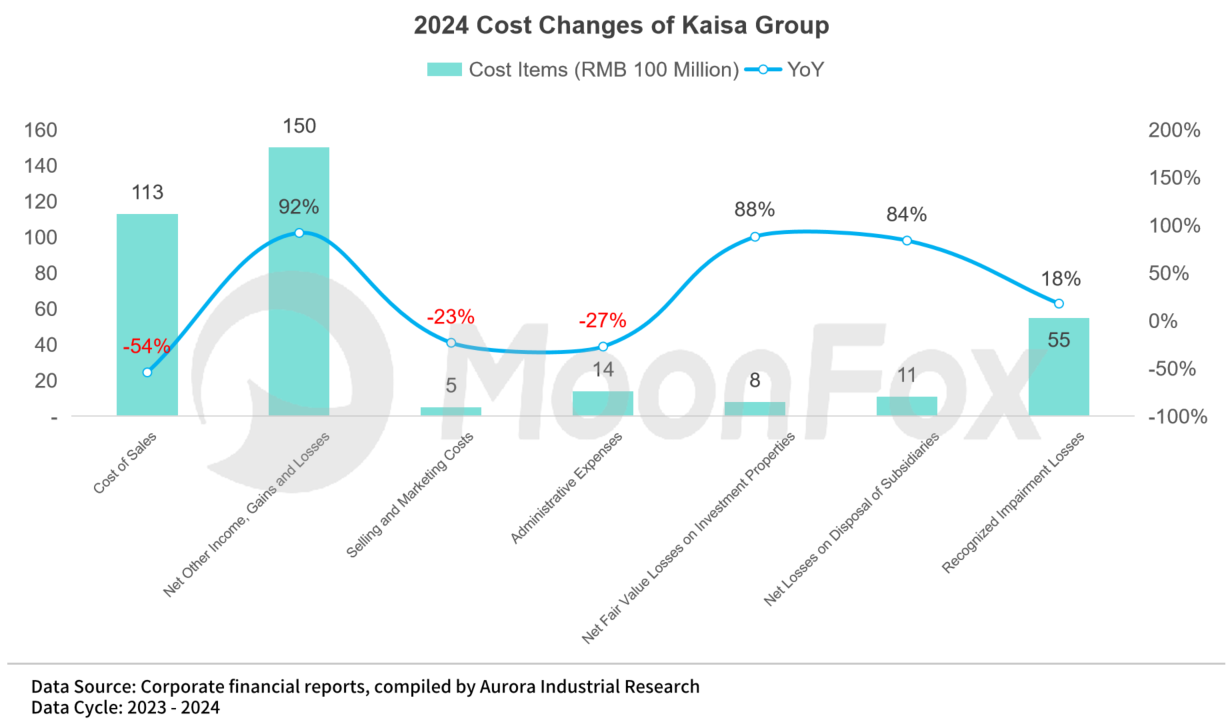

Year-on-year declines in cost items such as cost of sales, marketing expenses, and administrative expenses are related to the Group's internal cost control strategies. The sluggish real estate market led to a significant decrease in the fair value of the Group's investment properties and had multiple adverse effects on real estate sales and transaction prices.

As of the end of 2024, the Group's total assets were approximately RMB 210.6 billion, far exceeding its debt scale. The asset-liability ratio was as high as 117.2%, up 20.2 percentage points from the end of 2023. The 2024 financial report shows that the Group has made significant progress in its offshore debt restructuring. Whether the debt issue can be properly resolved remains key to whether the Group's development can return to a healthy track.

II. Interpretation of Business Status:

Kaisa Group's business covers more than 20 areas including comprehensive development, urban renewal, health care, and tourism. It has demonstrated resilience during the real estate industry adjustment period but also faces multiple challenges.

Core Real Estate Business Experienced Significant Decline

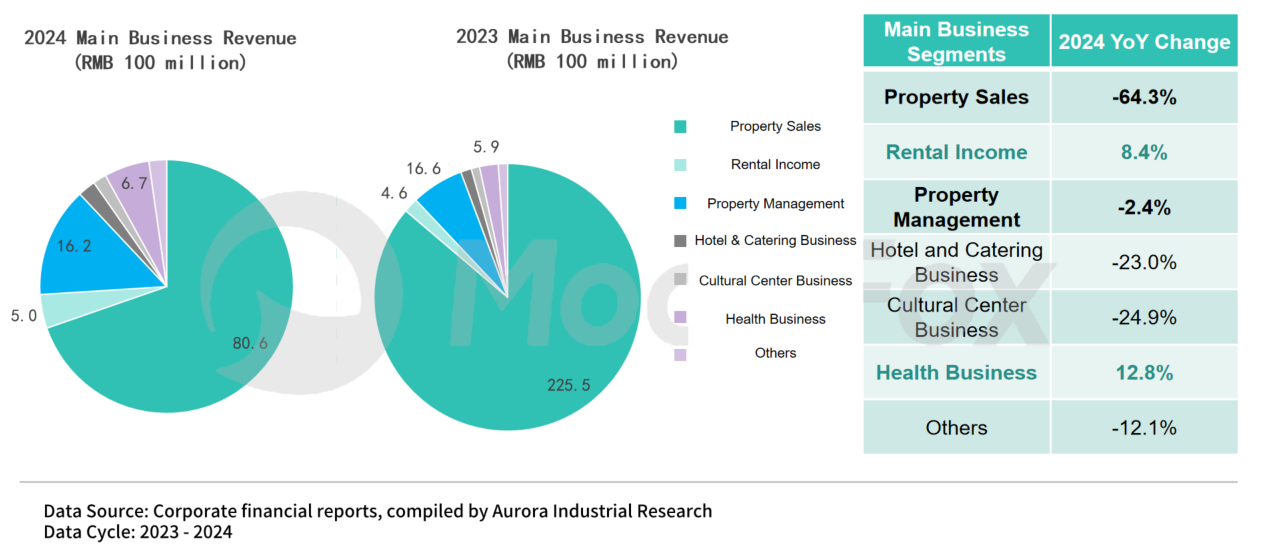

Property sales revenue in 2024 was RMB 8.057 billion, a sharp decrease of 64.3% year-on-year, with delivery area halved. The decline in property sales revenue had a series of knock-on effects, such as adverse impacts on Group financing, further affecting the construction of undelivered projects and business operations.

Reduced Reliance on Real Estate, Increased Proportion of Other Businesses

The proportion of revenue from non-property sales businesses increased to 30%, up 16 percentage points from 2023. The health business grew by 12.8% in 2024. Although this did not change the Group's overall reliance on the real estate sector, the business development was relatively stable. Conversely, revenue from hotel catering and cultural center businesses declined by over 20%.

III. Business Development Forecast:

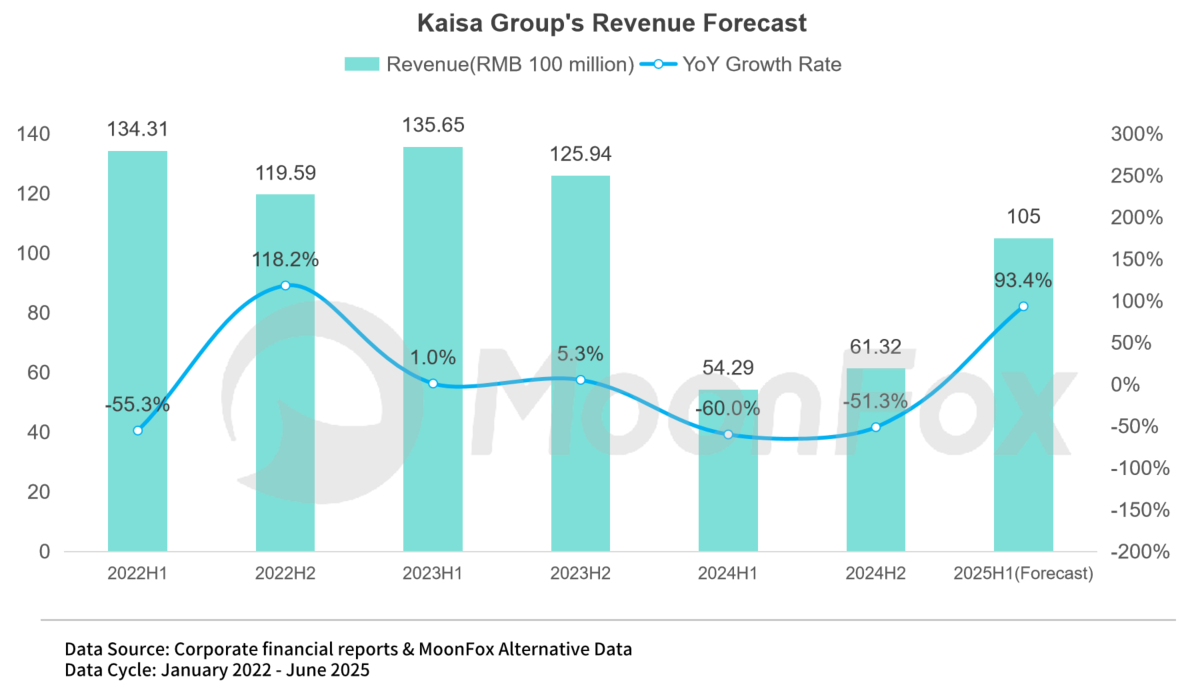

MoonFox Alternative Data estimates through financial modeling that Kaisa Group's revenue will recover in the first half of 2025, with a year-on-year growth rate of 93.4% to reach RMB 10.5 billion. However, there remains a significant gap compared to the 2023 level. Urban renewal and debt restructuring have become key focal points for Kaisa Group seeking a breakthrough, but significant uncertainties remain in the short term.

Urban renewal is a core strength of Kaisa Group. Policy support and high-quality land reserve resources play a central supporting role for the Group's medium to long-term development. By the end of last year, the Group's land reserve reached 2.231 million square meters, with 61% located within the Greater Bay Area. Furthermore, there are still over a hundred projects in the Greater Bay Area not included in the land reserve, amounting to approximately 3.7 million square meters. Meanwhile, leveraging its land reserves in the Greater Bay Area and its core advantages in urban renewal will help Kaisa explore innovative debt resolution models in the future and promote both onshore and offshore debt restructuring. The offshore debt restructuring plan was approved by the Hong Kong High Court and the Grand Court of the Cayman Islands in 2024.

In terms of business composition, the revenue structure already showed more changes in 2024. Non-property income accounted for a larger and more stable proportion of total revenue. The Group is promoting strategic transformation by integrating multiple industries such as health and wellness, culture, commerce, and tourism, increasing the proportion of asset-light businesses. Along with the development model of operating both asset-heavy and asset-light businesses in parallel, the impact of real estate market fluctuations on the enterprise is expected to gradually diminish.

In 2025, as national support policies for the private economy continue to release institutional dividends, Kaisa Group is expected to return to a healthy development track under the active implementation of its transformation strategy.

2026 年 1 月 AI 应用榜单解析:赛道分层竞逐,新锐势力强势突围

2026年春节AI应用市场大PK:豆包、元宝、千问、DeepSeek谁更强?

APP + 小程序双榜 TOP100 出炉,AI 赛道成最大黑马